Weighted average number of shares outstanding

Definition and explanation

The weighted average number of shares outstanding means the equivalent number of whole shares that remain outstanding during a particular period. It is computed by multiplying the number of common shares by the fraction of the period they have been outstanding.

The computation of weighted average shares incorporates all the changes in a company’s outstanding shares due to any reason such as sale and repurchase of shares, issuance of stock dividend, occurrence of stock split and conversion of other securities to common stock during the period. This number is significantly important for public companies as it constitutes the basis for computing important financial metrics like earnings per share (EPS). Since private companies are not legally required to report EPS on their income statement, they don’t need to calculate the weighted average number of shares outstanding.

Impact of sale and purchase of shares on weighted average number of shares outstanding

A company may issue new shares to investors or buy its own shares from them during a period. Every time a company issues or repurchases shares, the total number of its outstanding shares changes. Therefore, all public companies determine the weighted average number of shares outstanding at the end of their reporting period to calculate and report EPS in their financial statements. Let’s take an example to illustrate how the sale and purchase of common shares impact the company’s weighted average number of shares outstanding.

Example 1

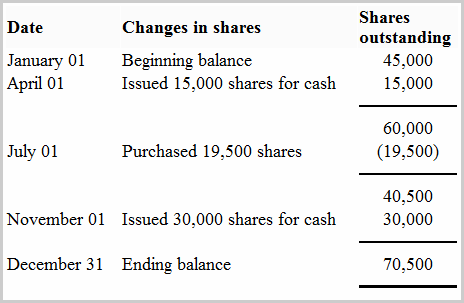

The changes in XYZ Inc’s common stock shares during the year 2022 are given below:

Required: Calculate the weighted average number of shares outstanding XYZ Inc.

Solution:

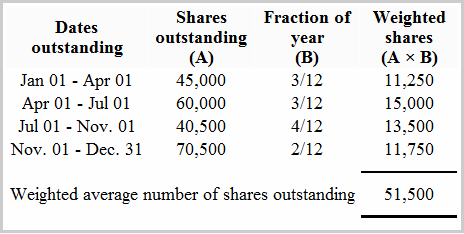

XYZ Inc. would compute its weighted average number of shares outstanding as follows:

In above example, 45,000 shares in beginning balance remained outstanding from January 1 to April 1 (i.e., 3 months period) which are equivalent to 11,250 shares for the entire year as computed below:

45,000 shares x 3/12 = 11,250 shares

On April 1, 2022, the Inc. sold 15,000 additional shares which increased its total outstanding common stock to 60,000 shares. These 60,000 shares remained outstanding from April 1 to July 1 (i.e., 3 months period) and are equivalent to 15,000 shares for the entire year as computed below:

60,000 shares x 3/12 = 15,000 shares

On July 1, 2022, the Inc. repurchased 19,500 shares which reduced its outstanding common stock to 40,500 shares. These 40,500 shares remained outstanding from July 1 to November 1 (i.e., 4 months period) and are equivalent to 13,500 shares for the entire year as computed below:

40,500 shares x 4/12 = 13,500 shares

On November 1, the Inc. issued another 30,000 shares which increased its outstanding common stock to 70,500 shares. These 70,500 shares were outstanding from November 1 to December 31 (i.e., 2 months period) and are equivalent to 11,750 shares for the whole year:

70,000 shares x 2/12 = 11,750 shares

By adding up the equivalent number of outstanding shares calculated on different dates, we get the weighted average number of shares outstanding for the year 2022:

11,250 shares + 15,000 shares + 13,500 shares + 11,750 shares = 51,500 shares

Impact of stock dividend and stock split on weighted average number of shares outstanding

The stock dividend and stock split both affect the computation of weighted average shares outstanding for a period. When a company issues a stock dividend or exercises a stock split, it needs to restate its outstanding shares of common stock before the date of stock dividend or split to compute its weighted average number of shares. It means that any additional shares issued as a result of stock dividend or split are assumed to be outstanding since the beginning of the year. Let’s illustrate this treatment through examples.

Example – impact of stock dividend

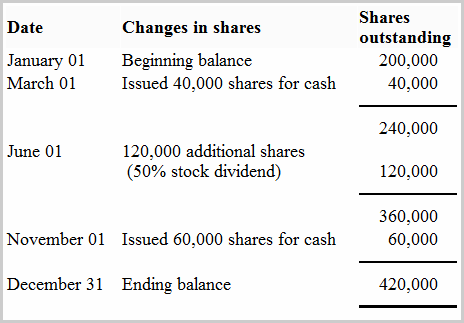

Maria Company has the following changes in its common stock during the year 2022.

Required: Calculate Maria’s weighted average number of shares outstanding for the year 2022.

Solution

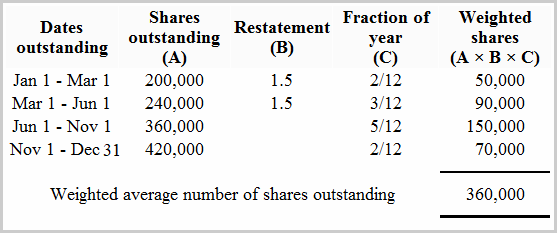

In above example, notice that Maria Company has adjusted all shares that exist prior to stock dividend (i.e., from January 1 to June 1). The purpose of this adjustment is to state these shares on the same basis as shares issued after the date of stock divided. The shares issued after stock dividend have not been restated because these shares have been issued on new basis and require no adjustment. A stock dividend only affects those shares that already exist prior to its occurrence. The same treatment is also applicable to the stock split.

Example – impact of stock split

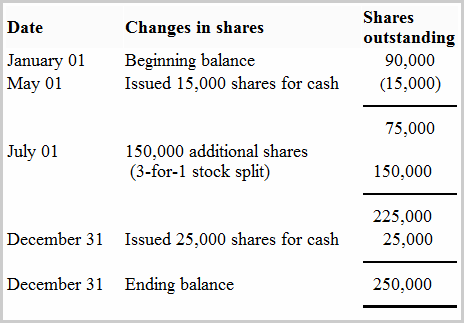

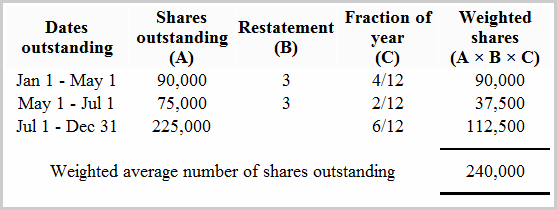

Alpha Inc. has the following changes in its outstanding common stock during the year 2022.

Required: Calculate Alpha’a weighted average number of shares outstanding for the year 2022.

Solution

Notice that Alpha Inc. has ignored 25,000 shares issued on December 31 in above computation. The reason is that these shares have been issued on the last day of the year and have not been outstanding during the year 2022.

If a company issues stock dividend or exercises a stock split after the end of its reporting period but before the issuance of financial statements to stakeholders, it must restate its common shares for the whole year. Similarly, if it uses the financial statements of one or more proir periods for comparison purpose, the shares for those periods must also be restated in the same way.

In the second example, why would issuing new shares have a negative impact on the number of outstanding shares?