Convertible preferred stock

Corporations offer several types of preferred stock with different features and privileges, like cumulative, noncumulative, participating, convertible, and nonconvertible preferred shares. This article briefly explains what is convertible preferred stock and how the conversion of preferred shares to common shares is journalized in the books of issuing entity.

What is convertible preferred stock?

Convertible preferred stock is a corporate issued preferred stock with a conversion covenant attached to it. It means, the holder of convertible preferred shares enjoys the privilege to receive dividend at a fixed rate plus the right to convert his owned preferred shares to a fixed number of common shares on his own option. Before issuing any convertible security (like bonds and preferreds), companies normally set a conversion ratio which helps individual holders calculate the number of common shares they will receive upon exercising their conversion right. The number of common shares to be issued to the investor upon conversion are usually mentioned in the preferred stock agreement; for example, 2 common shares for each share of preferred stock owned.

Like other convertible securities, convertible preferred stock can be a helpful tool for small and newly formed businesses to make their initial fund raising efforts successful. It can potentially attract those investors who might otherwise not be enticed to put their investment in the company.

Convertible preferred stock and convertible bonds are both dilutive securities i.e., they both can reduce firm’s earnings per share (EPS) if holders opt for conversion. The key difference between two convertibles is their distinct classification at the time of issuance. All types of preferred stock, including convertible ones, are classified as stockholders’ equity item unless a mandatory redemption exists. On the other side, all bonds, including convertible ones, are essentially classified as liability item.

Journal entries for conversion of preferred stock to common stock

Companies use book value method to account for the conversion of their convertible preferred stock to common stock. They debit preferred stock, related paid-in capital in excess of par – preferred stock (if any) and credit common stock. If an excess exists on entry’s debit part, it is credited to the paid-in capital in excess of par – common stock account. The journal entry to record this conversion looks like the following:

Preferred stock [Dr]

Paid-in capital in excess of par – preferred stock [Dr]

Common stock [Cr]

Paid-in capital in excess of par – common stock [Cr]

Examples of convertible preferred stock

Let’s illustrate the conversion of preferred to common stock through a couple of examples.

Example 1

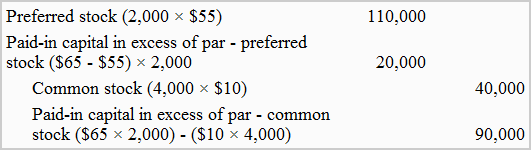

Roberts Corporation issued 4,000 common shares of $10 par value each upon conversion of 2,000 preferred shares of $55 par value each. At the time of conversion, Roberts common stock was trading at $28 per share. The convertible preferred stock was initially issued to stockholders at $65 per share.

Required: Make a journal entry to record the above conversion of preferred stock to common stock.

Solution:

The accounting treatment differs when book value of convertible preferred stock is less than the par value of common stock issued. In that case, the difference is usually debited to the retained earnings account. The journal entry in that case would look like the following:

Preferred stock [Dr]

Paid-in capital in excess of par – preferred stock [Dr]

Retained earnings [Dr]

Common stock [Cr]

Example 2

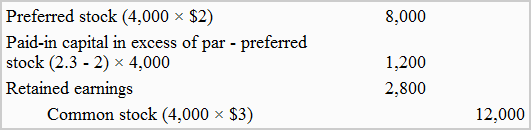

David Enterprise issued 4,000 shares of common stock (par value $3 per share) upon conversion of 4,000 shares of preferred stock (par value $2 per share) that was originally issued at a premium of $0.3 per share.

Require: Make a journal entry to record the above conversion.

Solution:

In above journal entry, the debit to retained earnings account indicates that David Enterprise has offered an additional return to the holders of its convertible preferred stock. The intention of this additional return may be simply to facilitate the conversion. In our example, David charges the additional return to its retained earnings account, which is an acceptable treatment under all major accounting frameworks like GAAP and IFRS. However, some states in USA require companies to reduce the balance of additional paid-in capital from other sources, if available.

Leave a comment