Common and preferred stock

The common and preferred are two different types of stock (also known as shares) that corporations issue to raise capital for their operations. The basic difference between common stock and preferred stock lies in the rights and opportunities that a stockholder enjoys upon purchasing either of the two types of corporate stocks.

The corporations try to add attractive features to their stock so as to attract a large number of investors. The general features of both common and preferred stock are briefly listed below:

Common stock

It is the basic type of stock that every corporation issues. The person who purchases the common stock of a corporation becomes an owner of the corporation and is known as common stockholder.

The following are the basic rights of a common stockholder:

- Right to vote for the election of directors and certain other issues; usually one share has the right of one vote attached to it.

- Right to participate in the dividends declared by the directors.

- Right to receive the share of assets upon liquidation of the corporation.

Preferred stock

In addition to common stock, many corporations issue preferred stock to finance their operations. When a person buys the preferred stock of a corporation, he is known as preferred stockholder of that corporation. The rights and opportunities of a preferred stockholder are essentially different from those of a common stockholder.

The usual rights of a preferred stockholder are given below:

- The preferred stockholders have a preference over common stockholders as to dividend payment. Unlike common stock, the rate of dividend on preferred stock is usually fixed.

- If the type of preferred stock is cumulative, the stockholders have cumulative dividend rights which means any unpaid dividend will be carried forward to the following year.

- Upon liquidation, preferred stockholders have a preference over common stockholders as to assets of the corporation.

- Preferred stockholders may have the option to convert their preferred stock into common stock. The preferred stock with such a feature is known as convertible preferred stock. This feature is attached to gain the attention of a larger number of investors.

- Preferred stock may be callable at the option of the corporation.

Preferred stock is often known as a hybrid security since it generally combines the features of both equity and debt. From stockholders point of view, the negative aspect of this class of stock is that it does not possess the voting power. It means, the preferred stockholders are not entitled to vote for the election of directors and other important matters of the corporation.

The distinct features attached with common stock and preferred stock discussed above appeal to different classes of investors. Thus, rather than relying only on common stock, many corporations prefer to issue both types of stock to attract as many investors as possible.

Balance sheet presentation of common and preferred stock

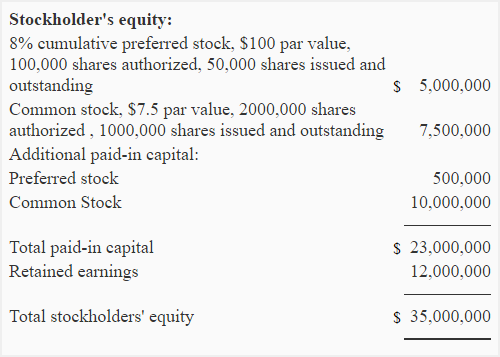

Both common and preferred stock are reported in the stockholders’ equity section of the balance sheet. The proper presentation is shown below:

In above example, the company is authorized to issue 100,000 shares of preferred stock and 2,000,000 shares of common stock. Notice that, out of these authorized numbers of shares, only 50,000 shares of preferred stock and 1,000,000 shares of common stock have actually been issued and subscribed by the investors.

Also notice that only the par value of shares that have actually been issued and subscribed (preferred: 50,000 x $100 = $5,000,000; common: 1,000,000 x $7.5 = $7,500,000) has been entered in the amount column of the balance sheet.

The additional paid-in-capital for each class of stock has also been presented separately. It is the amount received from stockholders over and above the par value of common or preferred shares.

Reporting mandatorily redeemable preferred stock

Special characteristics of preferred stock can affect its reporting in the balance sheet. For example, both International Financial Reporting Standards (IFRSs) and US-GAAP now require companies to report their mandatorily redeemable preferred stock as liability rather than equity.

Perfect!