Convertible bonds

Definition and explanation

Convertible bonds are corporate issued debt instruments that entitle their holders to exchange them for common shares or other corporate securities at holders’ option during a specified time after their issuance. In other words, we can say that these bonds combine a conversion option with the security of bond holding i.e., guaranteed interest and principle for holders.

There are two main reasons for issuing convertible bonds. One reason is to attract investors while avoiding unnecessary giving up of ownership control of the entity. For example, assume ABC company’s common stock is selling at $45 a share and it needs to raise $1,000,000. If we ignore the issue cost, the company would need to sell approximately 22,222 shares to collect this amount. On the other side, if ABC sells 1,000 bonds at $1,000 par, each convertible into 20 common shares, it could raise $1,000,000 by committing only 20,000 shares of common stock.

Under second approach, the company would be issuing 2,222 less shares than the first approach, even if all bond holders exercise their conversation option.

The other reason for issuing convertible bonds is to raise debt financing at lower rates. In many cases, the debt financing could be obtained only at high interest costs unless the company attaches a conversion privilege to the debt security. The conversion covenant attached to debt entices investors to accept a lower rate than would normally be the case on a straight debt issue.

Journal entry for conversion of bonds to common stock

Convertible bonds are initially recorded like a straight debt. No part of the proceeds received is recorded as equity at the time of their issuance because it is difficult to predict when, if at all, the actual conversion will occur. If a premium or discount arises from the issuance of convertible bonds, it is amortized to their maturity date.

Companies mostly use book value method to record the conversion of bonds to other securities like common stock etc. Under book value method, the common stock or other security that is exchanged for convertible bonds is recorded at the book value or carrying amount of bonds.

Examples of convertible bonds

Let’s illustrate the conversion of bonds to shares of common stock through a couple of examples.

Example 1

Delta Inc. has a $1,000 convertible bond that the holder can convert into 10 common shares of $10 par value each. The unamortized premium is $50 at the time of conversion. Using the book value method, Delta would record this conversion as follows:

Required:

- Calculate the number of common shares to be issued to bondholder upon conversion.

- Calculate the total par value of common shares to be issued upon conversion.

- Make a journal entry to record the conversion.

Solution

1. Number of common shares to be issued upon conversion:

= 1 bond x 10 common shares

= 10 common shares

2. Total par value of 120,000 shares:

= 10 shares x $10

= $100

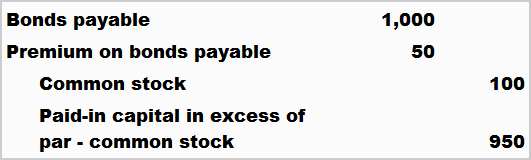

3. Journal entry to record the conversion

Amount credited to paid-in capital in excess of par – common stock:

= ($1,000 + $50) – $100

= $950

Example 2

Galaxy Corporation had outstanding 3,000 $1,000 bonds, each convertible into 40 shares of $10 par value common stock. The bonds were converted on December 31, 2022, when the total unamortized discount was $40,000 and the market price of the stock was $18 per share. Record the above conversion using the book value method.

Required:

- Calculate the number of common shares that would be issued upon conversion.

- Calculate the total par value of common shares that be issued upon conversion.

- Make a journal entry to record the conversion.

Solution

1. Number of common shares to be issued upon conversion:

= 3,000 bonds x 40 shares

= 120,000 shares

2. Total par value of 120,000 shares:

= 120,000 shares x $10

= $1,200,000

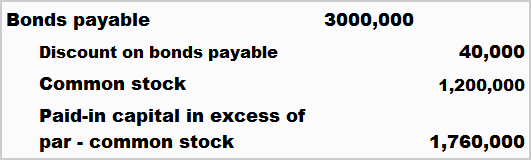

3. Journal entry to record the conversion

Amount credited to paid-in capital in excess of par – common stock:

= $3,000,000 – ($40,000 + $1,200,000)

= $1,760,000

Induced conversion of a security

Induced conversion means a conversion transaction in which the issuer of a security incentivizes the holders to convert their held security into another security, generally within a short duration. This term is particularly relevant to convertible debt securities.

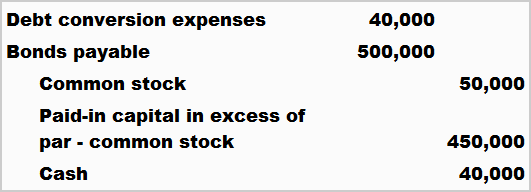

Sometimes the issuing companies want to encourage an early conversion of their outstanding convertible bonds. A prompt conversion is generally aimed at lowering the interest cost or improving the debt to equity ratio of the business. Companies try to achieve this by offering to security holders some additional consideration known as “sweetener”. The sweetener is generally given in the form of cash, additional shares of common stock or both. The fair value of securities or other consideration given as sweetener is reported as expense of the current period. The account name used to record this expense is “debt conversion expense”.

Let’s take an example to illustrate the recording of induced conversion.

Suppose, for example, Albania Company has outstanding $500,000 par value bonds convertible into 50,000 shares of $1 par value common stock. In order to reduce its interest cost, Albania offers its bondholders an additional cash amounting to $40,000 if they agree to exchange their convertible bonds to common shares. Assuming all the bond holders agree and conversion occurs successfully, Albania records the following journal entry:

Leave a comment