Treasury stock – cost method

What is treasury stock:

Sometime companies purchase shares of their own stock from existing stockholders of the company. Such repurchased shares of stock are known as treasury stock. Treasury stock includes only those shares that have not been cancelled or permanently retired by the company after repurchase. The shares held as treasury stock are not entitled to receive dividends and share of assets upon dissolution of the company’s business. Also, these shares have no voting rights.

Two methods are used for accounting treatment of treasury stock – the cost method and the par value method. In this article, we have explained the use of cost method. If you want to understand the use of par value method, read “treasury stock – par value method” article.

Purchase of treasury stock – cost method:

Journal entry:

Under cost method, the treasury stock account is debited and cash account is credited with the amount paid for acquiring the shares of treasury stock (i.e., the cost of treasury stock). The par value of shares is ignored for recording the purchase of treasury stock under cost method. For example, Eastern company repurchases 2,500 shares of its own common stock from stockholders. The par value per share is $10 and company reacquires it for $80 .The entry for this transaction would be made as follows:

Balance sheet presentation:

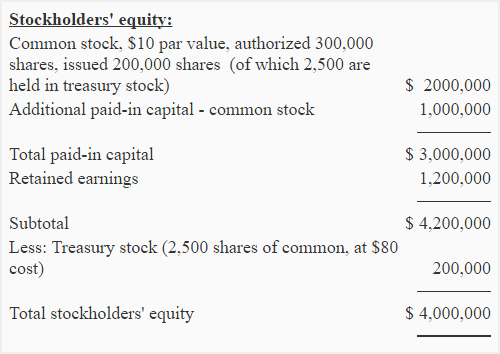

Treasury stock is not an asset, it is a contra-equity account that is reported as a deduction in the stockholders’ equity section of the balance sheet. In above example, treasury stock purchased by Eastern company should appear in the balance sheet as follows:

Reissuance of treasury stock – cost method:

The shares in treasury stock may be reissued by the company at any time. The journal entries for this purpose are given below:

If treasury stock is reissued at a price above cost:

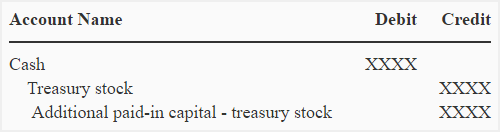

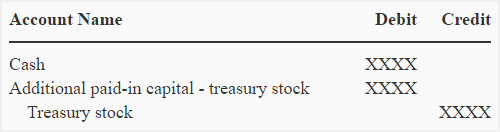

If the shares from treasury stock are reissued at a price that is higher than their cost, the difference is credited to additional paid-in capital. The journal entry is given below:

Suppose, for example, the Eastern company reissues 1,000 shares out of its treasury stock at $110 per share. The following journal entry would be made for this purpose:

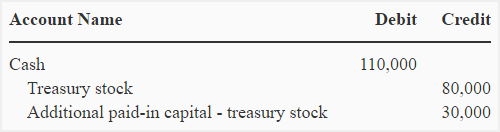

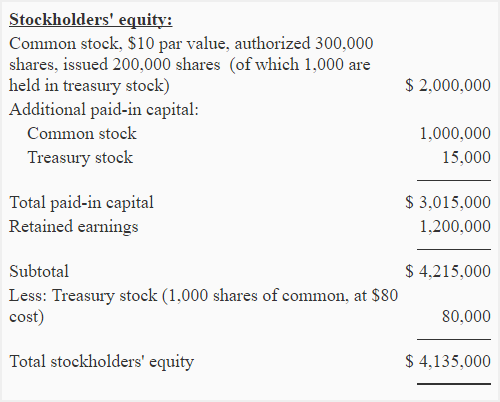

With this entry, the balance in treasury stock is reduced to $120,000 ($200,000 – $80,000). Its impact on the balance sheet of Eastern Company is illustrated below:

Notice that the additional paid in capital resulting from the reissuance of treasury stock has been reported immediately after additional paid in capital from common stock line.

If treasury stock is reissued at a price below cost:

If the shares from treasury stock are reissued at a price that is lower than their cost, the difference is debited to additional paid-in capital. The journal entry is given below:

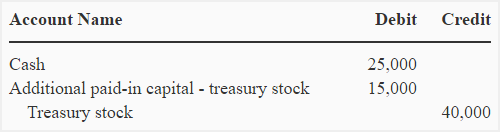

Suppose, the Eastern company reissues 500 more shares from its treasury stock at a price of $50 per share, the following journal entry would be made to record this transaction:

Notice that this entry reduces the additional paid-in capital from previously issued treasury stock.

Note for students:

If additional paid-in capital from previously issued treasury stock is not available then additional paid-in capital-common stock is debited and if additional paid-in capital-common stock is also not available or is not sufficient, the retained earnings account is debited.

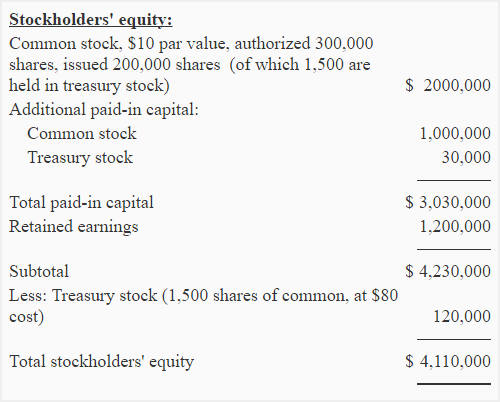

After this reissue of 500 shares, the changes in stockholders’ equity section have been illustrated below:

Leave a comment