Sales returns and allowances journal

The sales returns and allowances journal is a special journal maintained to record the return of inventory from buyers or any allowance granted to them. In the normal course of business, when customers receive damaged, defective, low-quality, or otherwise unwanted goods, they may return them to the seller or have the option to retain them at a reduced price.

Sales returns occur when a customer does not accept goods and returns them to the seller for a full refund or credit. A sales allowance occurs when a customer chooses to accept such goods but at a reduced price.

Any difference between invoice price and reduced price (i.e., the price that is finally received from the customer) is known as allowance. This allowance should not be confused with the sales discount, which is initially entered in the cash receipts journal at the time of receiving cash from buyers. The sales allowance is granted to buyers for the above-mentioned reasons, whereas the sales discount is granted for quick and timely payments. Moreover, two separate accounts are dedicated in the general ledger to account for each.

In a company’s general ledger, both sales returns and sales allowances are recorded in a single account known as the sales returns and allowances account. By nature, this account is a contra revenue account, and its balance is deducted from sales revenue when the income statement is drawn.

Journal entry for sales returns and allowances

When a customer returns goods or an allowance is allowed to him, the seller prepares a credit memorandum (abbreviated as a credit memo) containing the information about the type, quality, quantity, price, and invoice number of goods being returned by the buyer. The original copy of this credit memo is sent to the buyer to inform him that the return or allowance has been approved and his account has been credited. A duplicate copy of the memo is kept by the seller, which acts as a source document for recording the journal entry relating to returns and allowances. A sales memo is also often referred to as a “credit note.”

There are two approaches for making journal entries of transactions related to sales returns and allowances. A company may choose any approach depending on its volume of returns and allowances transactions during the year. The first approach is to record returns and allowances in the general journal, which is appropriate for companies with only a few returns and allowances during the year. The second one is to record these transactions in a special journal known as the sales returns and allowances journal. The second approach is more convenient for companies that experience too many such transactions during the year.

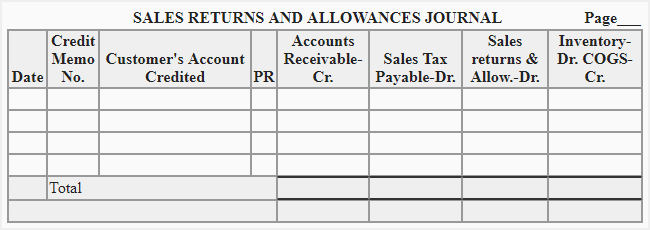

Format and posting of sales returns and allowances journal

The number of columns used in a sales returns and allowances journal usually differs from one organization to another depending on their information requirements and nature and size of business. However, the following format can be used for the sake of a common understanding of recording sales returns and allowance transactions:

Explanation of the columns

The purpose of eight columns used in above format has been briefly explained below:

- Date: The date at which the goods are returned by the customer.

- Credit memo number: All credit memos are serially numbered. This column is used to record the number of related credit memo.

- Customer’s account credited: When a customer purchases goods on credit, his account is debited, and when he returns the goods, his account is credited. This column is used to write the title of the customer’s account who returns the goods.

- Posting reference (PR): Mostly, all accounts in the ledger are properly numbered. This column is used to enter the number of the relevant account in the ledger. If a manual accounting system is used and the accounts are not properly numbered, then the page number of the ledger book on which the account exists is used as the account number.

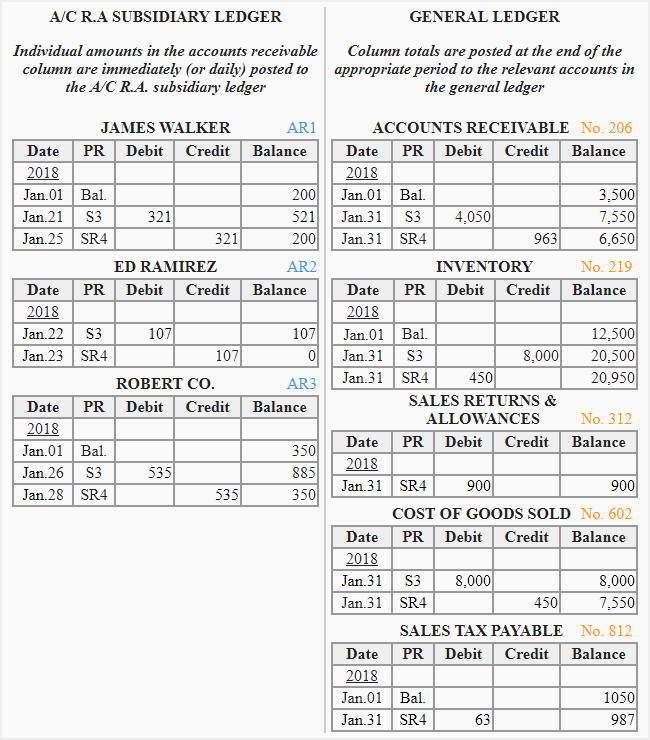

- Accounts receivable-Cr: The amount by which a customer’s account is credited is entered in this column. This amount includes the actual price of goods plus any sales tax collected on behalf of the tax agency. The individual amounts in this column are immediately (or on a daily basis) posted to the relevant accounts in the receivable subsidiary ledger. At the end of some appropriate period (usually one month), the total of this column is credited to the accounts receivable account in the ledger.

- Sales tax-Dr: When goods are returned by customers, the related sales tax is debited. The amount of sales tax related to sales returns is written in this column. At the end of some appropriate period (usually one month), the total of this column is debited to the sales tax payable account in the general ledger.

- Sales returns and allowances-Dr: In this column, the sales price of goods returned (excluding sales tax) or allowance allowed to customers is written. The sales returns and allowances account in the general ledger is debited by the total of this column at the end of some appropriate period (usually one month).

- Inventory-Dr/ cost of goods sold-Cr: When a customer returns goods, inventory increases and cost of goods sold decreases. The cost of inventory returned by a customer is written in this column. At the end of the period, the inventory account is debited, and the cost of goods sold account is credited by the total of this column.

The following example summarizes the whole explanation given above.

Example

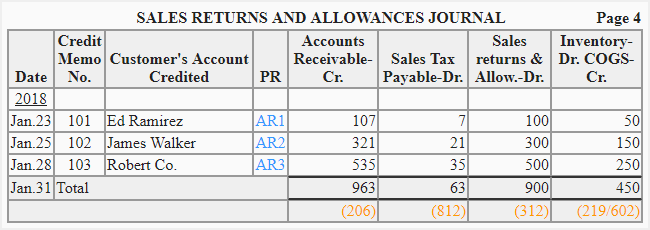

Maria Trading Company always sells goods to its customers on account. The company collects sales tax at 7% on all goods sold by it and periodically sends the collected amount of tax to a tax-collecting agency.

The following are some selected transactions performed by Maria Trading Company during the month of January, 2018.

- Jan. 21: Sold goods to James Walker on account, $300. Sales tax was collected @ 7%.

- Jan. 22: Sold goods to Ed Ramirez on account, $100. Sales tax was collected @ 7%.

- Jan. 23: The goods sold to Ed Ramirez on January 22 were returned by them.

- Jan. 25: The goods sold to James Walker on January 21 were returned by them.

- Jan. 26: Sold goods to Robert Co., $500. Sales tax was collected @ 7%.

- Jan. 28: The goods sold to Robert Co. on January 26 were returned by them.

The ledger account balances on January 1, 2018 were as follows:

General ledger accounts:

- Accounts receivable account: 3,500 Dr.

- Inventory account: 12,500 Dr.

- Sales tax payable account: 1,050 Cr.

Accounts receivable subsidiary ledger accounts:

- James Walker: 200 Dr.

- Ed Ramirez: 0

- Robert Co: 350 Dr.

Required:

- Record the transactions that occurred on January 22, 25, and 28 in a sales returns and allowances journal.

- How would you post the information from the sales returns and allowances journal to the accounts receivable subsidiary ledger and general ledger?

Solution:

(1). Recording entries in sales returns and allowances journal:

(2). Posting entries from sales returns and allowances journal to ledger accounts:

Make example in the video