Cash receipts journal

The cash receipts journal manages all cash inflows of a business organization. In other words, this journal is used to record all cash that comes into the business. For recording all cash outflows, another journal known as the cash disbursements journal or cash payments journal is used.

For the purpose of making entries in a cash receipts journal, all inflows of cash can be divided into the following three categories:

- Receipt of cash from cash sales

- Collection or recovery of cash from credit customers or receivables and

- Receipt of cash from other sources like sale of a business asset other than inventory, collection of dividend, interest or rent income, and obtaining a loan from a financial institution or an individual, etc.

Format and posting of cash receipts journal

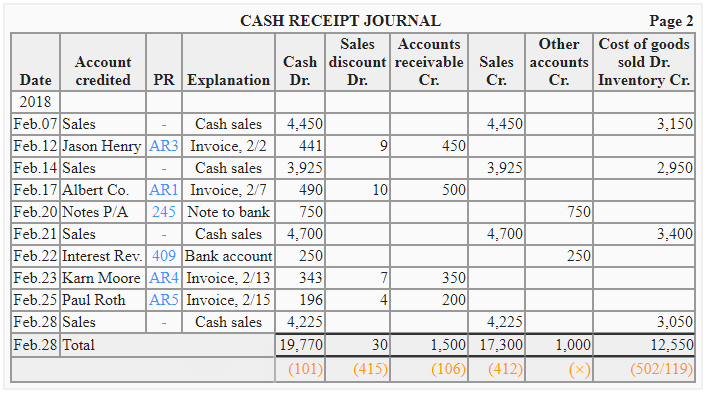

The format of a cash receipts journal used by an organization depends on its nature of business and information needs. For a common understanding, we can use the following format:

Explanation of the columns used in cash receipts journal

The information in ten columns shown in above journal is entered as follows:

- Date: The date at which the cash is received is entered in the date column.

- Account credited: The account credited column is used to enter the title or name of the account that is credited in the ledger as a result of cash inflow. For every inflow of cash, one or more accounts are essentially credited in accounts receivable subsidiary ledger, in general ledger, or in both.

- Post reference: The post reference column is used to enter the account number of the subsidiary or general ledger account to which the entry belongs.

- Explanation: The explanation or reason of the cash inflow is briefly explained in this column.

- Cash: In the cash column, the net amount of cash received is entered. The cash account in the general ledger is debited by the total of this column.

- Sales discount: Sellers generally allow a certain amount of discount to customers who make payment within the discount period. The amount of discount allowed to customers is entered in the sales discount column. The sales discount account in the general ledger is debited by the total of this column.

- Accounts receivable: When a credit customer makes payment for a previous purchase, his account is credited in the accounts receivable subsidiary ledger. The amount by which a customer’s account is to be credited is entered in this column. The total of this column is credited to the accounts receivable account in the general ledger.

- Sales: This column is used to record cash sales. Every time a cash sale is made, the amount received is entered in this sales column.

- Other accounts: This column is used to record the receipt of cash from sources other than cash sales or collection from credit customers. Examples include the receipt of cash for interest, rent, and the sale of old assets, etc.

- Cost of goods sold/inventory: In the cash receipts journal, this column is used to record the cost of merchandise sold for cash. This column is also found in the sales journal, where it is used to enter the cost of goods sold on credit. The total of this column is debited to the cost of goods sold account and credited to the inventory account in the general ledger.

The following example illustrates how a cash receipts journal is written and how entries from there are posted to relevant subsidiary and general ledger accounts.

Example

Steward Inc. engaged in the following cash transactions during February 2023:

- Feb 07: Sold goods for cash $4,450.

- Feb. 12: Collected cash from Jason Henry $441, discount allowed $9. Invoice no. 2/2.

- Feb. 14: Sold goods for cash $3,925.

- Feb. 17: Collected cash from Albert Co. $490, discount allowed $10. Invoice no. 2/7.

- Feb 20: Obtained loan from bank by issuing a note payable $750.

- Feb. 21: Sold goods for cash $4,700.

- Feb. 22. Interest on investment received via bank account $250.

- Feb. 23: Collected cash from Karn Moore $343, discount allowed $7. Invoice no. 2/13.

- Feb. 25: Collected cash from Paul Roth $196, discount allowed $4. Invoice no. 2/15.

- Feb. 28: Sold goods for cash $4,225.

Required: On the basis of the above transactions, draw up a cash receipts journal for Steward Inc. and post the same to relevant accounts in general and subsidiary ledgers.

Solution

Recording entries in cash receipts journal

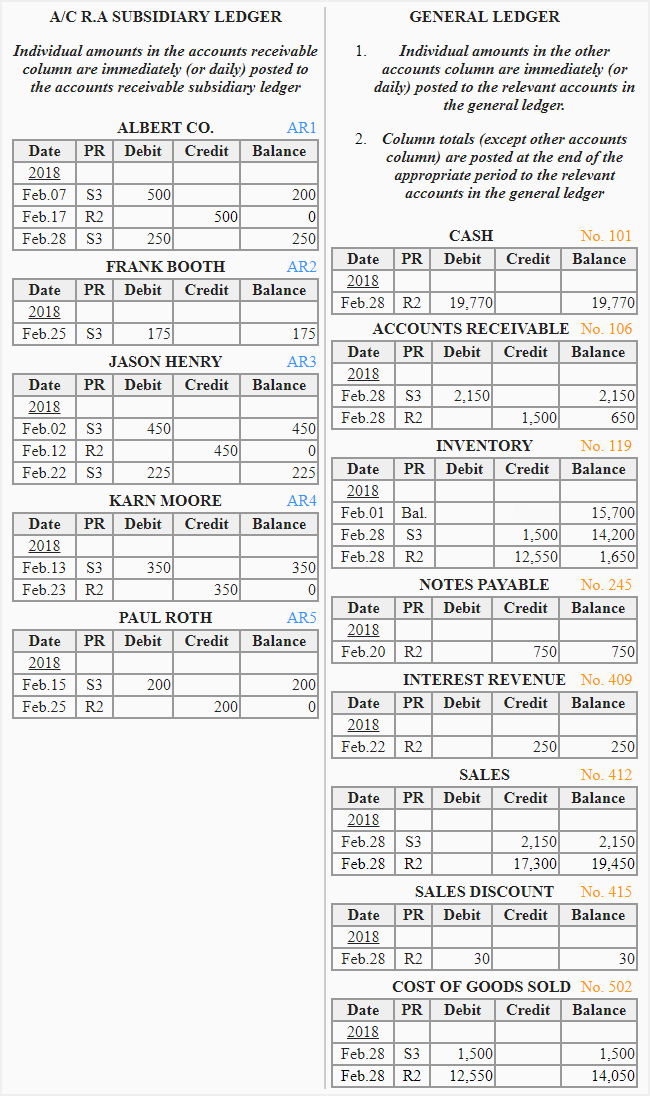

Posting entries from cash receipts journal to ledger accounts

Memo’s and Question paper

Hello Luthando can u please help me with the memo of crj

Just download it online

I want to write a CRJ table

I recommend that you watch online videos about the memo just like me

Please u can help me in accounting

Some examples with format

What is the DOC NO used for in Cash Receipt Journal