Cash disbursements journal

The cash disbursement journal (also known as the cash payments journal) is a special journal that is used by a business to manage all cash outflows. In other words, a cash disbursement journal is used to record any transaction that includes a credit to cash. All cash inflows are recorded in another journal known as the cash receipts journal.

The usual examples of cash outflows in a business are payments made for:

- purchase of merchandise inventory on cash.

- previous credit purchases, i.e., payments to accounts payable or creditors.

- various expenses like rent, advertisement, carriage, wages and salaries, etc.

- purchase of a tangible or intangible asset.

- donations, charities, Zakat, etc.

Besides the above payments, refunds of cash arising from the return of goods by customers are also recorded in the cash disbursements journal.

Format of cash disbursements/payments journal

In a cash disbursement journal, the cash payments are usually categorized as payments to accounts payable and payments for other purposes. The format of a cash disbursement journal and explanation of all the columns provided therein are given below:

Explanation of the columns used in cash disbursements journal

- Date column: The date at which a payment is made to someone is entered in the date column.

- Check number column: In large businesses, the payments are mostly made by checks. If the payment is made by a check, this column is used to enter the check number belonging to the payment.

- Payee column: The payee name (the person or entity to whom the payment is being made) is entered in this column.

- Account debited column: Every cash transaction results in a credit to the cash account and a debit to some other account. Account debited column is used to enter the title of the account to be debited in the accounts payable subsidiary ledger or general ledger as a result of the payment of cash.

- Posting reference (PR) column: All accounts in subsidiary and general ledger are properly numbered. The posting reference (abbreviated as PR) column is used to write the number of the account mentioned in the account debited column.

- Cash column: The amount of cash paid is entered in the cash column. This amount must be net of any purchase discount received from suppliers of inventory, etc.

- Inventory column: The inventory column is used to enter the purchase discount allowed by suppliers of inventory. As the discount taken from suppliers reduces our inventory cost, the inventory account in the general ledger is credited by the total of this column at the end of the period.

- Other accounts column: The cash paid for any purpose other than credit purchases is recorded in this column. Examples include payment for inventory purchased on cash, payment for the purchase of assets, and payment of salaries, carriage, and other expenses, etc.

- Accounts payable column: The amount by which a supplier’s account is debited is written in this column.

Posting cash disbursement journal to ledger accounts

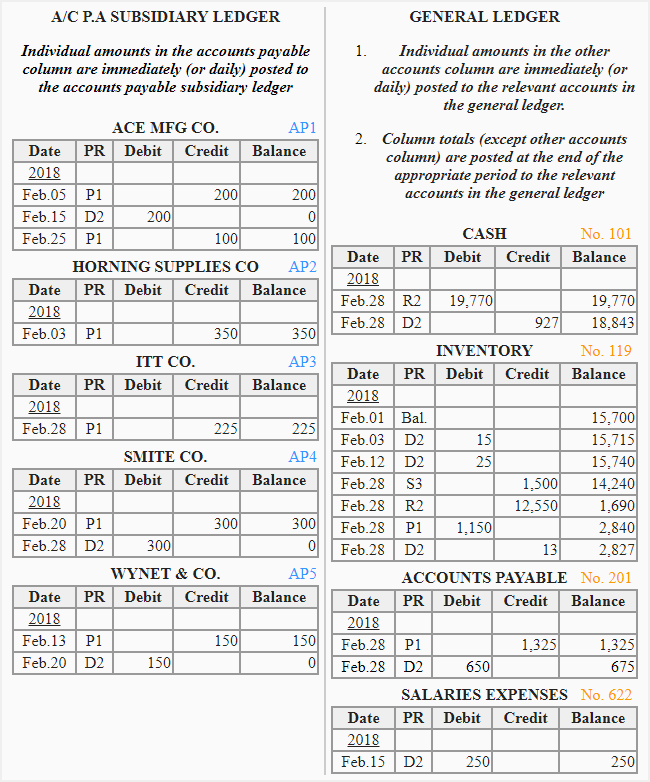

The cash disbursement journal is posted to ledger accounts as follows:

- The individual amounts in the accounts payable column are posted daily (or immediately, if a computer software is used) to the accounts payable subsidiary ledger, and the individual amounts in the other accounts column are posted daily (or immediately, if a computer software is used) to relevant accounts in the general ledger.

- The totals of cash, inventory, and accounts payable columns are posted at the end of the period (usually one month) to the relevant accounts in the general ledger. The total of other accounts column is not posted to any account.

Example

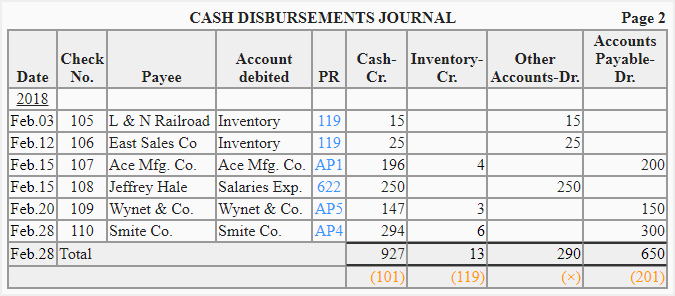

Consider the following example for a better understanding of how entries in a cash disbursement journal are made and how the posting to accounts payable subsidiary ledger and general ledger is performed.

Recording entries in cash disbursements journal

Posting entries from cash disbursements journal to ledger accounts

Thanks

this is helpful

Greatly appreciate the time and effort in explaining how a disbursement ledger works. Amazing information.