Accounts payable

Definition and explanation

Accounts payable (also known as creditors) are balances of money owed to other individuals, firms or companies. These are short term obligations which arise when a sole proprietor, firm or company purchases goods or services on account. Accounts payable usually appear as the first item in the current liabilities section of a company’s balance sheet.

In general ledger an account titled as “accounts payable account” is maintained to keep record of increases and decrease in accounts payable liability during a period. Since this account is a liability account, its normal balance is credit. Accounts payable account is credited when something is purchased on credit and debited when a payment is made to a creditor or supplier for a previous credit purchase (see rules of debit and credit). When the balance sheet is drawn, the balance shown by this account is reported as current liability.

Accounts payable are usually divided into two categories – trade accounts payable and other accounts payable. Trade accounts payable are the obligations for the purchase of goods that are merchandise inventory whereas other accounts payable are the obligations for the purchase of goods (including services) that are not merchandise in nature. Merchandise are the commodities that a business normally deals in. The goods that are not merchandise are the goods that the business does not normally deals in.

Companies mostly find it convenient to record an accounts payable liability when they actually receive the goods. However, in certain situations, the title to goods passes to the buyer before the physical delivery is taken by him. In such situations, the liability should be recorded at the time of passage of title.

Journal entries related to accounts payable

Each time a company purchases goods or services on account, it records an accounts payable liability in its books of accounts. The measurement of accounts payable liability involves no complications, as the seller’s invoice shows the exact amount that the buyer needs to pay within a specified date.

The transactions relating to accounts payable are repetitive in nature. Therefore, many companies use a special journal known as purchases journal for recording these transactions. However, small companies with low transaction volume don’t maintain special journals. These companies record their purchase transactions in general journal, along with other transactions.

The typical journal entries related to accounts payable liability are given below:

1. When merchandise inventory is purchased on account:

When merchandise inventory is purchased on account, an accounts payable liability is recorded by making the following journal entry:

Purchases account [Dr.]

Accounts payable [Cr.]

The above journal entry records accounts payable liability under periodic inventory system. If the company is employing a perpetual inventory system, the debit part of the entry would consist of “inventory account” rather than the “purchases account”.

2. When damaged or otherwise undesired inventory is returned to the supplier:

If a part or whole of the inventory is found to be damaged, unfit or otherwise undesired, the buyer may either return the goods to the seller or keep them and ask the seller for a reduction in price, known as allowance. When a return or allowance is approved by the seller, the buyer records a reduction in accounts payable liability in his books by debiting purchases returns and allowances account and crediting accounts payable account. The journal entry for this looks like the following:

Accounts payable [Dr.]

Purchases returns and allowances [Cr.]

If the buyer maintains a purchases returns and allowances journal, then the goods returned by him would be recorded in that journal, rather than in the general journal.

After recording above journal entry, the buyer sends a debit note (also known as debit memo) to the seller to inform him that his account has been debited for the value of goods returned. Upon receiving the debit note, the seller issues a credit note (also known as credit memo) to the buyer, informing him that his account has been credited. The process of return is thus completed this way.

3. When an asset other than merchandise inventory is purchased on account:

When an asset other than merchandise inventory is purchased on account, the accounts payable liability is recorded by the buyer as follows:

Relevant asset’s account [Dr.]

Accounts payable account [Cr.]

4. When expenses are incurred or services are purchased on account:

If some professional services are acquired or expenses are incurred whose payment is to be made on a future date, an accounts payable liability is recorded by means of the following journal entry:

Relevant expense [Dr.]

Accounts payable account [Cr.]

5. When the payment is made to a creditor or supplier:

When the payment is made to a payable or creditor, the accounts payable liability is reduced by recording the following journal entry:

Accounts payable [Dr.]

Cash [Cr.]

Example

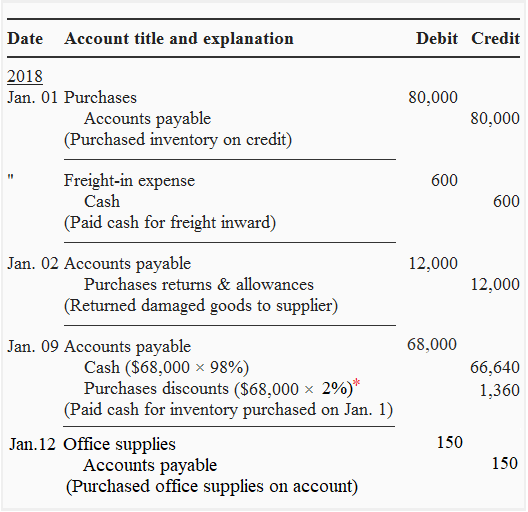

Chicago Corporation engaged in the following transactions during the month of January.

- Jan 01: Purchased $80,000 of inventory, terms 2/10, n/30, FOB shipping point. Paid freight costs of $600.

- Jan. 02: Returned damaged goods to supplier and received a credit of $12,000.

- Jan. 09: Paid cash to supplier for inventory purchased on January 1.

- Jan. 12: Purchased office supplies on account amounting to $150.

Required: Prepare all necessary journal entries assuming Chicago uses a periodic inventory system and gross method of accounting for purchases discounts.

Solution:

Under a periodic inventory system, Chicago Inc. would make the following journal entries to record above transactions:

*Chicago availed a purchase discount of 2% by making the payment within the discount period (i.e., within 10 days of the date of purchase).

Leave a comment