Purchases journal

Definition and explanation

Purchases journal (also known as purchases book and purchases day book) is a special journal used by businesses to record all credit purchases. All cash purchases are recorded in another special journal known as the cash payment journal or cash disbursements journal.

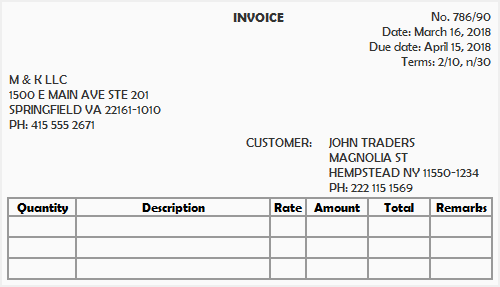

When merchandise along with their invoice are received from the supplier, responsible personnel from the receiving department compare them with the copy of the order placed by the purchase department. If both quantity and quality of merchandise conform to as mentioned in the original order, the merchandise is accepted and transferred to the warehouse. After it, an entry is made in the purchases journal on the basis of the information obtained from the seller’s invoice. For the purpose of recording entries in the purchases journal, this invoice is sometimes referred to as the inward invoice or purchase invoice. It usually contains the following information:

- The invoice number for the goods purchased from the supplier.

- The date on which the invoice has been prepared by the supplier.

- The name, address, email, and phone number of both buyer and seller.

- A proper description of merchandise, i.e., quantity, quality, rates, and total amount of the merchandise purchased.

- The details about the terms and conditions of the sale.

Format/specimen of the inward invoice

A simple inward invoice with basic information may look like the following:

The actual format or look of the invoice issued by a seller to his buyer may be slightly different from the above specimen, but the basic information provided therein is almost similar.

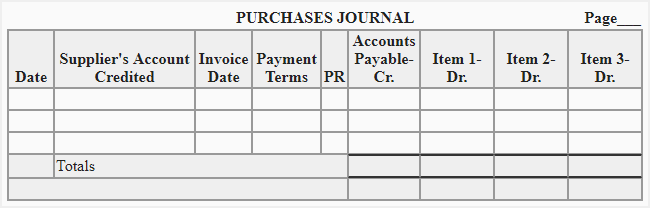

Format of purchases journal

The number of columns used in the purchases journal depends on the needs of each business. The commonly used format is given below:

Explanation of columns:

The entries in the seven columns shown in the above format of the purchases journal are made as follows:

- Date column: The date column is used to record the date on which the invoice belonging to goods purchased is received.

- Supplier column: The supplier’s name is written in this column. Some businesses also include a brief description of goods purchased in this column.

- Invoice date column: The invoice date column is used to record the date on which the invoice is prepared by the supplier.

- Payment terms column: This column is used to record the payment terms allowed by the supplier.

- Reference column: At the end of each day, the entries from the purchases journal are posted to individual accounts in the accounts payable subsidiary ledger. If computer software is used, these entries are immediately posted to the subsidiary ledger. The reference column is used to record the account numbers of the accounts to which the entries have been transferred. If accounts are not numbered, the page number of accounts is recorded in this column.

- Accounts payable column: The amount payable on the invoice is recorded in this column.

- Items columns: These columns are used to enter the cost of individual items purchased from suppliers, such as inventory, store supplies, office supplies, equipment, etc. The number of item columns to be used on a purchases journal depends on the nature and requirements of each individual business.

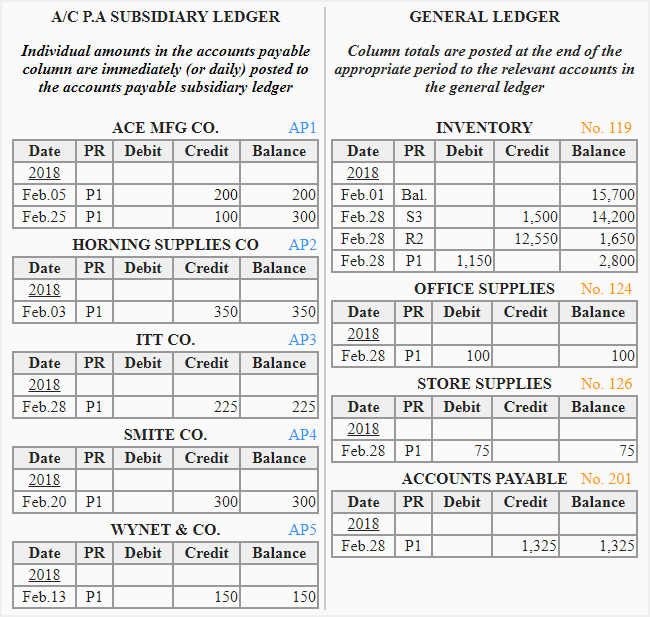

Posting the purchases journal to subsidiary and general ledger

A purchases journal is posted to the company’s general and subsidiary ledgers as follows:

Posting to accounts payable subsidiary ledger:

At the end of the day, each entry in the purchases journal is posted to the credit side of the relevant individual account in the accounts payable subsidiary ledger.

Posting to general ledger:

At the end of the month (or other appropriate period), the column totals are posted to the general ledger as follows:

- The total of accounts payable column is credited to accounts payable account in the general ledger.

- The total of the inventory column is posted to the inventory account in the general ledger.

- The total of all other items is posted to their relevant accounts in the general ledger.

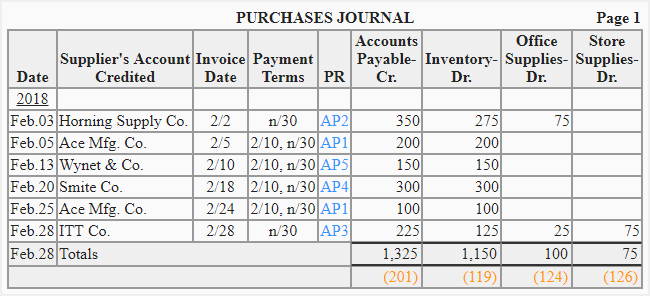

Consider the following example for a better understanding of the whole discussion.

Example

The following example summarizes the procedure of entering transactions in the purchases journal and then posting the entries to accounts payable subsidiary ledger and general ledger accounts.

Recording entries in purchases journal

Posting entries from purchases journal to ledger accounts

I really want to have an account