Purchases returns and allowances journal

The purchases returns and allowances journal is a special journal used to record the return of inventory to the vendor or any allowance taken from him. If the goods received from the seller are defective, damaged, of low quality, or not according to specifications, the buyer may return them to the seller or call him to arrange an allowance (i.e., a reduction in the price of such goods).

When goods are returned to the seller or an allowance arrangement is made, it can be either recorded in the general journal or in the purchases returns and allowances journal, depending on the frequency of the occurrence of purchases returns and allowances transactions during the accounting period of the business.

The entries in the purchases returns and allowances journal are made using a document known as a debit memorandum (often abbreviated as a debit memo). A debit memo is a small document that is prepared by the buyer and sent to the seller to inform him that his account has been debited for the value of goods returned or the allowance taken from him. In this document, the buyer mentions the type, quality, quantity, price, and invoice number of the goods being returned to the seller. A copy of the debit memo remains with the buyer, and the entry in the purchase returns and allowances journal is made on the basis of it. The debit memo is sometimes also referred to as a debit note.

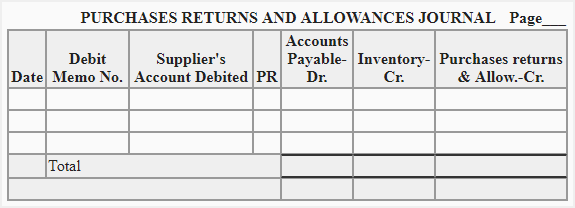

Format of purchases returns and allowances journal

The format of purchases returns and allowances journal depends on the nature of trade and size of each individual business entity. However, for a common understanding, a basic format of how entries related to returns and allowances are made is given below:

Explanation of columns

A brief explanation of the purpose of each column of purchases returns and allowances journal is given below:

- Date: Date column is used to enter the date at which the goods are returned or a debit memo is prepared for the agreed allowance (i.e., reduction in price due to any reason).

- Debit memo: All debit memos are serially numbered. These numbers are entered in the debit memo column of the journal.

- Supplier’s account debited: The suppliers’ individual accounts are maintained in the accounts payable subsidiary ledger. The title of the relevant supplier’s account in the accounts payable subsidiary ledger is entered in this column.

- Posting reference (PR): The suppliers’ accounts in the accounts payable subsidiary ledger are properly numbered. This column is used to enter the account number of the supplier.

- Accounts payable-Dr: When goods are returned to the supplier, a reduction in accounts payable liability occurs. The amount by which accounts payable liability is reduced is written in this column. The individual amounts in this column are immediately or daily posted to the relevant accounts in the accounts payable subsidiary ledger. The accounts payable account in the general ledger is debited by the total of this column at the end of the period.

- Inventory-Cr: The cost of goods returned to the supplier or allowance taken from him is written in this column. The inventory account in the general ledger is credited with the total of this column at the end of the period.

- Purchases returns and allowances-Cr: The cost of goods returned to the supplier or allowance taken from him is written in this column too. The purchases returns and allowances account in the general ledger is credited by the total of this column.

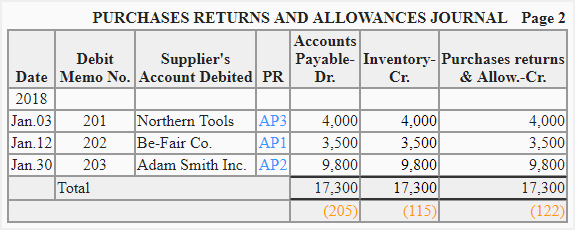

Example

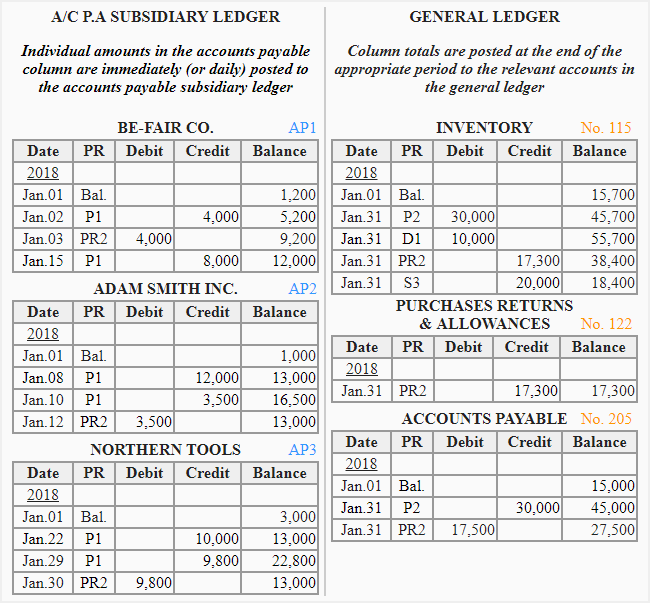

See the following entries in the purchases returns and allowances journal and their posting to the accounts payable subsidiary ledger and general ledger:

Recording entries in purchases returns and allowances journal

Posting entries from purchases returns and allowances journal to ledger accounts

Leave a comment