General journal

A journal entry is the second step of the accounting or bookkeeping process, the first being the analysis of business transactions. In this step, all the accounting transactions are recorded in a general journal in a chronological order. The general journal is maintained essentially on the concept of a double-entry system of accounting, where each transaction affects at least two accounts.

Other names used for general journals are journal book and book of original entry.

The process of making a journal entry

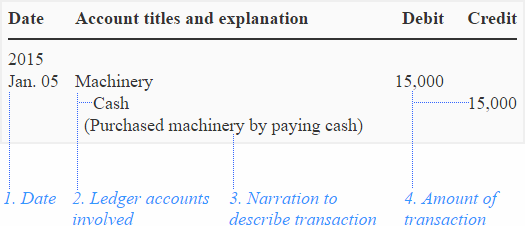

The first step in the process of preparing a journal entry is to analyze the accounts involved in a business transaction and then apply the rules of debit and credit based on the type of each account. After identifying the accounts involved in the transaction and deciding upon the applicable rules, the journal entry is recorded in the general journal in a specified format, which includes the following details:

- Date of transaction

- Ledger accounts involved

- Amount of transaction

- A brief narration to describe the transaction

Format of general journal

Let’s understand the format of the general journal and the process of making a journal entry through an illustration.

Transaction:

January 05: Purchase of machinery by making cash payment of $15,000.

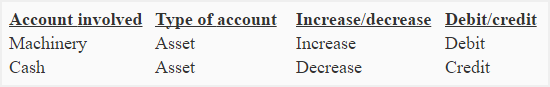

Analysis of transaction:

Recording journal entry:

According to the rules of debit and credit, when an asset increases, its account is debited, and when an asset decreases, its account is credited. In this transaction, machinery (an asset) is increasing, and cash (an asset) is decreasing. So the journal entry would be made as follows:

All business transactions are recorded in the general journal in a manner illustrated above. After making journal entries in the journal, they are periodically posted to the ledger accounts.

Example:

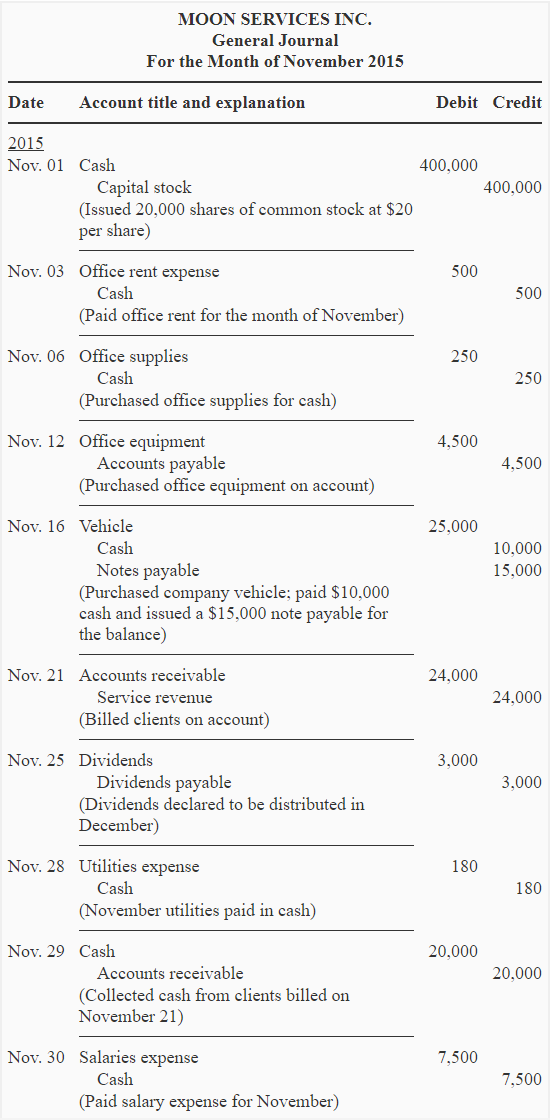

Moon Service Inc. engaged in the following transactions during the month of November 2015:

- Nov. 01: Issued 20,000 shares of common stock at $20 per share

- Nov. 03: Paid office rent for the moth of November $500.

- Nov. 06: Purchased office supplies $250.

- Nov. 12: Purchased office equipment on account $4,500

- Nov. 16: Purchased business car for $25,000. Paid $10,000 cash and issued a note for the balance.

- Nov. 21: Billed clients $24,000 on account.

- Nov. 25: Declared dividends $3,000. The amount of dividends will be distributed in December.

- Nov. 28: Paid utility bills for the month of November $180.

- Nov. 29: Received $20,000 cash from clients billed on November 21.

- Nov. 30: Paid salary for the month of November $7,500

Required: Record the above transactions in a general journal.

Solution:

The use of software packages for journalizing:

In modern accounting systems, most of the companies use some form of software package that automates many tasks involved in journalizing their business transactions. A basic understanding of manual procedure to record transactions in a general journal is, however, necessary to know how software packages perform their function.

Click on the next link below to see how ledger accounts of Moon Service Inc. will be prepared.

Good

I’ve really understood how to journalise,🖤🖤❤️

I finally understand how to do general journal but i am still stock with how to modifuy contengency plan with the ledger?

I appreciate everything, at least, I can now prepare a journal.

This helped me know how to journalize

I now understand and know how to prepare a journal