Source documents used to record sales, purchases and returns of goods

Every business transaction begins with an original or source document. Purchases and sales of goods begin with the documents known as invoices. Purchase returns and sales returns are acknowledged by a credit note. In every case, it is the seller who makes out the document, sending one copy to the other party in the transaction. These business documents are very important for understanding the procedure of recording sales, purchases, and returns of goods in the books of accounts. Let’s discuss them one by one in the rest of this article.

Invoice – the source document used to record sales and purchases

An invoice is a business document that is made out whenever one person sells goods to another. It can be used in a court of law as evidence for the sale of goods. The invoice is made out by the person selling the goods. In large businesses, it may have as many as four copies of different colors.

The first copy of the invoice is sent by post or by hand to the person buying the goods, who uses it to record the entry in his purchases journal. After recording the entry in his books, the buyer saves the invoice with him as his copy of the contract of sale. The invoice sent by the seller is an “outward invoice” to the seller, and the same invoice is an “inward invoice” to the buyer.

The second copy is kept by the seller with himself and is used to record sales in his sales journal. After recording sales, the seller files the invoice as his copy of the contract of sale.

The third and fourth copies are sent together to the store department of the seller. The third copy is often called the “delivery note,” and the fourth copy is called the “advice note.”

In order to be a valid proof of sale and purchase transaction, an invoice must have the following information:

- Names and addresses of both parties to the contract of sale.

- The date of sale

- An exact description of the goods, with quantity and unit price and details of any trade discount given to the buyer.

- The terms on which goods are sold, i.e., the cash discount and credit period. The word “terms net” means no discount is allowed. The word “prompt settlement” means no credit period is given.

- The letters E & O.E are often written on the bottom of the invoice. These letters mean “errors and omissions expected.” If an error or omission has been made, the firm selling the goods may put it right.

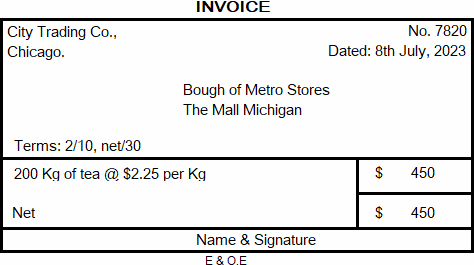

Specimen or format of an invoice

A specimen or format of the invoice used to record sales and purchase transactions are given below:

Note: The terms 2/10, net 30 mean if the buyer pays the price of goods within 10 days of the invoice date, he will be allowed a cash discount of 2%.

Debit and credit notes – the source documents used to record returns of goods

Debit note

If goods purchased on credit are returned to the seller for a solid reason, the buyer debits the seller’s account and informs him through a note. This note is called the debit note.

Specimen or format of a debit note

A simple format of the debit note is given below:

In the above debit note, John & Company (the buyer) intimates Roberts & Company (the seller) that their account has been debited by $2,000 for inferior quality goods returned to them.

Credit note

If goods sold on credit are returned by the buyer for a solid reason, the seller credits the buyer’s account and informs him through a note. This note is called the credit note.

Specimen or format of a credit note

The simple format of a credit note is shown below:

In the above credit note, Roberts & Company (i.e., the seller) intimates John & Company (i.e., the buyer) that their account has been credited by $2,000 for inferior quality goods returned by them.

In short, a debit note or credit note is nothing but an intimation of having debited/credited the buyer/seller account. The details of goods returned, reasons for return, etc. are mentioned in the note.

Leave a comment