Perpetual inventory system

Definition and explanation

Perpetual inventory system is a technique of maintaining inventory records that provides a running balance of cost of goods available for sale and cost of goods sold for a period. Under this system, no purchases account is maintained because inventory account is directly debited with each purchase of merchandise. Under perpetual inventory system, the expenses that are incurred to obtain merchandise inventory are added to the cost of merchandise available for sale. These expenses are, therefore, also debited to inventory account under this system. The general examples of such expenses include freight-in and insurances expense etc. Each time the merchandise is sold, the related cost is transferred from inventory account to cost of goods sold account by debiting cost of goods sold and crediting inventory account.

The journal entry for this transfer looks like the following:

Cost of goods sold account [Dr]

Inventory [Cr]

The balance in inventory account at the end of an accounting period shows the cost of inventory in hand. The accuracy of this balance is periodically assured by a physical count – usually once a year. If a difference is found between the balance in inventory account and the physical count, it is corrected by making a suitable journal entry (illustrated by journal entry number 6 given below). The common reasons of such difference include inaccurate record keeping, normal shrinkage, and shoplifting etc.

Both merchandising and manufacturing companies can benefit from perpetual inventory system. Merchandising companies use this system to maintain the record of merchandising inventory and manufacturing companies use it to account for purchase and consumption of their manufacturing inputs like direct materials and supplies etc.

Traditionally, the perpetual inventory system was used by companies that buy and sell easily identifiable inventories such as jewellery, clothing and appliances etc. However, advanced computer software packages have made its use easy for almost all business situations and the companies selling any kind of inventory can now benefit from the system.

Journal entries in a perpetual inventory system:

The set of journal entries involved starting from purchase to sale of goods under perpetual inventory system is given below:

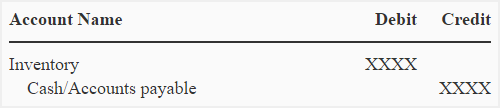

(1). When goods are purchased:

(2). When expenses such as freight-in, insurance etc. are incurred:

(3). When goods are returned to supplier:

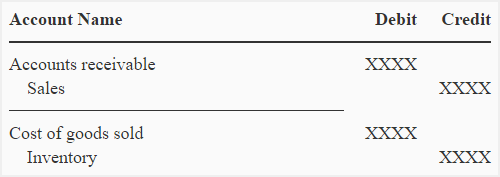

(4). When goods are sold to customers:

The sale involves two journal entries – one to record the sale which is the same as made under periodic inventory system and one to transfer the cost of inventory from inventory account to cost of goods sold (COGS) account.

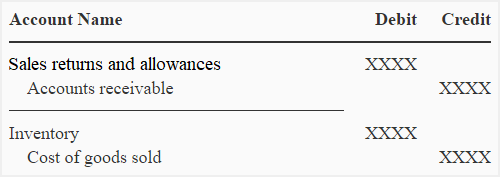

(5). When goods are returned by customers:

The return of goods from customers to seller also involves two journal entries – one to record the sales returns and allowances and one to reverse the transfer of cost from inventory to COGS account.

(6). When a difference between the balance of inventory account and physical count of inventory is found:

For further explanation of the concept of perpetual inventory system, consider the following example:

Example:

(1). On 1st April 2013, Metro company purchases 15 washing machines at $500 per machine on account. The supplier allows a discount of 5% if payment is made within 10 days of purchase. The Metro company uses net price method to record the purchase of inventory.

The following journal entry would be made in the books of Metro company to record the purchase of merchandise:

*Net of discount: ($500 × 15) – $25 discount

(2). On the same day, Metro company pays $320 for freight and $100 for insurance.

The following journal entry would be made to record the payment of freight-in and insurance expenses:

(3). On April 07, Metro company returns 5 washing machines to the supplier.

The return of washing machines to the supplier decreases the cost of inventory and accounts payable. The following entry would be made to record this decrease:

(4). On April 9, Metro sends the payment via online banking system and takes the advantage of the discount offered by the supplier.

As the payment is made within 10 days, the Metro company is entitled to receive discount. The following entry would be made to record the payment:

*($7,125 – $2,375)

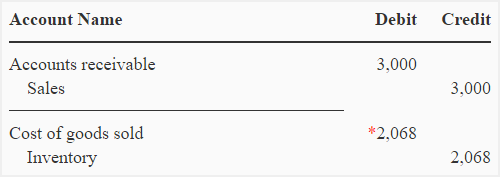

(5). On April 15, Metro company sells 4 washing machines at $750 per machine. The Metro company does not allow any discount to customers.

The sale of 4 washing machines transfers the cost of inventory from inventory account to cost of goods sold account. Two journal entries would be made; one for the sale of 4 washing machines and one for the transfer of cost from inventory account to cost of goods sold account:

*Cost of 4 machines sold:

[($475 × 10 machines) + $420 expenses]/10 = $517 per machine

$517 × 4 machines = $2,068

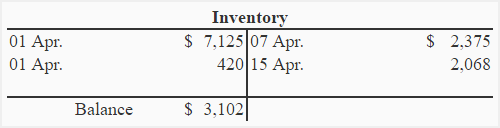

To summarize the events of increase and decrease in the cost of inventory, Inventory T-account of Metro company is given below:

Good, well understood

Well understood

Thanks for the review.

Thanks a lot