Sales tax payable

What is sales tax?

Sales tax is a type of tax levied by the government on the sale of certain goods and services. Companies, firms and individuals selling certain goods and services are required to collect sales tax from their customers and periodically remit the same to appropriate tax authorities. In other words, we can say that the sellers not only collect revenue for themselves by selling goods and services but also for the government in the form of sales tax. The amount of sales revenue and the amount of sales tax collected from customers should be separately listed on the sales invoice.

What is sales tax payable?

Sales tax payable is a liability that arises when companies, firms and individuals sell goods and services to their customers and collect sales tax from them on behalf of the government. Once the tax has been collected from a customer, it becomes a liability in the books of the seller because he is liable to deliver it to the government.

A general ledger account titled as “sales tax payable account” is used to account for the amount of tax collected from customers and the amount of tax remitted to the tax authorities. Sales tax payable account is a liability account that normally has a credit balance. This account is credited when the tax is collected from customers and debited when the amount is delivered to the tax authorities.

The sales tax is levied at a certain percentage of the retail price of goods and services. This percentage is generally not the same for all types of goods and services but varies depending on their nature. For example, the tax on sale of tobacco products may significantly differ from that levied on food and household goods. Similarly, the sale of some goods and services may be fully exempt from sales tax.

Sales tax payable liability on balance sheet

The sales tax payable liability is normally payable within one-year period of the date of its collection and is, therefore, classified as short-term or current liability. When a business prepares its balance sheet, the balance disclosed by its sales tax payable account up to the balance sheet date is reported in the current liabilities section.

Journal entries for recording the collection and remittance of sales tax

Two journal entries are related to sales tax payable liability – one that is made at the time of collection of sales tax and one that is made at the time of remittance of collection to the government.

(i). Journal entry at the time of collection of sales tax

When a business sells goods or services and collects sales tax, it makes the following journal entry:

Cash [Dr.]

Sales revenue [Cr.]

Sales tax payable [Cr.]

The above journal entry increases the balances of cash account (or accounts receivable account in case of credit sale), sales revenue account and sales tax payable account.

(ii). Journal entry at the time of remittance of sales tax

When the collected amount of tax is remitted to the relevant tax authorities, the following journal entry is made:

Sales tax payable [Dr.]

Cash [Cr.]

The above journal entry reduces the balance of both sales tax payable account and cash account by the same amount.

Example

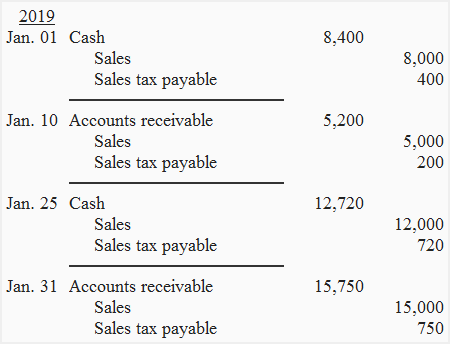

Marshal Company makes only four sales during the month of January 2019. These sales are made as follows:

- Jan. 01: A cash sale of $8,000 which is subject to 5% sales tax.

- Jan. 10: A credit sale of $5,000 which is subject to 4% sales tax.

- Jan. 25: A cash sale of $12,000 which is subject to 6% sales tax.

- Jan. 31: A credit sale of $15,000 which is subject to 5% sales tax.

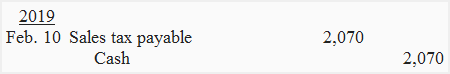

The state in which Marshal operates requires companies to remit the sales tax to appropriate tax agency by the 15th day of the month following the sales. Marshal remits the tax on February 10, 2019.

Required: Prepare journal entries to record the sales made by Marshal during the month of January. Also prepare a journal entry to record the remittance of sales tax by the company on February 10, 2019.

Solution

(a). Journal entries to record the sales made during January:

(b). Journal entry to record the remittance of sales tax on February 10, 2019:

Total sales tax collected from customers during January:

$400 + $200 + $720 + $750 = $2,070

Keeping sales tax record when a sales journal is used for credit sales

If a business uses a sales journal to record credit sales, it usually provides a separate column to record sales tax payable arising from each credit sale. At appropriate intervals, the total of this column is posted to sales tax payable account maintained in the general ledger. Similarly, any reduction in sales tax payable liability resulting from sales returns is recorded in a separate column provided in sales returns and allowances journal. The total of this column is debited to sales tax payable account at appropriate intervals.

Hi,

In QuickBooks Desktop why is the Sales Tax is accumulating in my Cash Account.?