Dividends payable

Contents:

- Definition and explanation

- Dividends payable liability on balance sheet

- Journal entries related to dividends payable liability

- Example

- Reporting of stock dividends and dividends in arrears

Definition and explanation

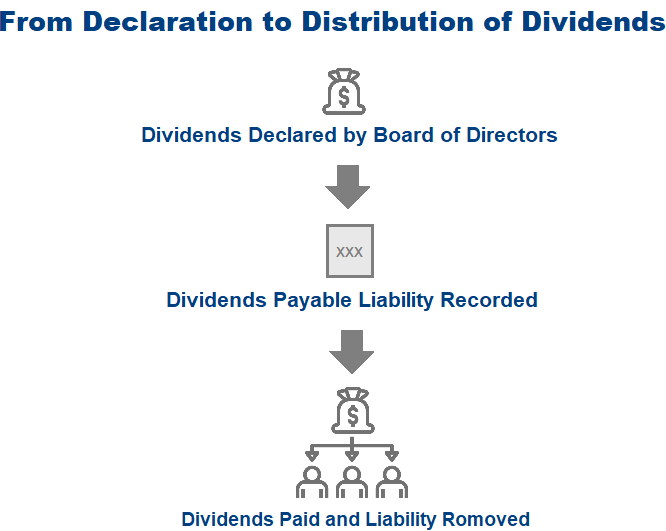

Dividends payable is a liability that comes into existence when a company declares cash dividends for its stockholders. When the board of directors of a company authorizes and declares a cash dividend, the dividends payable liability equal to the amount of dividends declared arises.

A general ledger account titled as “dividends payable account” is used to account for all declarations and payments of dividends to stockholders. Dividends payable account is a liability account and, therefore, normally has a credit balance. It is credited when directors declare a cash dividend and debited when the cash for a previously declared dividend is paid to stockholders.

Well established companies often pay dividends to their stockholders on regular basis. However, students should keep in mind that no liability arises in a period unless and until the board of directors actually authorizes and declares the dividends in that period.

Dividends payable liability on balance sheet

Dividends payable are classified as current liability because they are mostly payable within one year period of the date of their declaration. If a balance sheet is prepared between the date of declaration of cash dividends and the date of actual payment of cash to stockholders, the balance in the dividends payable account must be reported in the current liabilities section of the balance sheet. For example, suppose, Metro Inc. declares a cash dividend of $500,000 on December 15, 2023 and the cash payment against this declaration is to be made on January 15, 2024. Now, if Metro prepares its financial statements on December 31, 2023, it must report a dividends payable liability of $500,000 in current liabilities section of its balance sheet.

Dividends payable is a unique liability because the amount of this liability is payable to company’s own stockholders, not to a third party.

Journal entries related to dividends payable

Two journal entries are related to dividends payable liability – one that is made at the time of declaration of dividends and one that is made at the time of payment of dividends.

1. Journal entry at the time of declaration of dividends:

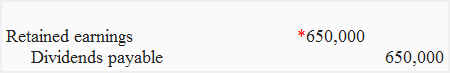

Dividends are often declared by the companies prior to their actual payment to stockholders. When dividends are declared, the retained earnings account is debited and dividends payable account is credited. The journal entry for this looks like the following:

Retained earnings [Dr.]

Dividends payable [Cr.]

The above journal entry creates a dividend payable liability equal to the amount of dividends declared by the board of directors and reduces the balance in retained earnings account by the same amount.

2. Journal entry at the time of payment of dividends:

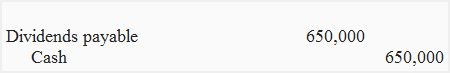

When cash for previously declared dividends is paid to stockholders, dividends payable account is debited and cash account is credited. The journal entry for the payment of cash dividends looks like the following:

Dividends payable [Dr.]

Cash [Cr.]

As a result of above journal entry, the cash balance reduces by the amount of dividend paid to stockholders and the dividend payable liability extinguishes.

Example

During the year 2023, the Manchester Inc. had 500,000 shares of $10 par value common stock and 50,000 shares of 8%, $100 par value preferred stock outstanding. The board of directors of the corporation declared dividends during the year 2023 as follows:

- Declared a cash dividend of $0.5 per share on $10 par value common stock.

- Declared a cash dividend on 8%, $100 par value preferred stock.

Required: Assuming the dividend declaration is recorded in retained earnings, prepare journal entries required at the time of declaration and payment of above dividends.

Solution

1. Journal entry required at the time of declaration of cash dividends:

As a result of above journal entry, the Manchester Inc. would debit its retained earnings account and credit dividends payable account by $650,000

2. Journal entry required at the time of payment of cash dividends:

As a result of above journal entry, the Manchester Inc. would debit its dividends payable account and credit cash account by $650,000.

*Dividends declared during 2023:

Cash dividend on common stock:

= 500,000 shares × $0.5

= $250,000

Cash dividend on preferred stock:

50,000 shares × $100 × 8%

= $400,000

Total cash dividends declared on two classes of stock during 2023:

= $250,000 + $400,000

= $650,000

Reporting of stock dividends and dividends in arrears

The declaration of stock dividends is not recognized as liability because it does not require any future outflow of cash or another current asset. Also the board of directors can revoke such issuance any time before the shares are actually distributed to stockholders.

The undistributed stock dividends don’t create a dividends payable liability. They are, therefore, generally presented in the stockholders’ equity section rather than the current liabilities section of the balance sheet.

The accumulated but undeclared dividends on cumulative preferred stock are also not reported as an obligation because they do not give rise to a liability until a formal action of authorization and distribution of dividends is taken by the company’s board of directors. These omitted or undeclared dividends are usually termed as dividends in arrears on cumulative preferred stock and are normally presented in the foot notes to the company’s balance sheet. Another acceptable means for disclosing dividends in arrears is to parenthetically report them in capital stock section of company’s balance sheet.

Leave a comment