Unearned revenue

Contents:

Definition and explanation

Unearned revenue liability arises when payment is received from customers before the services are rendered or goods are delivered to them. According to revenue recognition principle of accounting, an inflow of cash from customers or clients can’t be regarded as revenue until the underlying goods or services are actually provided to them.

Since the consideration (i.e., goods or services) against the receipt of advance cash is typically delivered within an year, unearned revenue mostly qualifies as a current liability and is reported as such in the balance sheet. Other names used for this liability include unearned income, prepaid revenue, deferred revenue and customers’ deposits.

Let’s assume, for example, Mexico Manufacturing Company receives $25,000 cash in advance from a buyer on December 1, 2021. The agreement pertaining to this transaction stats that the company must manufacture and provide goods to the buyer on January 15, 2022 against the prepayment received from him on December 1, 2021. The amount of $25,000 will essentially appear as liability in the books of Mexico Company until it manufactures and actually delivers the goods to the buyer on January 15, 2022.

If Mexico prepares its annual financial statements on December 31 each year, it must report an unearned revenue liability of $25,000 in its year-end balance sheet. When the company will deliver goods to the buyer on January 15, 2022, it will eliminate the liability and recognize a revenue in its accounting records on that date.

Under accrual concept of accounting, this revenue will essentially become a part of the company’s total revenue for the year 2022 because it will be considered as “revenue” or “earned revenue” only in year 2022, and not in 2021.

Unearned revenue is not an uncommon liability; it can be seen on the balance sheet of many companies. For example, hotels and restaurants issue special tickets that customers can exchange for meals within some specific future period, software companies issue coupons that their customers can use to update the software to latest version the company might release in future, magazine publishers may receive cash or checks in advance at the time of receiving orders from their customers, airline companies generally sell their tickets to passengers for future flights etc.

In some industries, the unearned revenue comprises a large portion of total current liabilities of the entity. For example in air line industry, this liability arisen from tickets issued for future flights consists of almost 50% of total current liabilities.

Journal entries related to unearned revenue

1. When advance cash is received from customer:

When prepayment from a customer is received, a liability is recorded immediately. To record this liability, cash account is debited and unearned revenue account is credited. The journal entry is given below:

Cash [Dr.]

Unearned revenue [Cr.]

2. When the revenue is actually earned:

When the revenue is actually earned by delivering the related goods and/or services, the liability decreases and revenue increases. It is recorded by debiting unearned revenue account and crediting earned revenue account. The journal entry looks like the following:

Unearned revenue [Dr.]

Earned revenue [Cr.]

The above journal entry converts the liability into revenue.

Companies in different industries use their own specific account titles to identify the source of their unearned and earned revenues. Some examples of account titles that are commonly used in this regard are given below:

Example

The Sydney Cricket Stadium sells 5,000 tickets at $100 each for a five-match ODI series between Australia and England.

Required: Make journal entry:

- to record unearned revenue liability at the time of sale of tickets.

- to recognize revenue at the end of each match of the series.

Solution

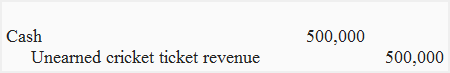

1. Journal entry required to record liability at the time of sale of tickets:

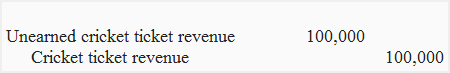

2. Journal entry required to recognize revenue at the end of each match:

Leave a comment