Overriding commission in consignment

Definition and explanation

Overriding commission is a type of commission which a consignor grants to the consignee who achieves a specific sales target or whose total sales revenue exceeds a specified amount. It encourages consignee to realize the best possible price for goods sold. Sometime it is given to consignee as an incentive for putting his efforts to introduce, promote and create market for a new product in certain areas.

Overriding commission is an extra commission which is awarded to the consignee in addition to his ordinary or regular commission. In consignment account, it is treated in the same way as the ordinary commission of consignee. Generally, all types of commission paid to consignee are added together and the total amount is debited to consignment account as a single line item.

Consider the following example to understand how this type of commission is calculated and treated in the books of consignor:

Example

On 1st August, 2019, Ali Brothers of Kolkata sent on consignment to Rana Brothers of Chennai 1,000 packets of goods costing $500 each and paid $2,000 for loading, $5,000 for freight and $8,000 for insurance.

Rana brothers paid $1,500 for unloading, $1,800 for godown rent and $3,500 for advertising. Rana brothers reported that 800 packets were sold for $600,000. They were entitled to an ordinary commission of 10% on regular selling price and an overriding commission of 15% on any amount realized over and above the regular selling price. No del credere commission was agreed upon in consignment contract. The regular selling price was $650 per unit (i.e., cost plus 30%).

Rana Brothers sent payment for the balance due directly to the bank account of Ali Brothers via internet banking.

Required: Draw up consignment to Chennai account, Rana Brothers account and goods sent on consignment account in the books of Ali Brothers. (The detailed calculation of consignee’s commission and the value of stock on consignment should be the part of your answer).

Solution

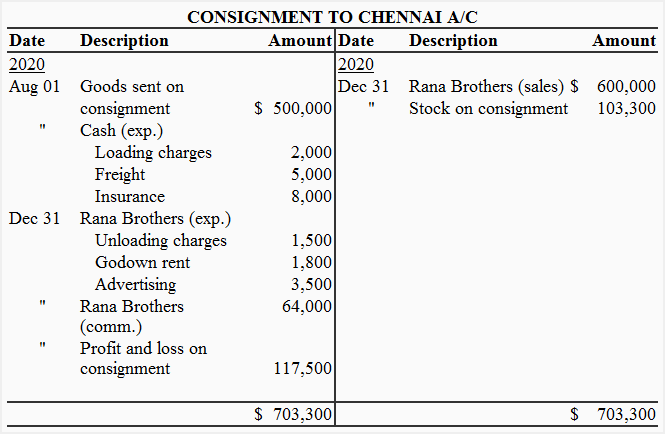

1. Consignment to Chennai account:

Working note 1: Calculation of commission:

Ordinary commission + Overriding commission

= [(800 × 650) × 0.1] + [(600,000 – 520,000) × 0.15]

= [520,000 × 0.1] + [80,000 × 0.15]

= 52,000 + 12,000

= $64,000

Working note 2: Calculation of stock on consignment:

= Cost of 200 units + Proportionate non-recurring expenses

= [(200 × 500) + (*16,500/1,000) × 200]

= 100,000 + 3,300

= $103,300

*Non-recurring expenses: $2,000 + $5,000 + $8,000 + $1,500

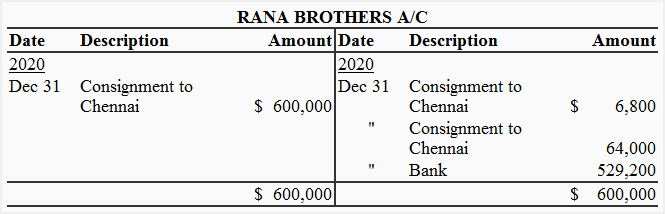

2. Rana Brothers account:

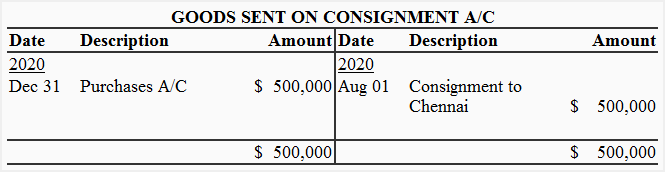

3. Goods sent on consignment account:

Leave a comment