Del credere commission and credit sales

Content:

- Definition and explanation

- Entries related to credit sales and del credere commission

- Example – consignment accounting with and without del credere commission

Definition and explanation

Del credere commission is related to credit sales. It is a type of commission which a consignor offers to the consignee who guarantees the collection of payment from credit customers. It is different from the consignee’s ordinary commission and works like a credit insurance to consignor in the event a customer becomes insolvent or fails to make payment due to some other reason. In consignment account, del credere commission appears on the debit side along with the ordinary commission allowed to the consignee.

Calculation of del credere commission

Del credere commission is paid to the consignee in addition to his ordinary commission. It is usually computed at a certain pre-agreed percentage of total gross sale proceeds. For example, the cash sales are $5,000 and credit sales are $2,500. If an ordinary commission of 10% and a del credere commission of 5% are allowed to consignee, the two types of commission would be computed separately as follows:

Ordinary commission = ($5,000 + $2,500) × 0.1

= $750

Del credere commission = ($5,000 + $2,500) × 0.05

= $375

The computation of del credere commission is similar to the computation of ordinary commission. However, the consignor and consignee may sign a separate agreement regarding the calculation and payment of del credere commission.

Students should remember the following two points:

- if del credere commission is not paid to the consignee, the consignor will bear the losses resulting from consignment related bad debts.

- if del credere commission is paid to the consignee, the consignee will bear the losses resulting from consignment related bad debts.

Entries related to credit sales

(1). When a del credere commission is not given to consignee

Entries in the books of consignor:

(1). At the time of credit sales:

Consignment debtors A/C [Dr]

Consignment A/C [Cr]

(2). At the time of collection of debtors:

Cash/Bank A/C [Dr]….Collection by consignor

Consignee A/C [Dr]…..Collection by consignee

Consignment debtors A/C [Cr]

(3). Entry for bad debts/discount allowed:

Bad debts/Discount allowed A/C [Dr]

Consignment debtors A/C [Cr]

(4). At the time of closing bad debts/discount allowed account:

Consignment A/C [Dr]

Bad debts/Discount allowed A/C [Dr]

Entries in the books of consignee

(1). At the time of credit sales:

No entry

(2). At the time of collection of debtors:

Cash/Bank A/C [Dr]

Consignor A/C [Cr]

(3) Entry for bad debts:

No entry

(2). When a del credere commission is given to consignee

Entries in the books of consignor

(1). When credit sales are made

Consignee A/C [Dr]

Consignment A/C [Cr]

(2). Entry for bad debts:

No entry – when del credere commission is allowed to the consignee, the consignor has nothing to do with bad debts.

(3). For consignee’s ordinary and del credere commission:

Consignment A/C [Dr]

Consignee A/C [Cr]

Entries in the books of consignee

(1). When credit sales are made:

Consignment debtors [Dr]

Consignor A/C [Cr]

(2). At the time of collection of debtors:

Cash/Bank [Dr]

Consignment debtors [Cr]

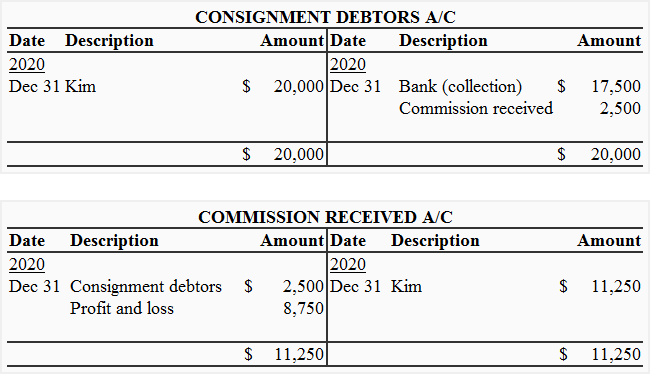

(3). Entry for bad debts:

Bad debts A/C [Dr]

Consignment debtors A/C [Cr]

(4). Entry for closing bad debts account

Consignee adjusts the amount of bad debts against his commission from consignment. The bad debts are debited to the commission received account. At the end of the year, the net balance of commission received account is transferred to the profit and loss account. This is done by means of the following two journal entries:

i. The following entry closes the bad debts account to commission received account:

Commission received A/C [Dr]

Bad debts A/C [Cr]

ii. The following entry closes the commission received account to profit and loss account:

Profit and loss A/C [Dr]

Commission received A/C [Cr]

Example – consignment accounting with and without del credere commission

On 1st October 2020, Kim of Manchester consigned goods costing $50,000 to Harry of Bristol. Kim paid $120 as railway freight and $150 as insurance. On 31 December 2020, an account sales was received from Harry showing that all the goods were sold for $75,000 – out of which, $20,000 were sold on credit. Harry paid $115 as carriage and $125 as storage expenses.

A credit customer who purchased goods for $2,500 did not make payment and the debt proved bad. All other payments were successfully collected by Harry. The Harry was entitled to an ordinary commission of 10% on gross sale proceeds. A cross check was enclosed with the account sales for the balance amount.

Required:

- Draw up necessary ledger accounts in the books of Kim and Harry using above information.

- Disregard the requirement 1 and refer to the original information. Draw up necessary ledger accounts in the books of Kim and Harry assuming the Harry is given a 5% del credere commission (in addition to his ordinary commission). Other things remaining the same.

Solution

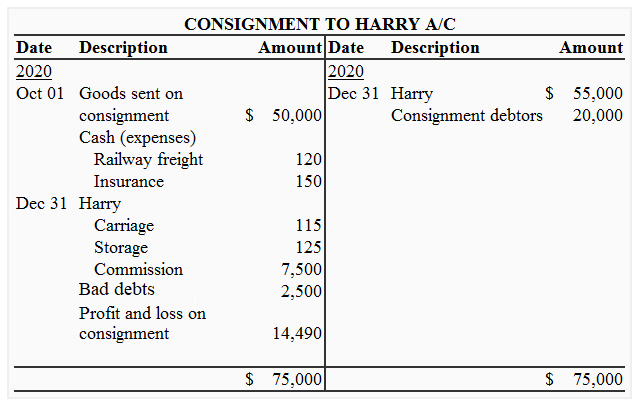

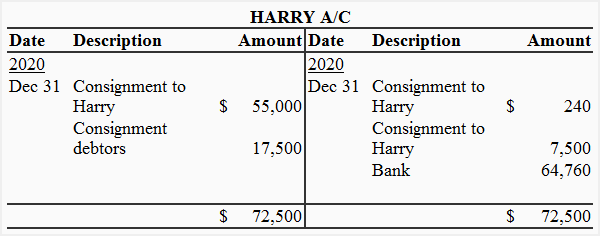

1. Where no del credere commission is given to Harry:

In the books of Kim (the consignor)

In the books of Harry (the consignee)

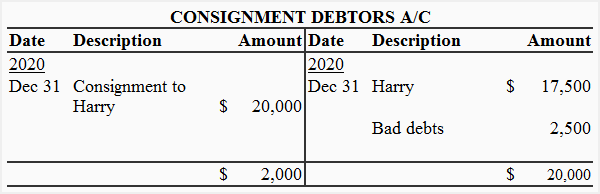

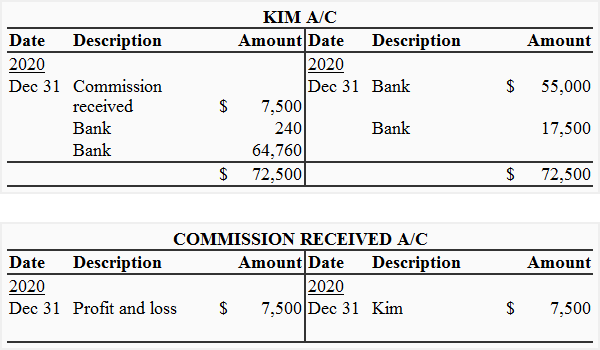

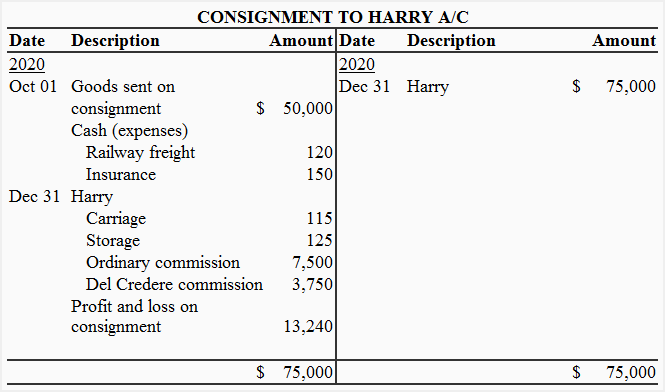

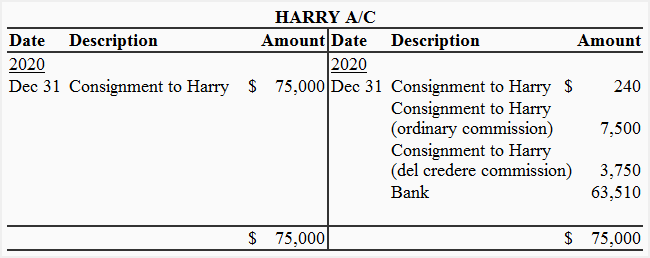

2. Where a del credere commission is given to Harry

In the books of Kim (the consignor)

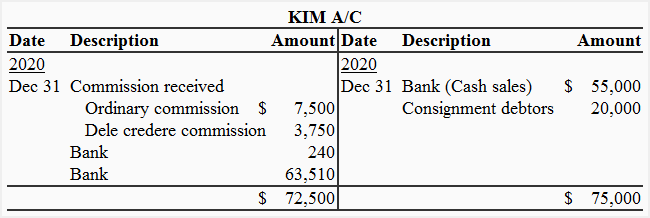

In the books of Harry (the consignee)

Leave a comment