Valuation and treatment of stock (goods) in transit

In consignment, the term stock in transit refers to the units of goods that remain in transit on the last day of consignor’s accounting year. Stock in transit must be valued and brought in the books of consignor so that the actual profit earned or loss sustained by the relevant consignment can be accurately determined.

This valuation includes consignor’s non-recurring cost which typically consists of original cost of units in transit plus all non-recurring expenses paid by the consignor. Since these units are still in transit and have not yet been received by the consignee, no portion of expenses paid by the consignee can be made part of stock in transit. Consignee’s non-recurring expenses belong to only those units that he has actually received and transported to his godown or shop etc.

The value of stock in transit is added to the value of unsold stock with consignee. The aggregate amount is then credited to the consignment account. In balance sheet, the same aggregate figure ( i.e., stock with consignee + stock in transit) is recorded as current asset.

Example

Abraham of Nagpur consigns 500 units of goods at a rate of $100 per unit to Suleman of Mumbai. The expenses incurred by Abraham are as follows:

- Loading and unloading charges: $600

- Transit insurance: $200

- Carriage: $300

- Octroi duty: $400

Suleman pays the following expenses in respect of consignment:

- Unloading: $400

- Cartage: $275

- Godown rent: $250

Suleman sells 300 units @ $180 per unit. 150 units remain unsold and 50 units are still in transit at the end of consignor’s accounting year. Suleman’s commission for this consignment is 20% of gross sale proceeds realized by him. No del credere commission is allowed.

Required: Compute the value of:

- stock in transit.

- unsold stock with consignee.

- total stock on consignment

Solution

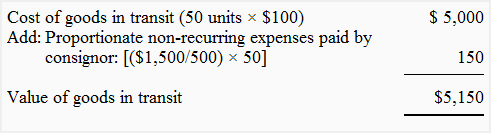

1. Value of stock in transit:

We have not taken into account the consignee’s non-recurring expenses in above computations because the consignee has not yet received these units.

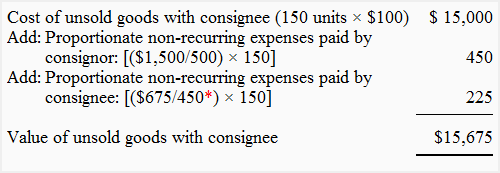

2. Value of unsold stock with consignee

*The consignee has paid non-recurring expenses of $675 for 450 units (i.e., the units he has actually received).

Units received by consignee = Units dispatched by consignor – Units still in transit

= 500 units – 50 units

= 450 units

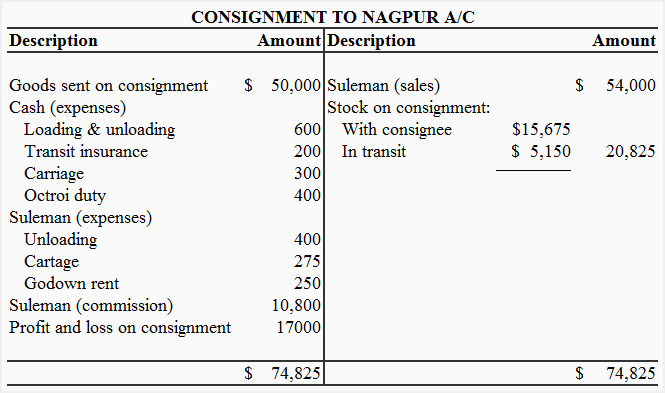

3. Total value of stock on consignment

Total stock on consignment = Value of unsold stock in consignee’s godown + Value of stock in transit

= $15,675 + $5,150

= $20,825

In the books of Abraham (consignor), the stock on consignment figure of $20,825 must be credited to consignment to Nagpur account. The presentation of stock on consignment may be made as follows:

Leave a comment