Advance on consignment made by consignee

Advance on consignment is the amount which a consignee sends to the consignor in advance, either as security against goods received or as investment assistance for consignor. The amount is sent in the form of cash, check or a bank draft in favor of consignor. Alternatively, the consignee may also accept a bill of exchange drawn by the consignor on him for this purpose.

Where the consignee sends advance, the amount of advance is adjusted against the proceeds due from him. The method of such adjustment highly depends upon the purpose for which the consignor asks for the advance payment from consignee. The procedure is discussed and exemplified below.

Where the purpose of advance is not the security of goods

Where the purpose of advance is not the security of goods, the full amount of advance is adjusted against the amount due from consignee, even if some stock remains unsold with the consignee at the end of the period. The journal entries in this regard are made as follows:

In the books of consignor

1. Journal entry at the time of receiving advance from consignee:

Cash/Bank/Bill receivable A/C [Cr]

Advance against consignment A/C [Dr]

2. Journal entry for adjusting the amount of advance at the end of the period:

Advance against consignment [Dr] – With full amount of advance

Consignee [Cr]

In the books of consignee

1. Journal entry when advance is sent to consignor:

Advance against consignment [Dr]

Cash/Bank/Bill receivable [Cr]

2. Journal entry for adjustment of advance at the end of the period:

Consignor [Dr] – Full amount of advance

Advance against consignment [Cr]

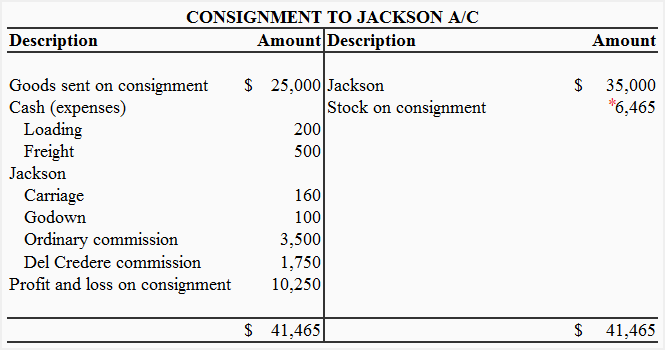

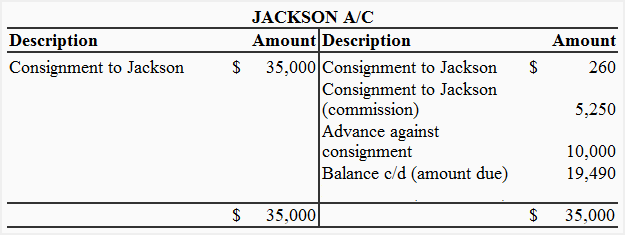

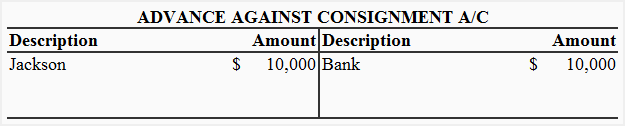

Consider the example 1 given below which makes the adjustment procedure more clear.

Example 1

William of Liverpool sent goods costing $25,000 to Jackson of Glasgow on consignment basis. William incurred the following expenses:

- Loading: $200

- Freight: $500

Jackson took the delivery of goods and transported the same to godown. He paid the following expenses:

- Carriage: $130

- Godown rent: $120

Jackson sent a cross check for $10,000 to William as advance against consignment. According to account sales sent by Jackson, 3/4 of goods were sold for $35,000. A customer who purchased goods for $1,000 failed to pay and the debt proved bad. The consignee was allowed a 10% ordinary commission and 5% del credere commission on gross sale proceeds.

Required: In the books of William, prepare a consignment to Jackson account, Jackson’s personal account and advance on consignment account.

Solution

*Valuation of closing stock on consignment:

= ($25,000 + $200 + $500 + $160) × 1/4

= $6,465

Where the purpose of advance is the security of goods

Where the purpose of advance payment to consignor is the security of goods, the amount so sent must be proportionally adjusted against the amount due from consignee. For example, a consignee receives 500 units of goods from a consignor and sends him $5,000 in advance advance. If only 400 units are sold at the end of the period and the remaining 100 units are still held by consignee then only $4,000 [= ($5,000/500)×400] should be adjusted against the amount due from consignee.

The journal entries in respect of advance as security are be made as follows:

In the books of consignor

1. Journal entry at the time of receiving advance from consignee:

Cash/Bank/Bill receivable A/C [Cr]

Advance against consignment A/C [Dr]

2. Journal entry for adjustment at the end of the period:

Advance against consignment [Dr] – With proportionate amount of advance

Consignee [Cr]

In the books of consignee

1. Journal entry when advance is sent to consignor:

Advance against consignment [Dr]

Cash/Bank/Bill receivable [Cr]

2. Journal entry for adjustment of advance at the end of the period:

Consignor [Dr] – With proportionate amount of advance

Advance against consignment [Cr]

Consider the example 2 given below for a better understanding.

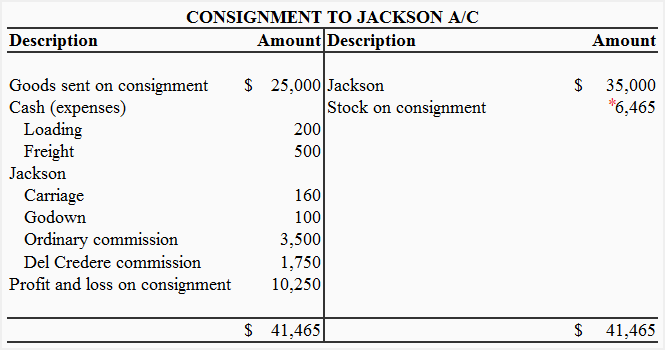

Example 2 – advance as security of goods

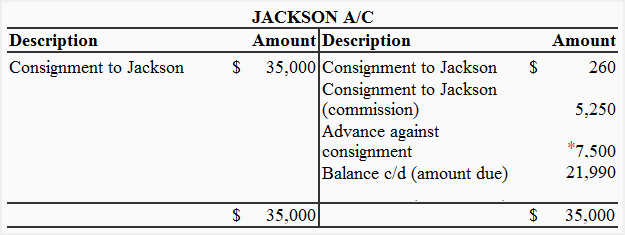

Refer to the data given in example 1 and assume that the cross check of $10,000 sent by Jackson is an advance against the security of goods on consignment.

Required: In the books of William, prepare consignment to Jackson account, Jackson’s personal account and advance against consignment account.

Solution

*Valuation of stock on consignment:

= ($25,000 + $200 + $500 + $160) × 1/4

= $6,465

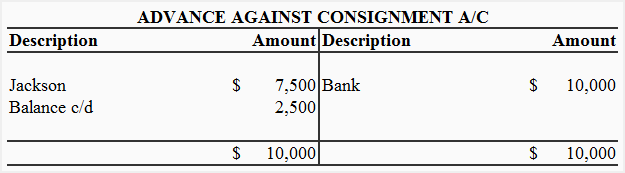

*Adjustment for advance against consignment:

The advance was sent as security against consignment. Therefore, $7,500 (= $10,000 × 3/4 ) would be adjusted against the amount due from consignee.

Notice that the advance against consignment account shows a balance of $2,500 which is proportionate to the unsold stock on consignment.

Leave a comment