Normal and abnormal loss in consignment

A part of the goods sent on consignment may possibly be lost or otherwise damaged while the goods are in transit or they are in consignee’s godown. It is the consignor who bears the loss because, in consignment model of business, the ownership to goods remains with the consignor and does not pass to the consignee. To understand the correct accounting treatment in the books of consignor, the loss on consignment must be classified as normal and abnormal.

In the rest of this article, we would see how normal and abnormal losses differ from each other and how they are treated in accounting for consignment.

Normal loss – meaning and treatment

Normal loss occurs majorly due to natural causes like drying, evaporation, leakage, shrinkage or perishing a few items due to handling goods in bulk quantities. It is an unavoidable or inevitable loss and we cannot avoided it by any effort.

Normal losses are mostly related to the nature or type of the goods being handled or moved from one place to another. These losses are highly expected in many industries and generally have a higher degree of acceptance as compared to abnormal losses.

In consignment, the normal loss is ignored which means its value is absorbed by remaining good units in the stock. For example, A consigns 1,000 units of goods costing $9,500 to B. The per unit cost of consignment is $9.5 (= $9,500/1,000 units). Suppose a normal loss of 50 units occurs and consignee receives 950 units. The increased per unit cost after normal loss would be $10 (= $9,500/950 units) and the stock on consignment would be valued using this new unit cost.

The students should remember the following two points while accounting for the normal loss in a consignment problem or assignment:

- If all the goods have been sold and nothing remains unsold in the stock, the normal loss does not require any treatment.

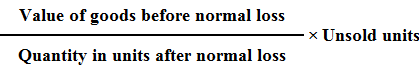

- If all the goods have not been sold and there remain some unsold units in the stock, the value of stock should be calculated using the following formula:

Example

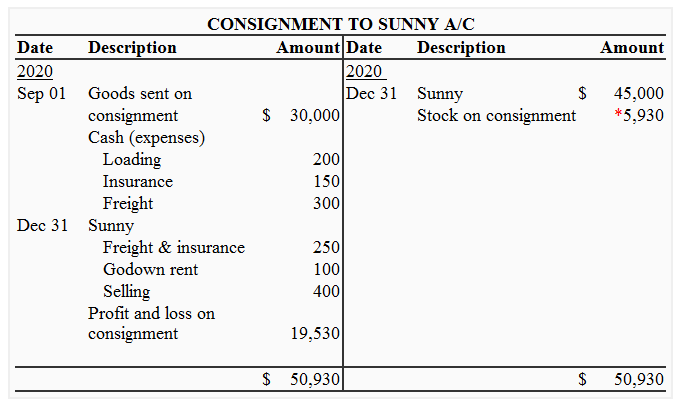

On 1st September, 2020, Dravid sent 1,000 kgs of goods costing $30,000 to Sunny on consignment basis. Dravid incurred the following expenses for sending the goods:

- Loading: $200

- Insurance: $150

- Freight: $300

Sunny’s expenses regarding consignment were as follows:

- Freight and insurance: $250

- Godown rent: $100

- Selling expenses: $400

Sunny sold 800 kgs for $45,000. His ordinary commission was 10% on gross sale proceeds. No del credere commission was allowed to him.

The consignee observed a loss of 10 kgs which was quite natural and was to be treated as normal.

Required: Prepare a consignment account in the books of Dravid. The detailed calculation of closing stock on consignment should be the part of your answer.

Solution

*Calculation of stock on consignment:

= (Value of goods before normal loss/Quantity received after abnormal loss) × Unsold stock

= [($30,000 + $200 + $150 + $300 + $250)/990] × 190

= $5,930 approx.

Abnormal loss – meaning and treatment

The abnormal loss is avoidable in nature and generally arises due to reasons like fire, theft, accident or flood etc. In consignment, the value of abnormal loss is charged to profit and loss account and not to consignment account. The consignment account, in fact, is given a credit for the value of abnormally lost units so that true profit or loss of consignment can be computed.

In consignment accounting, the abnormal loss is generally handled using one of the two methods discussed below:

Method 1

1. Journal entry if the goods are not insured:

Profit and loss A/C [Dr]

Consignment A/C [Cr]

2. Journal entry if the goods are fully insured:

Insurance claim A/C [Dr]

Consignment A/C [Cr]

3. Journal entry if the loss is more than the compensation given by insurance company:

Profit and Loss A/C [Dr]

Insurance claim A/C [Dr]

Consignment A/C [Cr]

4. Journal entry when the amount of claim is received from insurance company:

Bank A/C [Dr]

Insurance claim [Cr]

Method 2

Under second method, the abnormal loss is dealt through a special account known as “abnormal loss account”. When abnormal loss occurs, its entire value is transferred to abnormal loss account. The journal entries under this method are as follows:

1. Journal entry to transfer the loss to abnormal loss account:

Abnormal loss A/C [Dr]

Consignment A/C [Cr]

2. Journal entry to close the abnormal loss account if goods are not insured:

Profit and loss A/C [Dr]

Abnormal loss A/C [Cr]

3. Journal entry to close the abnormal loss account if goods are fully insured:

Insurance claim A/C [Dr]

Abnormal loss A/C [Cr]

4. Journal entry if the loss is more than the compensation given by insurance company:

Profit and Loss A/C [Dr]

Insurance claim A/C [Dr]

Abnormal loss A/C [Cr]

5. Journal entry when the amount of claim is received from insurance company:

Bank A/C [Dr]

Insurance claim [Cr]

Formula for the calculation of abnormal loss

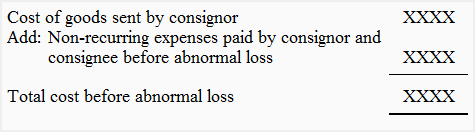

For computing the value of abnormal loss in consignment, we first need to compute the total cost of goods just before the occurrence of abnormal loss. It is done as follows:

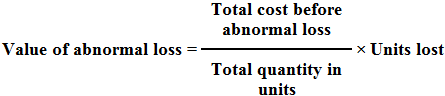

After the total cost of goods just the before abnormal loss has been obtained using above using above format, the value of abnormal loss can be ascertained by applying the following formula:

Consider the following example:

Example 1 – calculation of abnormal loss and closing stock

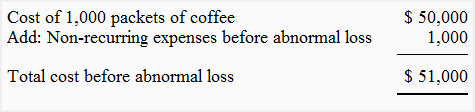

A consigned 1,000 packets of coffee costing $50,000 to B. A paid $700 for freight and $300 for insurance. While the goods were on their way to consignee, an accident occurred which completely destroyed 100 packets. B received the delivery of remaining 900 packets of coffee and transported them to a rented godown. B paid $600 as clearing charges, $400 as freight and insurance, $150 as godown rent and $200 as selling expenses.

800 packets were sold @ $75 per packet and 100 packets were still in stock at the end of the accounting period.

Required: Calculate the value of abnormal loss and the value of stock on consignment.

Solution

1. Calculation of abnormal loss:

Value of abnormal loss = ($51,000/1,000) × 100

= $5,100

The cost or value of 100 abnormally lost packets of coffee are $5,100.

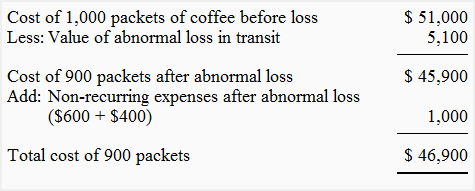

2. Calculation of stock on consignment:

Value of stock on consignment = ($46,900/900) × 100

= $5,289 approx.

Example – normal and abnormal loss simultaneously

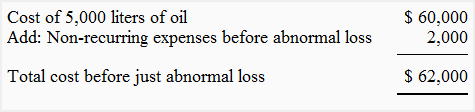

On January 1, 2019, PLC company of Toronto consigned 5,000 liters of olive oil, costing $12 per liter to Moon & Co of Ottawa. PLC incurred $500 as loading charges $1,500 as insurance and freight charges. On January 2, 2019, 150 liters of oil were destroyed in transit for which an insurance claim of $1,400 was settled and directly paid to the PLC on January 10. The Moon & Co. took delivery on January 3 and transported the goods to a rented godown. On the same day, they accepted a bill drawn on them by PLC for $30,000 for one month.

On January 31, 2019, Moon & Co. sent to PLC an account sales containing the following information:

4,000 liters of olive oil were sold @ $18 per liter. Unloading charges were $400, godown rent was $600, and selling and marketing expenses were $350. Due to leakage, a normal loss of 50 liters was observed. Moon & Co. was entitled to an ordinary commission of 10%. A check for the amount due was enclosed with the account sales.

Required: Show the following accounts in the books of PLC company:

- Consignment to Ottawa account

- Moon & Co. account

- Abnormal loss account

Solution

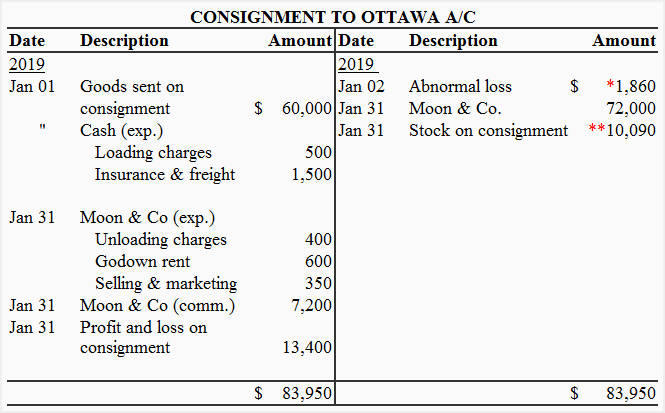

1. Consignment to Ottawa account

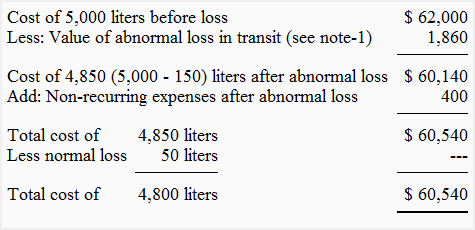

* Working note 1 – calculation of abnormal loss in transit:

Value of abnormal loss = (62,000/5,000 liters) × 150 liters

= $1,860

** Working note 2 – calculation of stock on consignment:

Value of stock on consignment = ($60,540/4,800 liters) × 800 liters

= $10,090

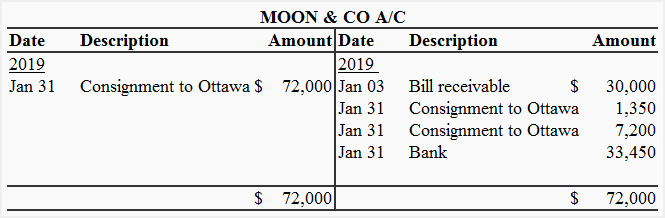

2. Moon & Co. account

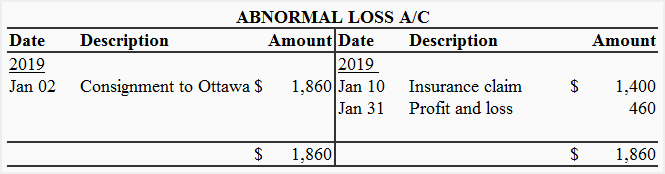

3. Abnormal loss account

Leave a comment