Return of goods by consignee

If some part of goods is not saleable, the consignee may return the same to the consignor. When goods are returned by the consignee, the consignor records it in his books by making the following journal entry:

Goods sent on consignment A/C [Dr]

Consignment A/C [Cr]

Notice that the above entry is exactly the reverse of the entry that is made at the time when consignor consigns goods to the consignee.

Treatment of expenses on return of goods

The return of goods from consignee to consignor may involve some expenses like loading, unloading, freight and octroi duty etc. The cash for these expenses may be paid either by consignor or by consignee. However, like other consignment expenses, they are ultimately born by the consignor.

A difference of opinion exists regarding the treatment of returning expenses in the books of consignor. Some accountants argue that these are consignment related expenses and should be charged to the consignment account. Others say that the expenses arisen from returning of the goods are policy costs and should therefore be charged to the general profit and loss account, and not to the consignment account.

For the sake of simplicity, students are advised to follow the first approach and charge these expenses to the consignment account while solving an examination problem or completing their homework assignment.

The journal entry to be passed by consignor is given below:

(i). If expenses are paid by consignor:

Consignment account [Dr]

Cash/Bank [Cr]

(ii). If expenses are paid by consignee:

Consignment account [Dr]

Consignee [Cr]

Example

On 1st January 2020, Rani Traders of Darjeeling consigned 1,000 kgs of tea costing $10 per kg to Mahesh & Co. of Nagpur. Rani Traders incurred the following expenses:

- Loading: $100

- Freight: $200

- Insurance: $150

Mahesh & Co. found that 100 kgs of tea was of poor quality which they returned to the Rani Traders on 15 December, 2020. They paid the following expenses in respect of consignment:

- Unloading & carriage to godown: $100

- Godown rent: $50

- Packaging and advertising: $250

- Freight on returning 100 kgs to consignor: $50

Mahesh & Co. sold 800 kgs of tea @ $14 per kg. Their ordinary commission was 10% of sales. They deducted all the money spent for expenses as well as the amount of their commission and remitted the balance to Rani Traders through wire transfer.

Required: Draw up the following accounts in the books on Rani Traders:

- Consignment account

- Mahesh & Co. account

- Goods sent on consignment account

Solution

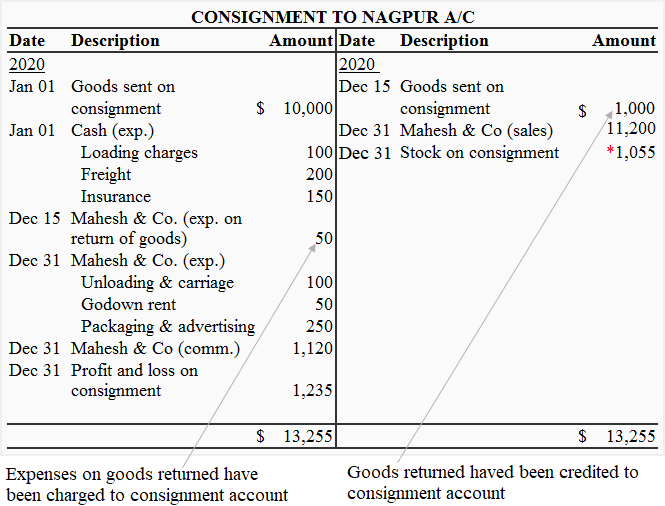

1. Consignment to Nagpur account

*Value of closing stock = Cost of 100 units in stock + Proportionate non-recurring expenses

= (100 units × $10) + [(*$550/1000 units) × 100 units]

= $1000 + $55

= $1,055

*Non-recurring expenses paid by both consignor and consignee: $100 + $200 + $150 + $100 = $550

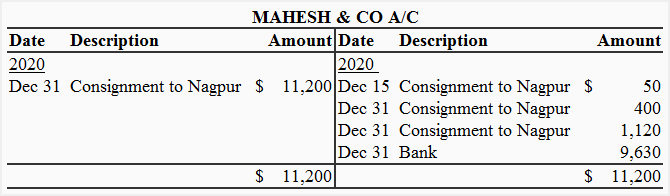

2. Mahesh & Co account

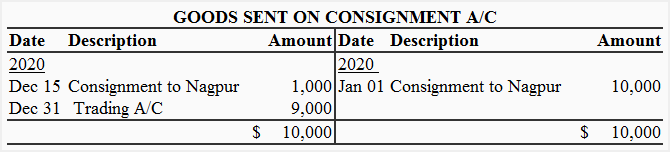

3. Goods sent on consignment account

VERY GOOD PRESENTATION