Diluted EPS with convertible securities

What is diluted earnings per share?

Diluted earnings per share (or diluted EPS, for short) is a financial metric that measures the net income allocable to each share of common stock after giving effect to all potentially dilutive securities that are outstanding during the entity’s reporting period.

The basic EPS computations presented on previous pages apply to a simple capital structure. An issue with basic EPS is that it ignores the potential impact of dilutive securities. As explained here, dilutive securities are those outstanding securities that can be converted to common shares . Upon conversion, dilutive securities can significantly dilute the EPS of the entity.

The publicly traded entities with complex capital structure are required to show both basic and diluted EPS numbers on the face of their income statement. A capital structure is complex when it has convertible securities, stock warrants, options or other rights that, upon exercise, can adversely impact the entity’s EPS.

The reporting of diluted EPS is mandatory because it calls attention towards potential dilutive effect of convertibles and other dilutive securities, which helps investors and other stakeholders conclude their decisions about the entity in future.

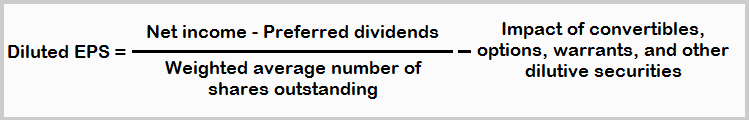

Formula and computation of diluted EPS

The computation of diluted earnings per share is similar to basic earnings per share. The difference is that diluted EPS recognizes the impact of potentially dilutive common shares but basic EPS does not. The formula of diluted EPS is given below:

Let’s illustrate the computation of diluted EPS through the following example:

Example of diluted EPS

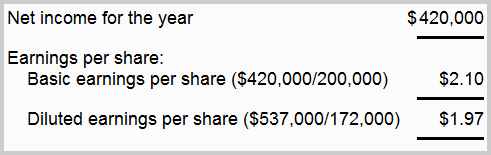

Alfred Trading Company has net income of $420,000 for the year 2023 and a weighted-average number of common shares outstanding during the year of 200,000 shares. The basic EPS is therefore $2.10 (= $420,000 ÷ 200,000 shares). During the year, Alfred has two convertible bond issues outstanding. One is a 5% issue sold at 100 (total amount $2,000,000) in last year and convertible into 40,000 shares of common stock. The other is an 8% issue sold at 100 (total amount $2,000,000) on July 1, 2023 and convertible into 64,000 shares of common stock. The company’s tax rate is 35%.

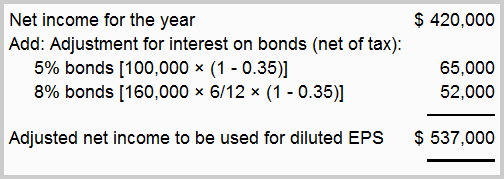

To find the numerator of diluted EPS formula, Alfred needs to add back the interest on its outstanding convertible securities (i.e., 5% and 8% bonds), less the tax effect.

Since Alfred assumes the conversion of its convertible bonds on the first day of the year 2023, it assumes that it pays no interest on these bonds during the year. The interest on 5% convertible bonds is $100,000 (= $2,000,000 × 0.05) and increased tax expense is $35,000 (= $100,000 × 0.35). The net of tax interest added back to net income is, therefore, $65,000 [= $100,000 – $35,000 or simply $100,000 × (1 – 0.35)].

Continuing with the above example, since Alfred issues 8% convertible bonds on July 1, 2023 (i.e., subsequent to the start of the year), it must weight all the common shares that could be issued upon conversion. In simple words, the company considers these shares to have been outstanding from July 1 to December 31, 2023. Therefore, the interest adjustment for these bonds reflects the interest expense for only six months period. As a result, the interest added back on these bonds is $52,000 [= $2,000,000 × 0.08 × 6/12 × (1 – 0.35)]. The last item in the computation is the adjusted net income which becomes the numerator for Alfred’s computation of diluted EPS.

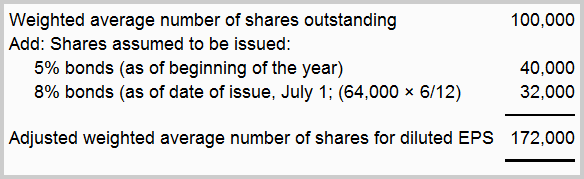

Alfred then calculates the weighted average number of shares to be used as the denominator in its diluted EPS computation. It calculates this number as follows:

Alfred reports both basic and diluted earnings per share in its income statements. This dual presentation is illustrated below:

Other considerations in diluted EPS computations

In addition to calculations presented in above example, the following factors need to be considered while computing diluted earnings per share of a company:

1. Discount or premium in convertible debt

The above example assumes that Alfred issued both 5% and 8% convertible bonds at their face amount. If the company instead issued these bonds at a discount or premium, it must adjust the interest expense to account for this occurrence.

2. Change in conversion rate

A security’s conversion rate may vary during the period it remains outstanding. In such situation, the company applies the most dilutive rate in computing its diluted earnings per share. The most dilutive rate means the conversion rate that results in maximum common shares upon conversion. Assume, for example, that ABC Company sells its convertible bonds on January 1, 2023, with a conversion rate of 5 common shares for each bond beginning January 1, 2025. Starting January 1, 2028, the conversion rate is 7 common shares, and starting with January 1, 2032, the rate is 10 shares. If ABC Company computes diluted EPS for the year 2023, it would use the conversion rate of 10 shares for each bond (i.e., the most dilutive rate).

3. Convertible preferred stock

The third important consideration in computing diluted EPS relates to convertible preferred stock. Assume, for example, that Alfred’s 5% convertible debt were instead 5% convertible preferred stock. In that case, the company considers its preferred shares as potential common stock and includes them in diluted EPS computations. Since Alfred assumes the conversion of all preferred shares to common shares, it does not subtract preferred dividend from net income in determining the numerator of diluted EPS formula. Also, it does not consider any tax effect because dividend on preferred stock is generally not tax-deductible.

Leave a comment