Exercise-10 (Change in sales mix, break-even analysis and margin of safety)

Metro International, a Mexico based company, manufactures two products – product X and product Y. Product X sells for $800 and product Y for $1200. Company sells its products through its own stores and outlets owned by various merchandising companies. Total fixed expenses of Metro International are $132,000 per month. Variable expenses and monthly sales data are given below:

Variable expenses per unit:

- Product X: $480

- Product Y: $240

Monthly sales in units:

- Product X: 200 Units

- Product Y: 80 Units

Required:

- Prepare a contribution margin income statement showing dollars and percent columns for the product X and Y and for the company as a whole.

- Compute the break-even point in dollars and margin of safety using above information.

- Metro International is considering to manufacture another product – product Z. The addition of new product will not affect the fixed cost of the company. The variable expenses to manufacture and sell a unit of product Z will be $1,200. If the selling price of the new product is set at $1,600 per unit, the company expect to sell 40 units per month.

(a). Prepare a new contribution margin income statement that includes product Z.

(b). Compute the new break-even point and margin of safety. - The president is unable to understand the increase in break-even sales because the new product has increased the sales revenue and contribution margin without any increase in fixed costs. Explain to the president the reason of increase in break-even sales.

Solution:

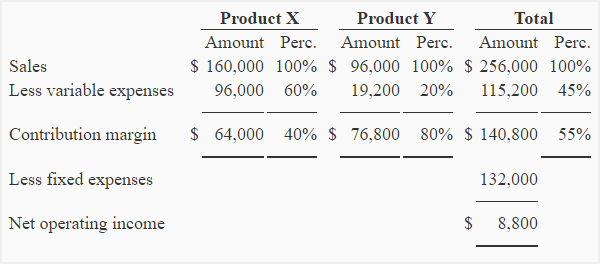

(1). Contribution margin format income statement:

(2) Break-even point and margin of safety:

Break even point in dollars = Fixed expenses/CM ratio

= $132,000/0.55

= $240,000

Margin of safety in dollars = Actual sales – Break-even sales

= $256,000 – $240,000

= $16,000

Margin of safety in percentage = (Margin of safety/Actual sales) x 100

= ($16,000/$256,000) x 100

= 6.25%

(3). Addition of product Z:

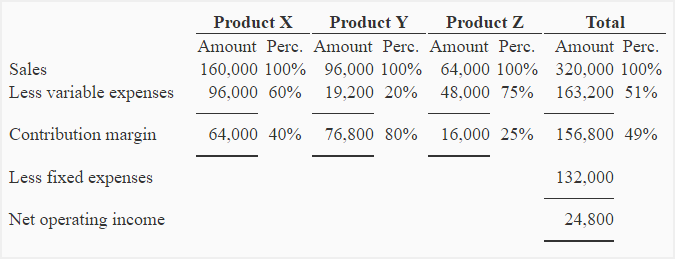

a. New contribution margin income statement:

b. New break-even point and margin of safety:

Break-even point in dollars = Fixed expenses/CM ratio

= $132,000/0.49

= $269,388

Margin of safety in dollars = Actual sales – Break-even sales

= $320,000 – $269,388

= $50,612

Margin of safety in percentage = (Margin of safety/Actual sales) x 100

= ($50,612/$320,000) x 100

= 15.82%

(4). Explanation to the president:

The break-even point has increased from $240,000 to $269,388 because the new product (product Z) has decreased the overall or average contribution margin ratio of the company. Product Z has a contribution margin ratio of only 25% which has caused a drop in overall or average contribution margin ratio from 55% to 49%.

Even though the break-even point is higher, the addition of new product has increased the margin of safety from $16,000 to $50,612 or from 6.25% to 15.82% which tells that the company has shifted much further from its break-even point.

Leave a comment