Margin of safety

Definition and explanation

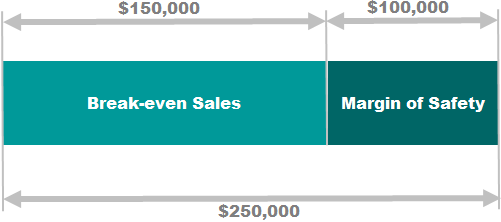

Margin of safety (MOS) is the difference between actual sales and break even sales. In other words, all sales revenue that a company collects over and above its break-even point represents the MOS. For example, if actual sales for the month of January 2022 are $250,000 and the break-even sales are $150,000, the difference of $100,000 is the margin of safety. The MOS concept can be used for a single product or a product line. Consider the following exhibition:

Margin of safety is the portion of sales revenue that generates profit for the business because the sales volume achieved up to break-even point can just cover the total variable and fixed cost and does not bring any profit. It is an important number for any business because it tells management how much reduction in revenue will result in break-even.

The MOS can be computed for a month, a quarter or full year period. However, if significant seasonal variations in sales volume are involved, then monthly or quarterly computations would not make sense. In such situations, it is advisable to use full year data in computations.

A higher margin of safety reduces the risk of business losses. Generally, the higher the MOS, the better it is.

Formula

The formula or equation of MOS is given below:

Margin of safety = Actual or budgeted sales – Sales required to break-even

MOS is also expressed in the form of ratio or percentage as follows:

MOS ratio = MOS/Actual or budgeted sales

or

MOS percentage = (MOS/Actual or budgeted sales) × 100

Examples

Example 1

The Noor enterprise, a single product company, provides you the following data for the Month of June 2015.

- Sales (3,500 units @ $20/unit): $70,000

- Contribution margin per unit: $12

- Total fixed expenses for the month: $15,000

There was no opening and closing finished goods inventory in stock.

Required: Calculate break even point and margin of safety for Noor enterprise using above data. Also draw a CVP graph and show the sales volume representing both break-even point and margin of safety on the graph.

Solution

1. Break-even point (BEP)

(i). BEP in units:

Fixed cost/Contribution margin per unit

= $15,000/$12

= 1,250 units

(ii). BEP in dollars:

Break even point in units × Selling price per unit

= 1,250 units × $20

= $25,000

2. Margin of safety (MOS)

(i). MOS in dollars:

Actual sales – Break-even sales

= $70,000 – $25,000

= $45,000

The margin of safety of Noor enterprises is $45,000 for the moth of June. It means if $45,000 in sales revenue is lost, the profit will be zero and every dollar lost in addition to $45,000 will contribute towards loss.

(ii). MOS in percentage:

The MOS of Noor Enterprises can be computed in percentage form by dividing the MOS in dollars by the actual sales in dollars as follows:

= $45,000/$70,000

= 0.6429

or

= 64.29%

(iii). MOS in units:

The Margin of safety of a single product company like Noor Enterprises can also be expressed in terms of units. It is done by dividing the MOS in dollars by the sales price per unit. The MOS of Noor Enterprises in terms of units is 2,250 as computed below:

= $45,000/$20

= 2,250 units

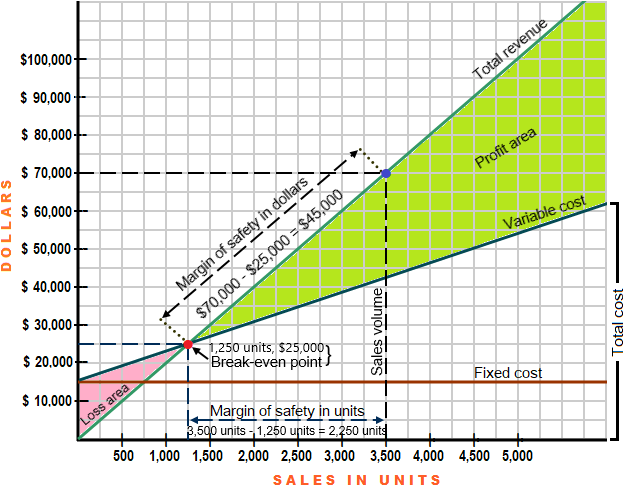

3. Graphical presentation of break-even point and margin of safety

In CVP graph presented above, red dot represents break even point at a sales volume of 1,250 units or $25,000. The blue dot represents the total sales volume of 3,500 units or $70,000. The margin of safety lies on the green line i.e., the revenue line. It has been show as the difference between total sales volume (the blue dot) and the sales volume needed to break even (the red dot).

Example 2

If Best Inc’s break-even sales are $65,000 and MOS is $45,000 for the first quarter of the current year, what would be the actual sales revenue for the first quarter?

Solution

MOS = AS – BES

$45,000 = AS – $65,000

AS = $45,000 + $65,000

AS = $110,000

Example 3

Fine Distributors, a trading firm, generated a total sales revenue of $75,000 during the first six months of the year 2022. If its MOS was $15,000 for this period, find out the break-even sales in dollars.

Solution

MOS = AS – BES

$15,000 = $75,000 – BES

BES = $75,000 – $15,000

BES = $60,000

Leave a comment