Sales mix and break-even point analysis

What is sales mix?

The proportion in which a multi-product company sells its products is referred to as sales mix. Companies involved in selling two or more products try to sell their products in a proportion or mix that maximizes their total profit. The term sales mix is not applicable to a seller who sells only a single product.

A business with low sales volume may earn more profit than a business with high sales volume if it has a larger proportion of high margin products in its total sales mix. However, a company is not always free to sell any number of units of a high contribution margin product because the sales largely depend on a number of factors that the sellers can’t fully control in short run. These factors include general demand for the product, company’s current market share, availability of inputs like raw materials, company’s production capacity, and restrictions imposed by the country’s government etc. Since the product sales are impacted by many uncontrollable and semi-controllable factors, the companies put their best effort to achieve and maintain a sales mix that can generate the highest profit for them.

Shift in sales mix and break-even point

Usually, different products have different sales prices, variable expenses and contribution margin associated with them. Therefore, any change in proportion in which the products are sold has a significant impact on the overall break-even point (BEP) of the seller. In CVP analysis, this change is generally known as ‘change in sales mix’ or ‘shift in sales mix’.

Let’s take an example to understand how the concept of sales mix works and how a shift in sales mix impacts the break-even point of a multi product seller:

Example:

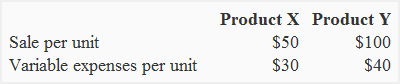

The NORAN company sells two products; product X and product Y. The information about sales price, variable expenses per unit and total fixed expenses is given below:

The total monthly fixed expenses of the company are $270,000. The company wants to generate a sales revenue of $1,000,000 in the next month. To obtain this goal the company has the following options:

(i). Sell 6,000 units of product X and 7,000 units of product Y.

(ii). Sell 14,000 units of product X and 3,000 units of product Y.

Required:

- Prepare contribution margin income statement and calculate break-even point if NORAN decides to select option (i).

- Prepare contribution margin income statement and calculate break-even point if NORAN decides to select option (ii).

- Whichever is the better option, (i) or (ii)?

- Explain the reason of change in break-even point in dollars (if any).

Solution:

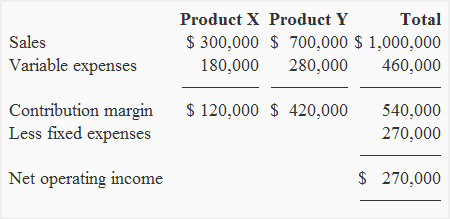

(1). If option (i) is chosen

Break-even point = Total fixed expenses / Overall contribution margin ratio

= $270,000/.54*

= $500,000

*540,000/1,000,000

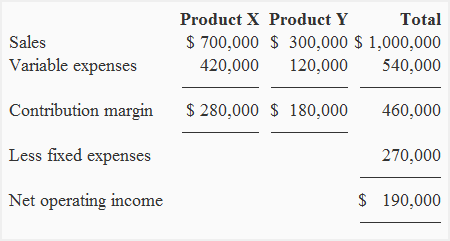

(2). If option (ii) is chosen:

Break-even point = Total fixed expenses / Overall contribution margin ratio

= $270,000/.46*

= $586,957

*460,000/1,000,000

(3) The better option to choose:

The “option a” is better than “option b” because it generates more net operating income for the company.

(4). The reason of change in break-even point:

A change in sales mix generally have a very strong effect on the break-even point of multi-product sellers. For instance, we can see that the break-even sales in dollars are $500,000 under first option but $586,957 under second option, even the total sales revenue assumed under both the options is the same – $1,000,000.

It means, under second option we need to generate $86,700 more in sales revenue just to break-even. This is because the shift in sales mix from a high contribution margin product (i.e., product Y) to a low contribution margin product (i.e., product X) has dropped the NORAN’s overall contribution margin ratio from 0.54 to 0.46 and, hence, increased the revenue needed to break-even.

Important point to remember

Students should learn that a shift in sales mix from high contribution margin product(s) to low contribution margin product(s) increases the dollar sales required to break-even and vice versa. This is because the products that generate higher contribution margin leave a greater portion of revenue to cover fixed expenses and ultimately contribute a greater amount towards net operating income.

This partially answers the question why some sellers, even with fewer sales revenue, are able to earn higher profit than their competitors.

Leave a comment