Contribution margin income statement

The basic difference between a traditional income statement and a contribution margin income statement lies in the treatment of variable and fixed expenses for a period. The difference in treatment of these two types of costs affects the format and uses of two statements.

In this article, we shall discuss two main differences of two income statements – the difference of format and the difference of usage.

(1).The difference of format:

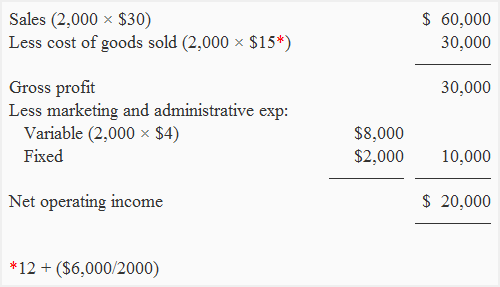

In a traditional income statement, cost of goods sold (variable + fixed) is subtracted from sales revenue to obtain gross profit figure and marketing and administrative expenses (variable + fixed) are then subtracted from gross profit figure to obtain net operating income.

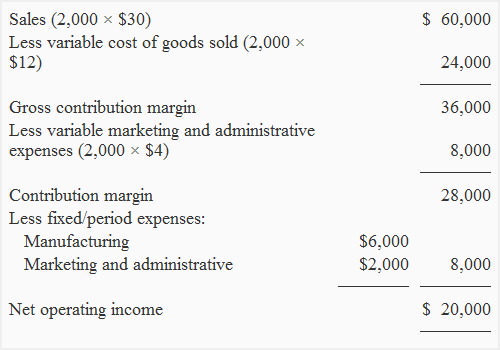

In a contribution margin income statement, variable cost of goods sold is subtracted from sales revenue to obtain gross contribution margin. The variable marketing and administrative expenses are then subtracted from gross contribution margin to obtain contribution margin. From contribution margin figure all fixed expenses are subtracted to obtain net operating income. The following simple formats of two income statements can better explain this difference.

Notice that a traditional income statement calculates gross profit and net profit whereas a contribution margin income statement calculates gross contribution margin, contribution margin and net profit.

(2). The difference of use:

A traditional income statement is prepared under a traditional absorption costing (full costing) system and is used by both external parties and internal management. As this statement fulfills the requirements of external parties to great extent, companies are required to follow applicable accounting standards such as generally accepted accounting principles (GAAP) or international accounting standards (IAS).

A contribution margin income statement, on the other hand, is a purely management oriented format of presenting revenues and expenses that helps in various revenues and expense related decision making processes. For example, a multi-product company can measure profitability of each product by preparing a product viz contribution margin income statement and decide which product to continue and which one to drop. Companies are not required to present such statements to any external party, so there is no need to follow GAAP or IAS.

Examples:

The following examples explain the difference between traditional income statement and variable costing income statement.

Example 1 – single product:

The Friends company is a single product company. The following data is available for the month of March 2014.

Sale price per unit: $30

Number of units manufactured and sold during the month: 2,000

Variable manufacturing cost per unit: $12

Variable selling and administrative cost per unit: $4

Fixed manufacturing cost per month: $6,000

Fixed marketing and administrative cost per month: $2,000

Company does not maintain finished goods and work in process inventory.

Required: Prepare a traditional income statement and a contribution margin income statement.

Solution:

Traditional format:

Contribution margin format:

Example 2 – multi product company:

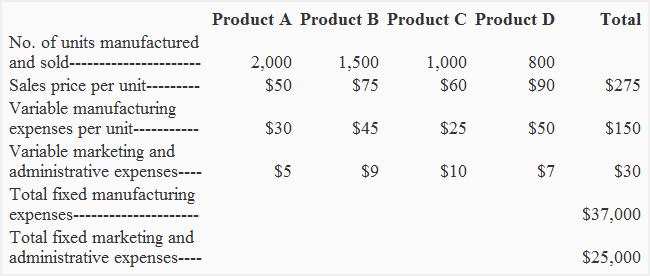

HC company is a US based multi product company. The company is currently manufacturing and selling four products successfully. The data for the year 2013 is given below:

The marketing department with the cooperation of research and development department has proposed the production of a new product. Because of limited resources, the new product can only be manufactured if one of the existing products is dropped. The new product is very attractive and is expected to generate a contribution margin of 35% but after a careful review of market share, competition in the market, available resources, and target profit of the next year, the company will only stop manufacturing a product if its contribution margin is less than 30% of its ultimate sales price.

Required:

- Prepare a product viz contribution margin income statement of HC company.

- Will HC company start manufacturing proposed product? Use the answer of requirement 1 for your calculations.

Solution:

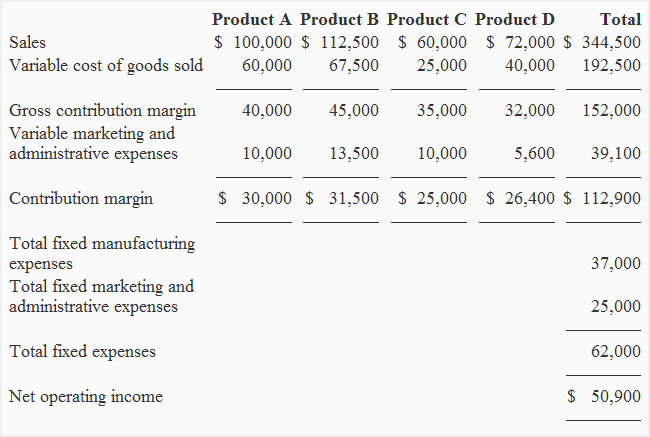

(1) Contribution margin income statement:

(2). Introduction of new product:

The production of newly proposed product is possible only if at least one of the existing products is dropped. The company will manufacture newly proposed product because product B does not generate a contribution margin of 30% or above. The calculations are given below:

Product A: (30,000/100,000) × 100 = 30%

Product B: (31,500/112,500) × 100 = 28%

Product C: (25,000/60,000) × 100 = 41.67%

Product D: (26,400/72,000) × 100 = 36.67%

The product B will be replaced by the newly proposed product.

Leave a comment