Uncollectible accounts expense – direct write-off method

Under direct write-off method, the uncollectible accounts expense is recognized when a receivable is actually determined to be uncollectible. Unlike allowance method, no valuation allowance is used and accounts receivables are reported in the balance sheet at their gross amount .

This method does not follow the matching principle of accounting because no attempt is made to match sales revenue with uncollectible accounts expense. For example, a company sells goods to five different customers on credit in the last month of year A. In year B, one of those customers becomes bankrupt and proves to be uncollectible. The company, therefore, has to write-off his account in full. The expense resulting from such credit loss belongs to year A because the relevant sales revenue has been recognized in year A. However, if the company uses a direct write-off method, it will recognize this expense in year B which is the violation of matching principle of accounting.

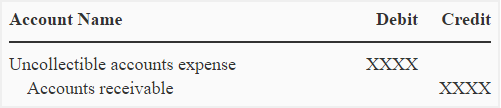

Journal entry

The uncollectible accounts expense is recognized under direct write-off method by making the following journal entry:

Example

The Fast company uses direct write-off method to recognize uncollectible accounts expense. On December 25, 2022, the company comes to know that Small trader, (a customer of the company) whose account shows a balance of $1,500, has become bankrupt and nothing can be recovered from him. The company writes off the account of small trader immediately.

Required:

- Prepare a journal entry to write-off the account of Small trader on 25, 2022.

- How Fast company will report accounts receivable in the balance sheet?

Solution:

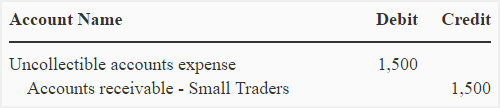

(1). Journal entry to write-off Small trader’s account:

(2). Reporting accounts receivable in the balance sheet:

The fast company uses direct write-off method. It will show the accounts receivable at gross amount.

The direct write-off method is simple and easy to adopt but is considered a less accurate and less reliable approach when compared with the allowance method. The major drawback of this method is that it does not follow the matching principle of accounting. Its use may, however, be acceptable in situations where most of the goods are sold on cash and only a small portion of the sales are made on credit.

Companies mostly prefer to use allowance method because it follows the matching principle of accounting and is in accordance with the generally accepted accounting principles (GAAP).

Uncollectible accounts expense and Income tax:

In many countries, including United States, companies are legally required to use direct write-off method for recognizing uncollectible accounts expense while calculating taxable income.

Leave a comment