Allowance for doubtful accounts – percentage of sales method

This page explains the use of sales method for estimating allowance for doubtful accounts. Click here to read about another commonly used method, known as aging method.

The percentage of sales method (also referred to as income statement approach) estimates allowance for doubtful accounts using total credit sales number for the period. Under this approach, some percentage of the total credit sales for the period is determined to be uncollectible. This percentage is determined on the basis of past operating experience and current economic conditions of territories or regions where the company conducts its business.

Under percentage of sales method, aging schedule of accounts receivable is not prepared. The adjusting entry is made with the full amount of estimated uncollectibles. The existing balance in the allowance for doubtful accounts account is not taken into account. This approach is very simple and straight forward. It is usually adopted in companies where most of the sales are made on cash and the volume of credit sales is relatively small.

Example 1

The following data belongs to Southern Enterprises:

- Total cash sales for the year 2022: $175,500

- Total credit sales for the year 2022: $265,000

The company has reasonable ground to believe that 0.5% of the total credit sales will prove to be uncollectible.

Required: Compute the allowance for doubtful accounts for the year 2022 using sales method.

Solution

Allowance for doubtful accounts = $265,000 × (0.5/100)

= $265,000 × 0.005

= $1,325

Note: The cash sales figure of $175,500 has not been taken into account while computing the allowance for doubtful accounts under this method.

Example 2

The total credit sales of Fast Company for the year 2022 are $175,000. At the end of the year, the management estimates that 1% of the total credit sales will prove to be uncollectible. The balance in allowance for doubtful accounts is $650 before making adjusting entry for uncollectible accounts expense.

Required:

- Calculate allowance for doubtful accounts using percentage of sales method (or income statement approach).

- Prepare adjusting entry to recognize uncollectible accounts expense and to update the allowance for doubtful accounts account at the end of the year 2022.

Solution:

(1). Allowance for doubtful accounts:

$175,000 × 0.01 = $1,750

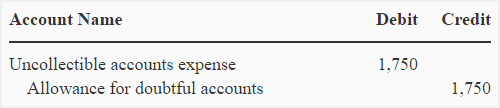

(2). Adjusting entry at the end of the year:

Notice that, while preparing above journal entry, the existing balance of $650 in allowance for doubtful accounts account has been ignored .

The percentage of sales method (or income statement approach) of estimating uncollectible accounts is simple and easy to employ but is considered a less accurate and less reliable technique when compared with the aging method. This method is therefore appropriate only for entities with small credit sales.

Leave a comment