Recovery of uncollectible accounts/bad debts – allowance method

An account receivable that has previously been written off may subsequently be recovered in full or in part. It is known as recovery of uncollectible accounts or recovery of bad debts. This article briefly explains the accounting treatment when a previously written off account is recovered and the cash is received from him.

Journal entries:

The accounting treatment of recovered amount requires two journal entries; the first entry is made to reinstate the recovered account as accounts receivable asset and the second one is made to record the receipt of cash from that receivable.

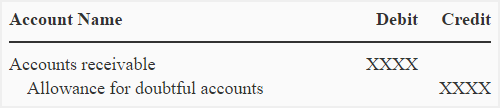

(1). When recovered account is reinstated as an asset:

When a written off account is recovered, the first step is to reinstate it in the accounting record. The following journal entry is made for this purpose:

Notice that this entry is exactly the reverse of the entry that is made when an account receivable is written off. See uncollectible accounts expense – allowance method.

(2). When cash is received from recovered account:

The following journal entry is made when cash is received from recovered or reinstated account:

For more clarification of the procedure, consider the three journal entries included in the following example:

Example:

The Fine Company writes off a $450 account receivable from Weak trader on March 12, 2022. The Weak Trader pays the account in full on March 28, 2022.

Required: What journal entry(ies) the Fine Company should prepare:

- to write off the account of Weak Trader on March 12, 2022?

- to reinstate the account of Weak Trader on March 28, 2022?

- to record the receipt of cash from Weak Traders on March 28, 2022?

Solution:

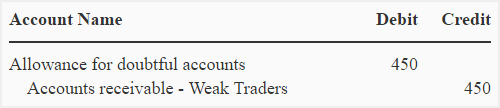

(1). When Weak Trader’s account is written off:

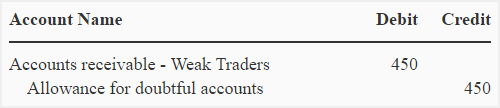

(2). When Weak Trader’s account is reinstated as an asset:

(3). When cash is received from Weak Trader:

The second entry will reinstate the account of Weak Trader and the third entry will eliminate his account from the system.

When a customer’s account is written off due to non payment, the company will certainly not sell anymore goods to that customer on credit basis. In our example, however, the Weak Trader has paid the full amount due from him. This payment may reinstate its creditworthiness in the eyes of seller i.e., Fine Company. The Fine Company may, therefore, reconsider to sell more goods to Weak Trader on credit in future.

Leave a comment