Uncollectible accounts expense – allowance method

The allowance method of recognizing uncollectible accounts expense follows the matching principle of accounting i.e., it recognizes uncollectible accounts expense in the period in which the related sales are made. Under this method, the uncollectible accounts expense is recognized on the basis of estimates. There are two general approaches to estimate uncollectible accounts expense. The first one is known as aging method or balance sheet approach and the second one is known as sales method or income statement approach.

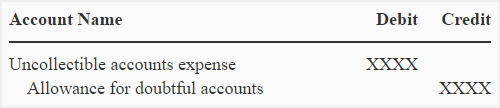

Journal entry to recognize uncollectible accounts expense:

At the end of accounting period, the amount of uncollectible accounts is estimated and the following adjusting entry is made to recognize them:

The uncollectible accounts expense (debited in the above entry) is closed into income summary account like any other expense account and the allowance for doubtful accounts (credited in the above entry) appears in the balance sheet as a deduction from the face value of accounts receivable. It is a contra-asset account that reduces the amount of accounts receivable to their net realizable value.

Face value of accounts receivable – Allowance for doubtful accounts = Net realizable value of accounts receivable

Journal entry to write off accounts receivable:

In the next accounting period, when an account actually turns out to be uncollectible, it is written off from accounts by making the following journal entry:

The above entry is recorded every time a receivable actually proves to be uncollectible. This entry reduces the face value of accounts receivable as well as the balance in allowance for doubtful accounts with the same amount. Because both face vale of accounts receivable and the allowance for doubtful accounts are reduced by the same amount, this entry will have no effect on the net realizable value of accounts receivable.

At the end of the year, the accounts receivable are reevaluated and a new allowance for doubtful accounts is determined to make a new adjusting entry (just like the entry No. 1).

The following example may be helpful to understand the whole procedure discussed above.

Example:

The Fast Company starts business on January 1, 2021. On December 31, 2021, the total accounts receivable of the company are $350,000; out of which, company estimates that the receivables amounting to $4,500 will turn out to be uncollectible. On February 12, 2022, Weak trader, who is a receivable of $1,200, becomes bankrupt and nothing can be recovered from him. On December 31, 2022, the accounts receivable show a balance of $475,000. On this date, the company revises the estimates of its credit losses and determines that receivables amounting to $4,800 will become uncollectibles.

Required: Using the above information of Fast Company, prepare:

- an adjusting entry to recognize uncollectible accounts expense on December 31, 2021.

- an entry to write off accounts receivable on February 12, 2022.

- an adjusting entry to recognize uncollectible accounts expense on December 31, 2022.

Solution:

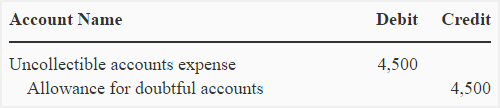

(1). Recognition of accounts receivable expense at December 31, 2021:

(2). Writing off accounts receivable at January 12, 2022:

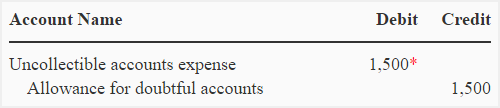

(3). Recognition of accounts receivable expense at December 31, 2022:

*4,800 – (4,500 – 1,200)

Notice that the estimated uncollectible accounts on December 31, 2022 are $4,800 but allowance for doubtful accounts has been credited with only $1,500. The reason is that there already exists a credit balance of $3,300 (= $4,500 – $1,200) in the allowance for doubtful accounts. We just need to increase the existing balance by $1,500 to achieve the required balance of $4,800 (= $3,300 + $1,500).

Also notice that in the first entry the estimated uncollectible accounts and allowance for doubtful accounts are the same at December 31, 2021. The reason is that it is the first year of company’s operation and there does not already exist any allowance for doubtful accounts.

In this example, allowance for doubtful accounts is given. In practice, companies usually use either aging method and sales method for calculating this allowance, as mentioned at the beginning of this article.

Leave a comment