Matching principle of accounting

Definition and explanation

The matching principle is an important concept in accrual accounting that states that revenues and related expenses must be matched in the period to which they relate. Expenses relate to the period in which they are incurred and not necessarily to the period in which they are paid. For example, a company consumes electricity for the whole month of January but pays its electricity bill in February. If the company is operating under cash-based accounting, it should have recorded its electricity expense in the month of February, as it has actually paid cash in February. But under accrual-based accounting, the entity must record this expense in the month of January and not February, because the expense has been incurred in January.

The matching principle is one of the most fundamental concepts in accrual accounting. In simple terms, the principle states that, in relation to a given time period, the expenses that are recorded in the financial statements of a company must relate to the revenues generated in the exact same period. This treatment of revenues and expenses makes sure that the whole effect of a transaction is reported in the same reporting period. Another aspect to consider is the timing of when both the revenues and the expenses should be recognized in the accounting record.

Recognition of revenues:

Revenues must be recognized when the entity believes that it has earned those revenues by fulfilling its part of the obligation and that the other party will also fulfill its obligation in terms of payment.

Recognition of expenses:

Expenses must be recognized when they are incurred and the related revenue is recognized, irrespective of the outflow of cash.

Examples:

- A company has a policy to award a 1% bonus on sales secured by its sales representatives. Suppose all representatives collectively earn a bonus of $5,000 (= 4 x $500,000) in the first quarter. If the company pays the bonus in May (i.e., the starting month of the second quarter), the company must recognize this bonus expense in the first quarter and not in the second quarter. The reason is that this $5,000 bonus expense relates to the revenues generated in the first quarter.

- A law firm pays a salary of $4,000 to each of its six consultants. The firm earned revenues of $230,000 and $180,000 in June and July, respectively. Since the monthly salary of each consultant is fixed, the firm’s total salary expense for each month would be $24,000 (= 6 x $4,000). If we consider only the salary of consultants and ignore all other expenses, the firm’s profit for June and July would be $206,000 (= $230,000 – $24,000) and $156,000 (= $180,000 – $24,000), respectively. This is because the salary expense would be matched against the revenues generated during the individual months.

Importance of matching concept:

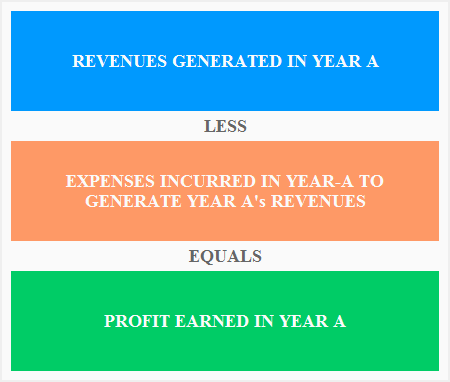

The matching concept is vital for companies to report their financial results correctly. It helps companies avoid any misstatement of profit as revenues and related expenses work under the same income statement equation.

Net profits earned = Generated revenues – Incurred expenses

A business cannot generate revenues without incurring necessary expenses like materials, labor, manufacturing overhead, marketing and administrative expenses, etc. Therefore, reporting revenues without expenses that helped earn those revenues could alter the face of the company’s financial statements by either overstating or understating its profits, resulting in incorrect decision-making by the end user of those statements.

Leave a comment