Exercise-8 (variable and absorption costing – constant sales, change in production)

Learning objective:

This exercise illustrates how the net operating income gets impacted when sales remain constant but production changes.

AJX Company manufactures and sells only a single product. The company sold exactly the same number of units this year as it did last year but showed a different net operating income figure. The president of AJX is a little bit confused about these results and asks for the explanation of why it happened.

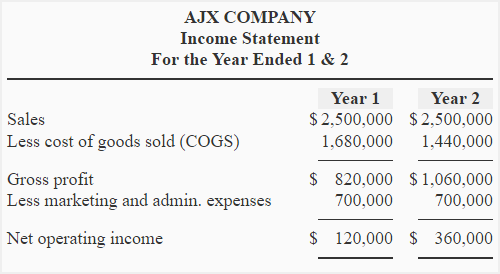

A condensed absorption costing income statement for year-1 and-2 is given below:

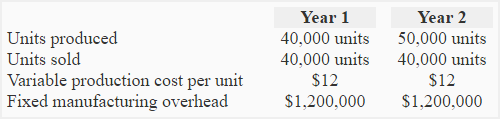

The sales and production data for year-1 and-2 was as follows:

Variable selling and administrative expenses of AJX are $4.00 per unit sold sold. A new manufacturing overhead rate is computed each year.

Required:

- Calculate unit product cost for both the years under absorption costing and variable costing system.

- Prepare a contribution margin format income statement for both the years.

- Reconcile the net operating income figures for each year under two costing methods.

- Explain how operations would have different in year-2 if the company had been using a just in time (JIT) manufacturing and inventory control method.

Solution:

(1) Computation of unit product cost:

Year-1:

- Unit product cost under variable costing: $12

- Unit product cost under absorption costing: $12 + $30* = $42

*$1,200,000/40,000 units

Year-2:

- Unit product cost under variable costing: $12

- Unit product cost under absorption costing: $12 + $24* = $36

*$1,200,000/50,000 units

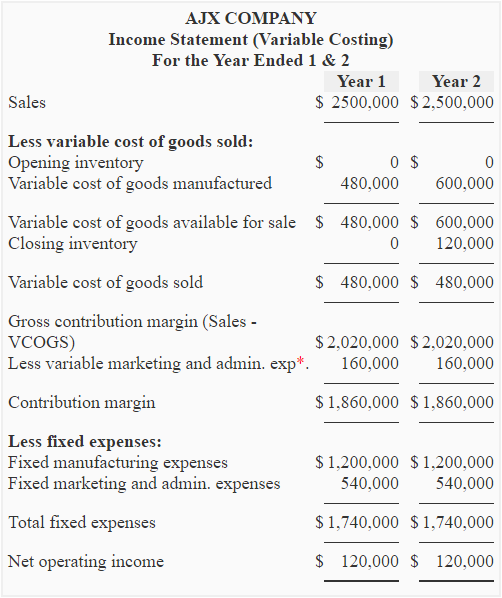

(2) Variable costing income statement:

*Units sold during the period x Per unit variable marketing and administrative expenses

= 40,000 x $4.00

= $160,000

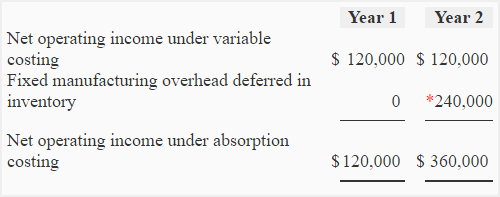

(3) Reconciliation of net operating income:

The production was increased by 10,000 units in Year-2 that caused a buildup of closing inventory and a deferral of a portion of fixed manufacturing overhead to the next period. This deferral relieved Year-2 of $240,000 [= 10,000 units x (1,200,000 units/$50,000)] of cost that it otherwise would have borne. Hence, the net operating income in Year-2 was $240,000 higher than it was in Year-1, even though the company sold the same number of units each year.

Conclusively, we can say that the profit increased in Year-2 without any increase in sales revenue or reduction in manufacturing costs. This is a general criticism of the absorption or traditional costing system. The reconciliation schedule for Year-1 and Year-2 can be prepared as follows:

*Units in closing inventory x Per unit fixed manufacturing overhead

= 10,000 units x (1,200,000 units/$50,000)

= $240,000

(4) The use of just in time manufacturing in Year-2:

Under just in time (JIT) manufacturing and inventory control method, production would have been geared to sales and inventories would not have been built up in Year-2. Since no fixed manufacturing overhead would have been deferred in inventory to the next periods, the net operating income for year-2 would have been $120,000 under absorption costing approach – the same as in Year 1.

With production geared to sales under JIT system, the entire $1,200,000 in fixed manufacturing overhead would have been expensed in year-2, rather than having $240,000 of it deferred to next periods. Hence, the net operating income figure would have been about the same for each year under both variable costing and absorption costing.

Leave a comment