Exercise-9 (Variable and absorption costing – constant production, change in sales)

Learning objective:

This exercise illustrates how the net operating income gets impacted when production remains constant but sales fluctuate.

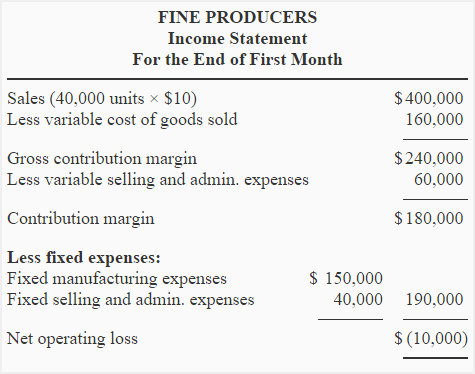

Fine Producers Company suffered a loss for its first month of operations. The following is the income statement of the prepared by an accounting firm.

The loss created a serious problem for the company because the management was planning to use this statement to encourage investors to purchase the company’s stock. Other relevant data is given below:

- Units produced during the first month: 50,000 units

- Units sold during the first month: 40,000 units

Variable costs:

- Direct materials: $2.00 per unit

- Direct labor: $1.60 per unit

- Variable manufacturing overhead: $0.40 per unit

- Variable selling and administrative expenses: $1.50 per unit

Required:

- What costing method was used by the accounting firm for preparing the first month’s income statement of Fine Producers? Can an absorption costing income statement show a profit rather than the loss? Support your answer by preparing a reconciliation schedule.

- Prepare an income statement for the second month of operations under both variable and absorption costing approaches. Assume the company sold 60,000 units in second month and there was no finished goods inventory at the end of the month.

- Reconcile the second month’s net operating income under both the costing approaches.

Solution:

(1) Costing method used by accounting firm:

The accounting firm used a variable costing approach for preparing the first month’s income statement of Fine Producers.

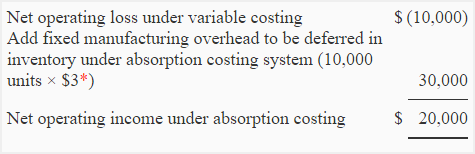

Yes, an income statement prepared on the basis of an absorption costing system can show a profit rather than a loss because, under absorption costing, a portion of fixed manufacturing overhead cost would be absorbed by the ending inventory and deferred to the next periods. This deferral of manufacturing overhead cost would reduce the cost burden of the current period under absorption costing.

Under variable costing, the net operating loss for the first month of operations was $10,000. The portion of fixed manufacturing overhead cost that could be deferred to the next periods under absorption costing is $30,000. This deferral of cost would essentially result in a net operating income of $20,000 under the absorption costing approach. A reconciliation schedule to arrive at absorption costing net operating income figure can be prepared as follows:

*Fixed manufacturing overhead/Units manufactured:

= $150,000/50,000 units

= $3.00 per unit

(2) Income statement for the second month:

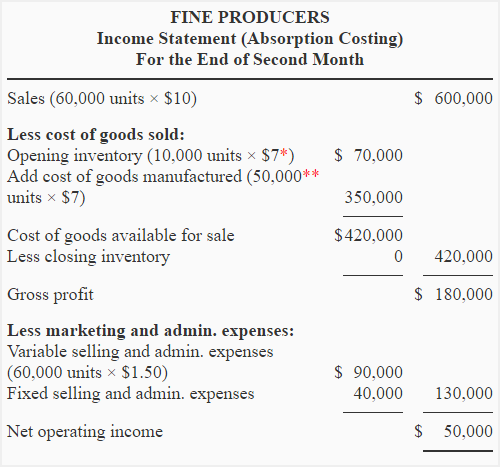

a. Absorption costing income statement:

*Unit product cost under absorption costing:

Direct materials + Direct labor + Variable manufacturing overhead + Fixed manufacturing overhead

= $2.00 + $1.60 + $0.40 + $3.00

= $7.00

**Units manufactured in second month:

Units sold + Units in ending inventory – Units in beginning inventory

= 60,000 units + 0 units – 10,000 units

= 50,000 units

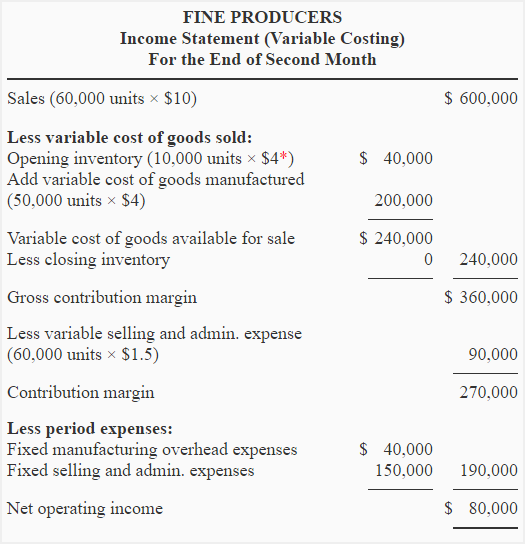

b. Variable costing income statement:

*Unit product cost under variable costing:

Direct materials + Direct labor + Variable manufacturing overhead

= $2.00 + $1.60 + $0.40

= $4.00

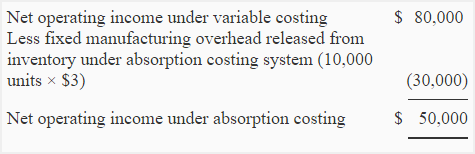

(3) Reconciliation of net operating income:

If Fine Producers sold 60,000 units in the second month, its sales would exceed its production of 50,000 units. In that case, the fixed manufacturing overhead cost deferred in inventory in the first month under absorption costing would be released in the second month. Hence, the company’s net operating income under absorption costing would be less than that under variable costing. To further explain this difference in net operating income, we can prepare a reconciliation schedule as follows:

Leave a comment