Exercise-23: Discounted payback period method

Learning objective:

This problem illustrates the computation of discounted payback period for evaluating the viability and cash flows of an investment project.

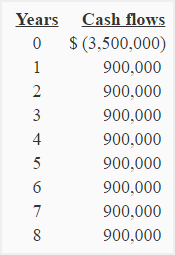

SK Manufacturing Company uses discounted payback period to evaluate investments in capital assets. The company expects the following annual cash flows from an investment of $3,500,000:

No salvage/residual value is expected. The company’s cost of capital is 12%.

Required:

- Compute discounted payback period of the investment.

- Is the investment desirable if the required payback period is 4 years or less.

Solution:

(1) Computation of discounted payback period:

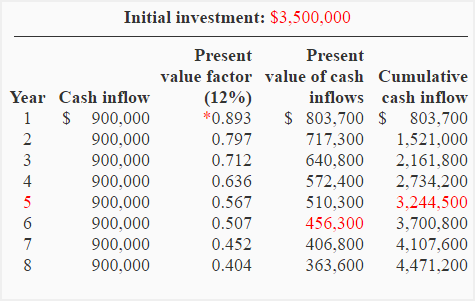

Discounted payback method is a variant of simple payback method. It simply incorporates the concept of time value of money into the simple payback method. Under this approach, we first discount all the cash flows involved and then ask how long it will take for the discounted cash flows to equal the initial investment. See the computations below:

Discounted payback period = Years before full recovery + (Unrecovered cost at start of the year/Cash flow during the year)

= 5 + (**$255,500/$456,300)

= 5 + 0.56

= 5.56 years

*Value from “present value of $1 table“.

**Unrecovered cost at start of 6th year = Initial cost – Cumulative cash inflow at the end of 5th year

= $3,500,000 – $3,244,500

= $255,500

(2) Conclusion:

Because the discounted payback period is longer than 4-year period, this investment is not desirable.

Doing great work.