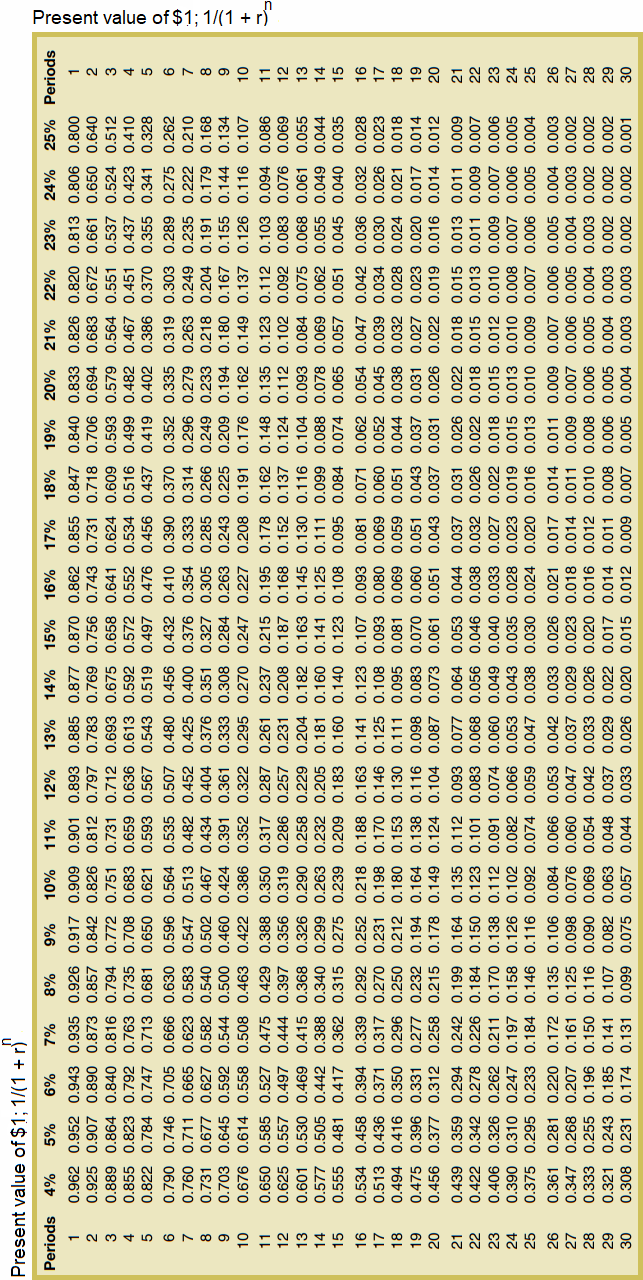

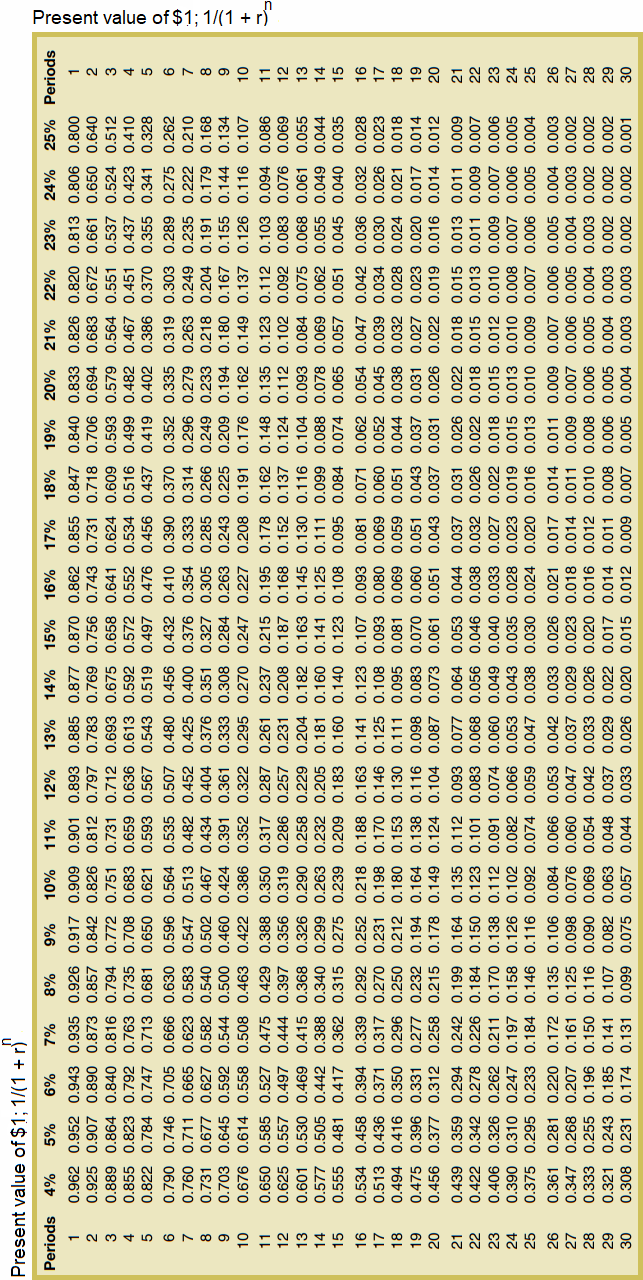

Present value of $1 table

Posted in: Capital budgeting techniques (explanations)

Present value of $1 table is used to find the present value of a single cash flow (payment or receipt) that is expected to occur in future.

Present value of $1 table is used to find the present value of a single cash flow (payment or receipt) that is expected to occur in future.

Leave a comment