Discounted payback method

Definition and explanation

Discounted payback method is a capital budgeting technique used to evaluate the profitability of a project based upon the inflows and outflows of cash. Under this technique, we first discount project’s all cash flows to their present value using a preset discount rate and then determine the time period within which the initial investment would be recovered. Since this method takes into account the time value of money, it can be considered as an upgraded variant of the simple payback method.

The discounted payback method tells companies about the time period in which the initial investment in a project is expected to be recovered by the discounted value of total cash inflow. Additionally, it indicates the potential profitability of a certain business venture. For example, if a project indicates that the funds or initial investment will never be recovered by the discounted value of related cash inflows, the project would not be profitable at all. The company should therefore refrain from investing its funds in such project.

Formula

The formula for computing the discounted payback period is the same as used to compute the simple or traditional payback period with uneven cash flow. It is given below:

Discounted payback period = Years before full recovery + (Unrecovered cost at start of the year/Cash flow during the year)

The following example illustrates the computation of both simple and discounted payback period as well as explains how the two analysis approaches differ from each other.

Example

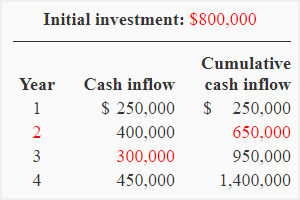

An opportunity arises for a company which requires an initial investment of $800,000 now. The amount of cash inflows expected from the new opportunity are:

- Year-1: $250,000

- Year-2: $400,000

- Year-3: $300,000

- Year-4: $450,000

The management’s discount rate is 12%.

Required: Compute the simple and discounted payback periods of the new investment opportunity. Is this investment opportunity acceptable under two methods if the maximum desired payback period of the management is 3 years?

Solution

1. Simple payback period

The simple payback method dos not take into account the present value of cash flows.

Simple payback period = Years before full recovery + (Unrecovered cost at start of the year/Cash flow during the year)

= 2 + *150,000/300,000

2.5 years

*$800,000 – $650,000

We see that in year 3, the investment is not just recovered but the remaining cash inflow is surplus. The initial investment of the company would be recovered in 2.5 years. The project is acceptable according to simple payback period method because the recovery period under this method (2.5 years) is less than the maximum desired payback period of the management (3 years).

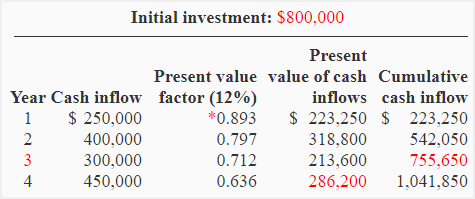

2. Discounted payback period

The discounted payback method takes into account the present value of cash flows.

*Present value factor at 12%: 1/(1 + 0.12)^1 = 0.893; 1/(1 + 0.12)^2 = 0.797; 1/(1 + 0.12)^3 = 0.712; 1/(1 + 0.12)^4 = 0.636

Alternatively we can use present value of $1 table to obtain these factors.

The formula and computations are similar to simple payback period.

Discounted payback period = Years before full recovery + (Unrecovered cost at start of the year/Cash flow during the year)

= 3 + *44,350/286,200

= 3.15 years

*$800,000 – $755,650

According to discounted payback method, the initial investment would be recovered in 3.15 years which is slightly more than the management’s maximum desired payback period of 3 years. The project is therefore not acceptable according to this analysis.

From above example, we can observe that the outcome with discounted payback method is less favorable than with simple payback method. Since discounting decreases the value of cash flows, the discounted payback period will always be longer than the simple payback period as long as the cash flows and discount rate are positive.

Advantages and disadvantages of discounted payback method

The main advantages and limitations of using a discounted payback method are listed below:

Advantages/benefits:

- It takes into account the time value of money by deflating the cash flows using the company’s cost of capital.

- The method is cash based so it reveals the period within which the cash will be available for reuse elsewhere.

- The concept backing the method is easy to understand and apply.

Limitations/disadvantages:

- Both simple and discounted payback method do not take into account the full life of the project. The overall benefit and profitability of a project cannot be measured under either of the two approaches because both ignore the cash flows that may occur beyond the payback period.

- It may become a relative measure. In many situations, the project’s discounted payback period may be longer than the maximum desired payback period of the management but other measures like accounting rate of return (ARR) and internal rate of return (IRR) etc. may favor the project.

- The accuracy of the output only depends on the accuracy of the input provided, like the accuracy of cash flow figures, the timing of cash flows which affects their present values, and the discount rate used to deflate the cash flow etc.

Conclusion

The discounted payback method may seem like an attractive approach at first glance. On closer inspection, however, we find that it shares some of the same significant flaws as the simple payback method. For example, it first arbitrarily chooses a cutoff period and then ignores all cash flows that occur after that period. This approach might look a bit similar to net present value method but is, in fact, just a poor compromise between NPV and simple payback technique.

If you have already gone to the trouble of calculating the discounted cash flows over the life of the project, you might just as well add up all the discounted cash flows to get the project’s net present value for your decision.

Leave a comment