Initial investment in capital budgeting

Definition and explanation

In capital budgeting, the term initial investment (or initial capital outlay) refers to the amount of capital that a firm needs to start a project, or resume a previously abandoned project. Major capital budgeting techniques pay special attention to the cost of starting a project because it is generally the largest lumpsum outlay of funds involved in undertaking a project. A careful estimation of a project’s initial investment and any future cash movement is very important to test its financial viability.

Formula and calculation

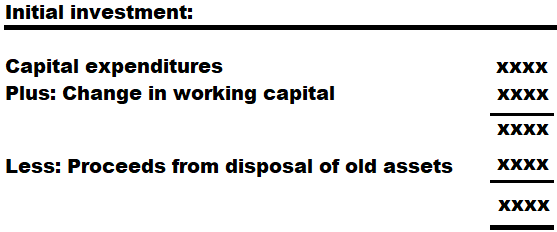

The initial investment of a project is equal to the funds required for all capital expenditures (like purchase of machinery, equipment, tools, shipment and installation costs etc.), plus increase in working capital, minus after tax proceeds from disposal of old assets, if any. The sunk costs, if any, are ignored because they are irrelevant in this regard.

The formula of initial investment can be written as follows:

Example

Volatile Coal Company (VCC) started a coal exploration and extraction project in Jharkhand, India in 2020. In 2021 – 2022, the company incurred $100 million on seismic studies of the region and $250 million on machinery and equipment needed to start the project. In 2023, the company had to abandon the project due to a conflict relating to the agreement with the government.

Recently, a business friendly government has sworn in and the managing director of VCC is of the opinion that the project should be reconsidered. The company’s chief engineer and financial analyst estimate that the following costs are involved in resuming the coal project:

- New machinery and equipment: $7,500 million

- Shipment and installation: $100 million

- Working capital: $55 million

The old machinery and equipment purchased in 2021 – 2022 are now outdated and can no longer work in the project. These out dated machinery and equipment would be disposed of for a net of tax proceeds of $60 million.

Required: Calculate the total initial investment required to restart the coal project.

Solution

Initial investment

= Cost of new machinery and equipment + Shipment and installation cost + Working capital − Proceeds from sale of old machinery and equipment

= $750 million + $100 million + $55 million − $60 million

= $845 million

In order to decide whether or not to restart its abandoned coal project, the company may need to further evaluate the project through a number of viability tests like net present value, internal relate of return and payback period method.

The amount of $100 million incurred on the seismic studies in 2021 – 2022 is a sunk cost and is not relevant for the calculation of initial investment.

Leave a comment