Capital and revenue expenditures

Capital and revenue expenditures are two different types of business expenditures that we often find in financial accounting and reporting. A business expenditure is an outflow of economic resources (mostly in the form of cash and cash equivalents) as a result of undertaking various activities during the normal course of business and to further the objectives of a particular business function.

Capital expenditures

Definition and explanation

Capital expenditures are business expenditures the benefit of which can be utilized or enjoyed by the business for more than one financial year. In accounting and finance these expenditures are also termed as CapEx. These expenditures are capitalized when incurred and are made a part of company’s balance sheet at the end of accounting period.

Example

Suppose in a board meeting of EFG company, the purchase of a new plant was proposed for the newly opened production facility in another city. The budget was approved for the purchase of new plant. The procurement department purchased the fixed assets from an approved supplier and intimated the finance department about the transaction which carried the total costs of the acquired asset to balance sheet of the company. The plant is a fixed asset that will be used for many years by the company. Its purchase is therefore a capital expenditure for EFG Company.

More examples of capital expenditures

- Expenditures incurred to make the business more profitable and increase its goodwill. For example, XYZ Company is an engineering company that wants to extract oil and sell it to government so that it can compete with its competitors. In order to extract oil, it has to buy exploration rights. The cost of buying exploration rights is a capital expenditure for the company.

- Expenditures incurred to increase the useful life of a fixed asset. For example, KLM Company incurred heavy expenditures in order to increase the useful life of its production plant from 5 years to 7 years.

Revenue expenditures

Definition and explanation

Revenue expenditures are business expenditures the benefit of which is utilized by the business within one financial year. They are expensed out when incurred and are not made part of the balance sheet but rather shown in income statement of the company.

Example

Suppose, the JKL company hired a professional bug exterminator firm to get rid of all the insects manifesting in their production facilities. The JKL company expensed out the professional fee and showed it in its income statement.

More examples of revenue expenditures

- Day-to-day expenses incurred by the company. For example, carriage, office, admin, and stationary expenses e.t.c.

- Expenses incurred to maintain the fixed assets in working order.

- Depreciation on furniture, equipment, plant, machinery and other fixed assets.

- Bank charges paid by the company.

- Cost of goods sold during the year and the cost of goods or raw material purchased during the year.

- Financial charges on loan given or undertaken by the company.

- Professional services fee paid by the company.

- Repair and maintenance of buildings used for factory and office of the company.

Summary and conclusion

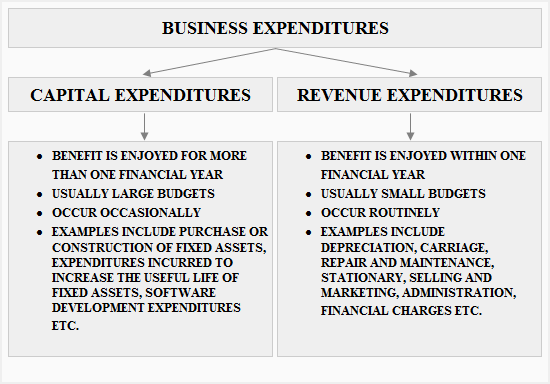

The whole concept of capital and revenue expenditures explained above is summarized as follows:

- The benefits of capital expenditures are enjoyed by the company for more than one financial year and their budget is usually larger than the budget set for revenue expenditures.

- The benefits of revenue expenditures usually expire within one financial year and their budget is smaller as compared to capital expenditures.

- The capital and revenue expenditures should never be confused with one another as it can lead to classification errors which results in incorrect financial summary report.

I need good answers from great group and be with you all the time