Operating activities section by indirect method

This article is focused on the indirect method of preparing the operating activities section of the statement of cash flows. If you are looking for the direct method, please read the “operating activities section by direct method” article.

Contents:

- The indirect method

- Adjustments to reconcile net income to net cash flows from operating activities

- Formula

- Example of indirect method of operating activities section

The indirect method of preparing the operating activities section

Under the indirect method (also known as the reconciliation method), we convert the net income (or net loss) to the net cash provided (or used) by operating activities during the reporting period. For this purpose, the net operating income (or net loss) figure is taken from the income statement and adjusted for non-cash expenses, timing differences, and non-operating gains or losses. The rest of this article explains how these adjustments are made to the net income (or net loss) to arrive at the net cash flow from operating activities.

Adjustments to reconcile net income to net cash flows from operating activities

(1). Adjustments for non-cash expenses

Under accrual accounting, the non-cash expenses reduce net income but do not affect cash. A popular example of such expenses is the annual depreciation charge. As non-cash expenses reduce net income without reducing cash, they are added back to net income under the indirect method. The other examples of expenses that require a similar treatment are the depletion of natural resources, the amortization of intangible assets, the amortization of bond discounts, etc. The following example illustrates the treatment of depreciation in the operating activities section.

Example:

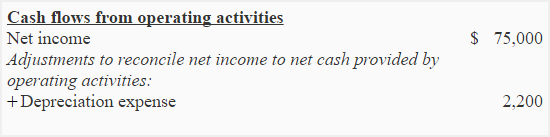

The income statement of XYZ Company shows a net income of $75,000 for the year ended December 31, 2023. The only non-cash expense reported in the income statement is depreciation of $2,200. How should XYZ treat the depreciation expense for preparing the operating activities section under the indirect method?

Solution:

Depreciation is a non-cash expense that must be added back to net income as an adjustment to reconcile net income to net cash provided (or used) by operating activities. The proper presentation is given below:

(2). Adjustments for timing differences

Under accrual-based accounting, revenues are recognized when they are earned and expenses are recognized when the goods and/or services are used by the business (i.e., when the benefit is taken), rather than the time when cash changes hands. For example, when we make a sale on account, we recognize it immediately rather than waiting for the time the customer will make the payment. We recognize it by debiting the “accounts receivable account” and crediting the “sales account”.

Whenever revenue is recorded without debiting cash, a non-cash current asset is debited, and whenever an expense is recorded without crediting cash, a current liability is credited. In other words, we can say that the recognition of a revenue or an expense without debiting or crediting the cash account gives rise to a non-cash current asset or a current liability. So, the changes in the balances of these non-cash current asset and liability accounts during the period represent the differences between the accrual-based revenues or expenses reported in the income statement and the net cash flows from operating activities. Examples of balance sheet accounts that create such timing differences include accounts receivable, accounts payable, prepaid expenses, accrued expenses, inventories, etc.

(3). Adjustments for non-operating gains and losses

While determining the net income, the gains and losses resulting from non-operating activities are included in the income statement. Since these gains and losses are the result of non-operating activities, their effect is eliminated by adding any non-operating loss to and deducting any non-operating gain from the net income figure. Suppose, for example, a company sells some of its old equipment with a book value of $1,200 for $1,500. The gain of $300 (= $1,500 – $1,200) on this sale will be considered for the computation of net income. If a statement of cash flows is prepared, this gain of $300 will be deducted from the net income in the operating activities section, and the total proceeds of $1,500 will be shown in the investing activities section of the statement. Other examples of gains and losses that require a similar treatment are gains or losses on discontinued operations, gains on early payment of debts, etc.

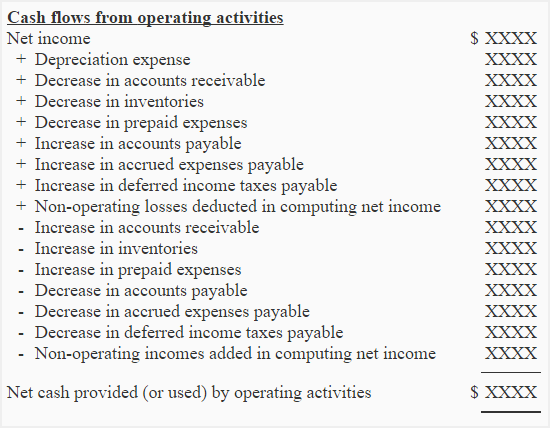

Format and formula of operating activities section

In order to arrive at net cash flows from operating activities, the three types of adjustments described above are made to net income as follows:

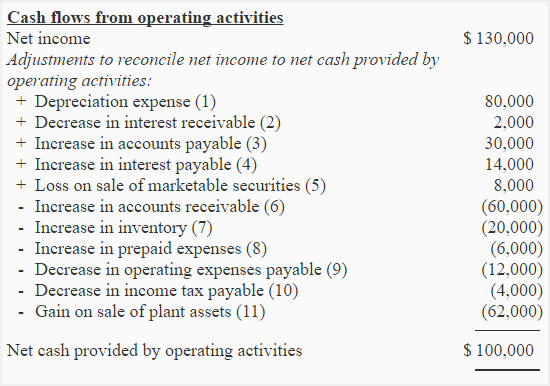

Example of indirect method of operating activities section

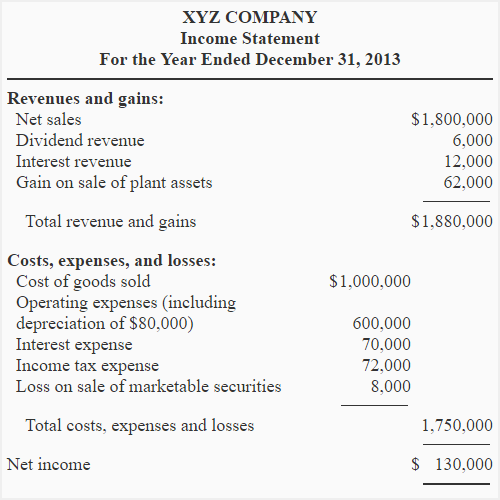

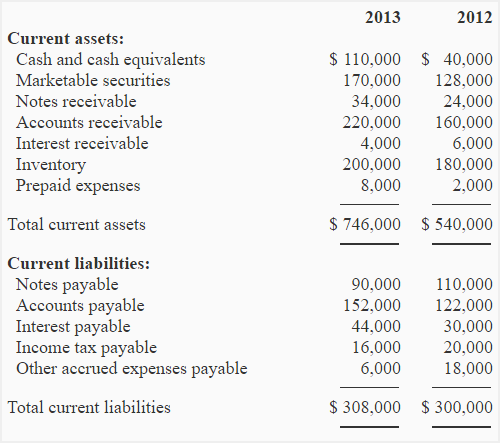

The single-step income statement for the year ending 2013 and the selected data from the comparative balance sheet of XYZ Company are given below:

Required: Prepare the operating activities section of XYZ Company using the indirect method.

Solution:

Explanations to the solution

- Note 1 – depreciation expense:

Depreciation is a non-cash expense that reduces net income but does not affect the cash balance. Therefore, under the indirect method, it is added back to the net income in the operating activities section. - Note 2 – decrease in interest receivable:

$6000 – $4,000 - Note 3 – increase in accounts payable:

$122,000 – $152,000 - Note 4 – increase in interest payable:

$44,000 – $30,000 - Note 5 – loss on sale of marketable securities:

It is a non-operating loss. It reduces net income and is, therefore, added back to the net income to compute the amount of net cash flows from operating activities. The sale of marketable securities is an investing activity, and the total cash received from it will be included in the investing activities section. - Note 6 – increase in accounts receivable:

$220,000 – $160,000 - Note 7 – increase in inventory:

$200,000 – $180,000 - Note 8 – increase in prepaid expenses:

$8,000 – $6,000 - Note 9 – decrease in operating expenses payable:

$18,000 – $6,000 - Note 10 – decrease in income tax payable:

$20,000 – 16,000 - Note 11 – gain on sale of plant assets:

It is a non-operating gain. It increases net income and is, therefore, deducted from the net income to compute the amount of net cash flows from operating activities. The sale of the plant asset is an investing activity, and the total sale proceeds will be reported as such.

Leave a comment