Sale of marketable securities

The sale of marketable securities often results in a gain or a loss depending on their fair market value at the time of sale. The accounting treatment for the sale of securities under both the situations are discussed below:

Sale of marketable securities at a gain

If marketable securities are sold for a price that is higher than their cost, the difference represents a gain on sale of marketable securities. When securities are sold at a gain, cash account is debited, marketable securities account and gain on sale of investment account are credited.

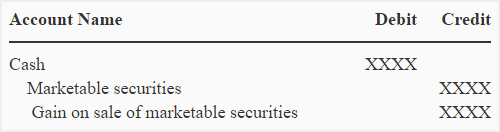

The journal entry for the sale of marketable securities at a gain is given below:

The above entry would increase the balance of cash account and decrease the balance of marketable securities control account in the general ledger. If seller pays a brokerage commission on sale of securities, the cash in above journal entry would be debited by net of such commission.

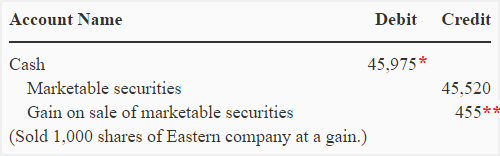

Example 1

Fast Company purchases 5,000 shares of Eastern Company at a cost of $45.52 per share on December 1, 2022 for the purpose of short term investment. It sells 1,000 shares on December 20, 2022 at the rate of $46 per share and pays a $25 brokerage commission.

Required: Prepare a journal entry to record the sale of 1,000 shares by Fine Company.

*Net cash proceeds:

= (1,000 shares x $46) – $25 brokerage commission

= $45,975

**Gain on sale:

= $45,975 net cash proceeds – 45,520 cost

Sale of marketable securities at a loss

If marketable securities are sold at a price that is lower than their cost, the difference represents a loss on sale of marketable securities. When securities are sold at a loss, cash account and loss on sale of investment account are debited and marketable securities account is credited.

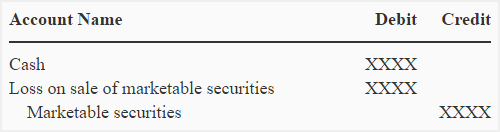

The journal entry for the sale of marketable securities at a loss is given below:

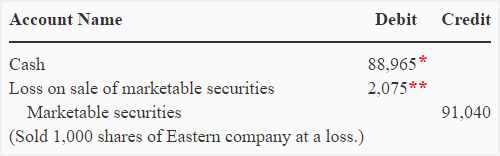

Example 2

Refer to the example 1 and suppose the Fast Company sells an additional 2,000 shares of Eastern Company on December 26, 2022 at a rate of $44.50 per share and pays a $35 brokerage commission.

Required: Prepare a journal entry to record the sale of 2,000 shares by Fast Company.

*Net cash proceeds:

= (2,000 shares x $44.50) – $35 brokerage commission

= $88,965

**Loss on sale:

= 91,040 cost – $88,965 net cash proceeds

= $2,075

The gains or losses on sale of marketable securities are reported in the income statement and, therefore, impact the net income of the seller. Both the gain of $455 in example-1 and the loss of $2,075 in example-2 on the sale of shares of Eastern Company would appear on the income statement of Fast Company under “other income/expenses section”.

How does sale of marketable securities impact the statement of cash flows?

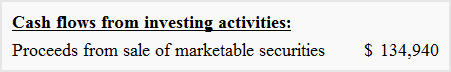

The cash flows resulting from sale of marketable securities is classified as positive investing cash flow and is reported under investing activities section of statement of cash flows. The line item used for this purpose is “proceeds from sale of marketable securities”.

The total cash proceeds from sale of marketable securities in example-1 and example-2 amounts to $134,940 (= $45,975 + $88,965) which the company would report in its statement of cash flows for the year 2022 as follows:

If a company follows indirect method to draft its statement of cash flows, the gains and losses on sale of securities appear in operating activities section, where they form part of the calculation needed to reconcile net income (or loss) to net cash provided (or used) by operating activities of the business. We have exemplified this treatment here.

Leave a comment