Investing activities section of statement of cash flows

The investing activities section is the second section of the statement of cash flows that reports the cash flows arising from the sale and acquisition of long-term assets and investments. It typically involves the movement of cash on account of the following activities:

- Purchase and sale of productive long-term assets.

- Purchase and sale of investments.

- Making and collecting loans.

- Purchase and sale of intangible assets.

The acquisition or sale of long-term assets and investments during a specific period can be determined by analyzing their opening and closing balances. A comparative balance sheet can be used for this purpose. An increase in the balance of a long-term asset indicates that the company has acquired or constructed the asset during the period. A reduction, on the other hand, signifies that the asset has been sold during the period. Such acquisitions and sales of long-term or fixed assets are known as investing activities. The rest of this article explains how inflows and outflows of cash caused by such activities are computed and reported in the statement of cash flows.

Contents:

- Understanding cash and non-cash investing activities

- Acquisition and sale of long-term productive assets

- Purchase and sale of investments

- Cash flows from making and collecting loans

- Purchase and sale of intangible assets

- Format of investing activities section

Understanding the cash and non-cash investing activities

The assets are acquired using cash or another medium of exchange. When a medium other than cash is used to acquire an asset, we call it a non-cash investing activity. For example, a company can purchase a piece of equipment for $1,000 by making a payment in cash, which is a cash transaction, or it can purchase a tract of land by issuing shares to the vendor, which is a non-cash investing transaction. When we prepare a statement of cash flows, we are concerned only with cash transactions. The significant non-cash investing activities are, however, disclosed in the footnotes under the caption “non-cash investing and financing activities”.

Purchase and sale of long term productive assets

Long-term productive assets (also known as non-current assets or fixed assets) are purchased to be kept and used in business for a long period of time. They are capital assets and are purchased to maintain or enhance the production or trading capabilities of the entity. Examples of such assets include plant and machinery, equipment, tools, buildings, vehicles, furniture, land, etc. Since long-term assets are not purchased with the intention of resale in the ordinary course of business, the cash flows resulting from their purchase and sale (including any gain on their sale) are classified as “cash flows from investing activities” and are reported under the investing activities section of the statement of cash flows.

Gains or losses on sale of fixed assets:

The sale of a used fixed asset normally results in a non-operating gain or loss. As non-operating gains or losses are included in the determination of net income, their effect is eliminated from the net income in the operating activities section. It is done in the following way:

- Deduct from the net income any gain on the sale of fixed assets included in the income statement.

- Add to the net income any loss on the sale of fixed assets included in the income statement.

Consider the following example to understand how these gains and losses are handled while preparing a statement of cash flows:

Example:

Big Brand Company earned a net income of $65,000 for the year 2023. During the year, it sold an old plant asset for $6,400 and purchased a tract of land for $1,500. The plant was purchased several years ago for $10,000 and was being depreciated using the straight-line method. The accumulated depreciation on the plant at the time of its sale was $4,000.

Required:

- Calculate the gain (or loss, if any) on the sale of old plant asset. How should it be adjusted in the operating activities section, assuming the company uses an indirect method to prepare its statement of cash flows?

- How should the sale of plant asset and the purchase of land be reported in the statement of cash flows?

Solution:

(1). Gain on the sale of plant and its presentation:

Gain on sale of plant = Sale proceeds – Book value of the plant

= $6,400 – $6,000*

= $400

*10,000 – 4,000

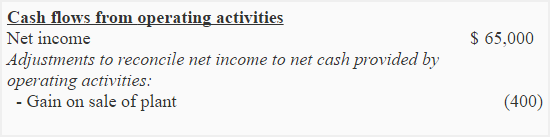

The gain on the sale of plant asset is a non-operating gain and therefore must be deducted from the net income in the operating activities section. Its presentation is given below:

(2). Presentation of the sale of plant asset and purchase of land:

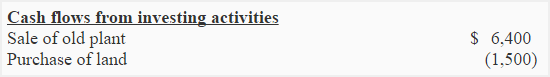

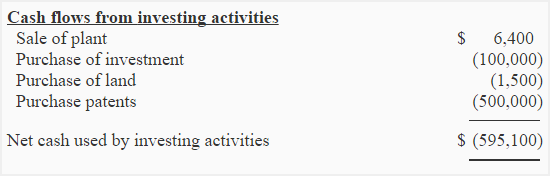

The sale of plant and the purchase of land are both investing activities. The cash flows resulting from these activities must be shown in the investing activities section of the statement of cash flows as follows:

Sale and purchase of investments

The cash flows resulting from the purchase and sale of those investments that are not treated as cash equivalents or trading securities are classified as “cash flows from investing activities” and are reported in the investing activities section of the statement of cash flows. It usually involves the sale and purchase of long-term investments in debt and equity instruments of other entities. Examples of debt instruments (also known as debt securities) are government bonds, corporate bonds, mortgages, etc. The holder of such instruments is generally entitled to receive periodic interest income at some specified rate. Equity instruments (also known as equity securities) are the stocks of other companies that entitle the holder to receive dividend income.

Treatment of interest and dividend income

According to generally accepted accounting principles (GAAPs), cash received for interest and dividends is classified as “cash flows from operating activities”, whereas international financial reporting standards (IFRSs) allow their treatment as operating or investing cash inflows. IFRSs, however, require such cash flows to be reported on a consistent basis from period to period.

Example

Big Brand Company purchased 2,000 shares of Company A at $50 per share during the year 2023 for investment purpose. It also received a dividend of $1,200 in cash during the year from Company B.

Required: How should Big Brand classify above cash flows on its statement of cash flows?

Solution

(1). The purchase of shares for investment must be classified as investing activity and reported in the following way:

The receipt of a cash dividend of $1,200 may be classified as either operating or investing cash inflow if financial statements are prepared in accordance with IFRSs. However, if GAAPs are to be followed, the cash received for dividends should be classified as operating cash inflow.

Cash flows from making and collecting loans

The loans and advances given to others are investing activities, and the cash outflows resulting from such activities are shown in the investing activities section. The collection of such loans and advances are also investing activities, with the exception of any interest received thereon. The interest earned on loans and advances is reported in the statement of cash flows as described above.

Purchase and sale of intangible assets

Intangible assets (also known as intangible fixed assets) like copyrights, trademarks, patents, and goodwill are purchased to improve or enhance the trading or manufacturing capabilities of the business. These purchases are, therefore, classified as investing activities. The cash flows resulting from them are reported under the investing activities section of the statement of cash flows.

Amortization of intangible assets:

While preparing the statement of cash flows, the treatment of amortization of intangible assets is similar to the treatment of depreciation on fixed assets. It is a non-cash expense and is added back to the net income in the operating activities section under the indirect method. Like depreciation, amortization has nothing to do with the investing activities section.

Example:

Big Brand Company purchased a patent for $500,000 on January 1, 2023. The patent is being amortized over its economic useful life of 5 years using a straight-line method. On December 31, 2023, the company’s income statement showed a net income of $350,000. The company is ready to prepare its statement of cash flows for the year 2023.

Required:

- What is the use of amortization on patents in preparing the operating activities section of the statement of cash flows if an indirect method is used?

- How should the cash flows arising from the acquisition of patents be reported in the investing activities section?

Solution:

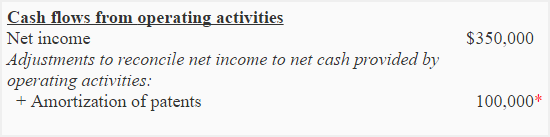

(1). The presentation of operating activities section:

A cash payment of $500,000 was made at the time of the acquisition of patents. No cash occurs when amortization is recorded. Amortization on patents is a non-cash expense and must be added back to net operating income in the operating activities section. Its presentation is given below:

*$500,000/5 years

(2). The presentation of investing activities section:

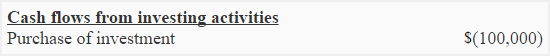

The cash paid to purchase patents is to be disclosed in the investing activities section as follows:

Format of investing activities section

The general format of the investing activities section is illustrated below. It is just an illustration, not a complete list of all cash inflows and outflows that may result from the investing activities of a company.

The cash flows resulting from the investing activities of Big Brand Company have been discussed in the above examples. We can now list them all together to prepare the investing activities section of the company as follows:

Hello Javed,

I have a question:-

A company purchase a building and it paid $500,000 cash as down payment and borrowed $3,000,000 from bank for the balance payment. Total cost of building is $3.500,000.

The loan of $3,000,000 is repayable monthly over a period of 10 years. What amount should i show under “cash flow from investing activities” for purchase of building and under “cash flows from financing activities”.

Thank you in advance for your advice.

The company paid a total of $3,500,000 to purchase a building during the period, which is essentially an investing cash outflow. It borrowed $3,000,000 from the bank which is essentially a financing cash inflow. If the company repays the first instalment of loan (i.e., $3,000,000/10 = $300,000) within the current period, than it would be considered a financing cash outflow. If the first instalment is repayable in the next period, then it would be the financing cash outflow of the next period.

Hope that helps 🙂