Straight-line method of depreciation

The straight-line method of depreciation attempts to allocate equal portion of depreciable cost to each period of the asset’s useful life. This method assumes that the depreciation is a function of the passage of time rather than the actual productive use of the asset. Under straight line method, the depreciation expense for a period is calculated by dividing the depreciable cost of the asset by the years of its useful. Depreciable cost is arrived at by deducting salvage or residual value from the original cost of the asset. For example, if an asset is purchased for $10,000 and its salvage value is expected to be $800 at the end of its useful life, the depreciable cost would be computed as follows:

Depreciable cost = $10,000 – $800

= $9,200

Other names used for straight-line method are original cost method or fixed installment method of depreciation.

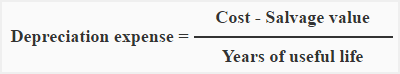

Formula:

The following formula is used to calculate depreciation under straight line method:

Example:

The Eastern company provides the following information regarding one of its fixed assets that has been purchased on January 1, 2022:

- Cost of the asset: $35,000

- Salvage value: $3,000

- Useful life: 10 years

Required: Calculate annual depreciation expense of this asset using straight line method.

Solution:

= ($35,000 – $3,000)/10 years

= $3,200

The Eastern Company will allocate a depreciation of $3,200 to all the years of the useful life of the fixed asset.

Straight-line depreciation rate

Alternatively, we can calculate a depreciation rate by dividing 1 by the years of useful life of the asset. This is known as straight line depreciation rate that can be applied to the total depreciable cost to calculate the depreciation expense for the period. In our example, the useful life of the asset is 10 years and the depreciation rate is 10%, as computed below:

1/10 = 0.1 or 10%

It means the depreciation expense to be recognized in each period of the useful life of the asset is 10% of $32,000 (depreciable cost), as computed below:

($35,000 – $3,000) × 0.1 = $3,200

The straight-line method of depreciation is popular among companies world wide because it is more conceptual and simple to employ.

Limitations:

The major limitations/disadvantages of straight-line method of depreciation are given below:

- It assumes that the useful economic life of the asset is same each year that may not always be true.

- It assumes that the annual repair and maintenance expenses are the same during the useful life of the asset. In practice, an asset may require different repair and maintenance expenses in different years.

- It creates a distortion in the rate of return analysis.

nice