Sum of years’ digits method

The sum of years’ digits method is a form of accelerated depreciation charge that is based on the assumption that the productivity of an asset decreases with the passage of time. Under this method, a fraction is computed by dividing the remaining useful life of the asset on a particular date by the sum of the year’s digits. This fraction is applied to the depreciable cost of the asset to compute the depreciation expense for the period.

Like declining balance method, sum of years’ digits method attempts to charge a higher depreciation expense in early years of the useful life of the asset and a lower expense in later years. This is because the assets are generally more productive in early years and less productive in later years of their economic life. Also many assets lose much of their productive efficiency during the early years of their economic life.

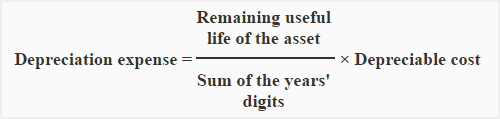

Formula:

The following formula is used to calculate depreciation expense under sum of years’ digits method

Consider the following example for a better understanding.

Example:

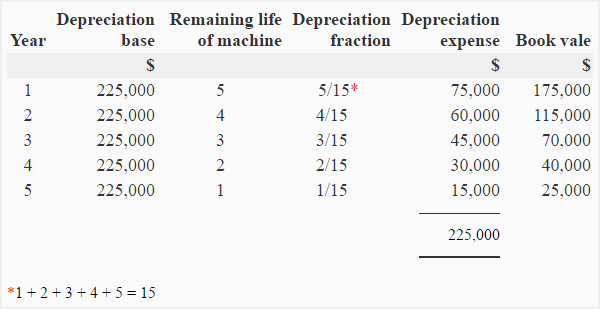

Monster Company purchased a machine on January 1, 2022. The relevant information is given below:

- Cost of the machine: $250,000

- Expected useful life of machine: 5 years

- Salvage value: $25,000

Required: Prepare a schedule showing the depreciation expense of each year of the useful life of the machine using sum of years’ digits method.

Solution:

- Depreciable cost (depreciable base): $250,000 – $25,000 = $225,000

- Depreciation expense at the end of the first year: $225,000 × (5/15) = $75,000

- Book value at the end of the first year: $250,000 – $75,000 = $175,000

Notice that as the remaining life of the machine decreases, the depreciation expense also decreases.

Leave a comment