LIFO liquidation

Definition and explanation

LIFO liquidation occurs when a company, using LIFO inventory valuation method, sells (or issues) the old stock of merchandise (or raw materials) inventory. In other words, it occurs when a company using LIFO method sells (or issues) more inventory than it purchases.

LIFO liquidation causes distortion of net operating income and may become a reason of a higher tax bill in current period. When LIFO inventory is liquidated, the old costs are matched with the current revenues and as a result, financial statements show higher income. The LIFO liquidation, therefore, causes a higher tax liability in periods of high inflation.

Why does LIFO liquidation occur?

In most of the cases, companies do not liquidate their LIFO inventory voluntarily. A company may have to liquidate its LIFO inventory due to one or more of the following reasons:

- Shortage of merchandise or materials inventory

- Higher volume of sales than purchases

- A sudden or unexpected increase in demand for the product

- Shortage of funds

- Need to move the old inventory immediately due to change in taste or fashion

- Need to free up warehouse space etc.

For further explanation of the concept, consider the following example:

Example of lifo liquidation:

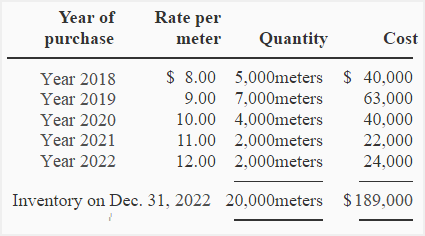

The Delta company uses last-in, first-out (LIFO) cost flow assumption. At the end of the year 2022, the company has 20,000 meters of copper coil in its inventory. The details are given below:

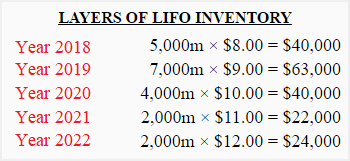

Notice that the total cost of inventory at the end of 2022 comprises of the costs incurred in 2022, 2021, 2020, 2019 and 2018. These costs are referred to as ‘layers of LIFO inventory’ or only ‘LIFO layers’. The LIFO layers of Delta company are shown below:

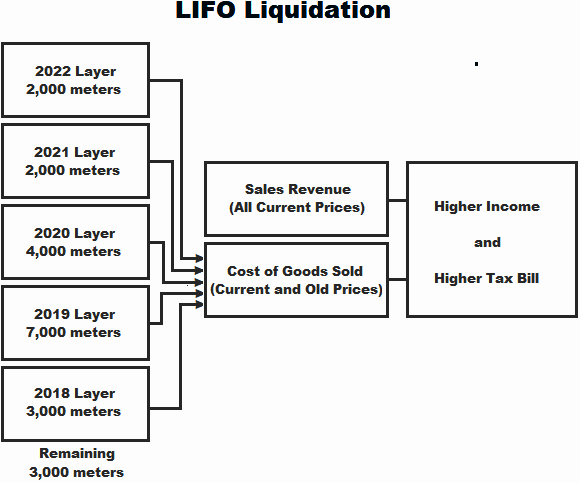

Assume that the Delta company needs to use 18,000 meters of copper coil during the year 2023 but the company experiences a shortage of it and, therefore, must liquidate much of its old copper coil inventory.

Because the company employs a LIFO method, the most recent layer, 2022, would be liquidated first, followed by 2021 layer and so on. This liquidation would enforce the company to match old low costs with the current higher sales prices. The income statement of Delta would, therefore, show much higher profits that would eventually lead to higher tax bill in the current period.

Use of specific goods pooled LIFO approach:

To overcome the problem that LIFO liquidation creates, some companies adopt an approach known as specific goods pooled LIFO approach. Under this approach, a number of similar products are combined and accounted for together. This combination or group of similar items is referred to as pool. Under this approach, the liquidation of an item in the pool is usually offset by an increase in another item.

Specific goods pooled LIFO approach is not a perfect solution of LIFO liquidation but can eliminate the disadvantages of traditional LIFO inventory system to some extent.

Many companies frequently change their sales mix as they grow their business. This approach may prove costly as well as time consuming for such companies because they have to redefine the inventory pools each time a change in mix of their products occurs.

Leave a comment