Dollar-value LIFO method

Like specific goods pooled LIFO approach, Dollar-value LIFO method is also used to alleviate the problems of LIFO liquidation. Under this method, goods are combined into pools and all increases and decreases in a pool are measured in terms of total dollar value. The pools created under this method are, therefore, known as dollar-value LIFO pools.

This approach is considered more effective than the specific goods pooled LIFO approach (discussed in ‘LIFO liquidation’ article) because of the following reasons:

- As the pools are determined and measured in terms of total dollar value, this method allows companies to include a broader range of goods in a pool.

- Under specific goods pooled LIFO approach, an item can be replaced only with an item that is substantially identical whereas in a dollar-value LIFO pool, an item can be replaced with an item that is similar in use or interchangeable.

Under this method, it is possible to use a single pool but a company can use any number of pools according to its requirement. The unnecessary employment of a large number of dollar-value LIFO pools may, however, increase cost and also reduce the effectiveness of dollar-value LIFO approach.

Who uses dollar-value LIFO method?

The companies that maintain a large number of products and expect significant changes in their product mix in future frequently use dollar-value LIFO technique. The use of traditional LIFO approaches is common among companies that have a few items and expect very little to no change in their product mix.

Consider the following example to understand how the value of inventory is computed under dollar value LIFO method:

Example 1:

The Fast company adopted dollar-value LIFO method on December 31, 2011. The inventory on current prices at the end of 2011 and 2012 was as follows:

- December 31, 2011(end of year prices): $40,000

- December 31, 2012 (end of year prices): $52,800

The inventory prices were increased by 25% during the year 2012.

Required: Compute the amount of inventory at the end of 2012 using dollar-value LIFO method.

Solution:

First of all, we need to compute the value of ending inventory at base-year-prices. It is computed using the following formula:

Ending inventory at base-year-prices:

=$52,800/1.25

= $42,240

Now we can compute the real-dollar quantity increase in inventory:

= ($42,240 – $40,000)

= $2,240

The next step is to value this real dollar quantity increase in inventory at year-end-prices:

= $2,240 × 1.25

= $2,800

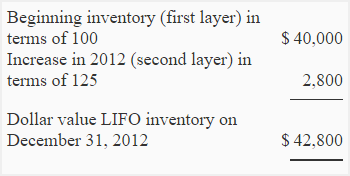

The real dollar quantity increase in inventory valued at year-end-prices is usually known as dollar-value LIFO layer (or layer for short). If this layer is added to the beginning inventory of the year 2012, we would get the total inventory at the end of the year 2012. It is shown below:

Hint!

A layer is formed only when ending inventory at base-year-prices exceeds the beginning inventory at base-year-prices.

Example 2 – the use of dollar-value LIFO method in a more complex situation:

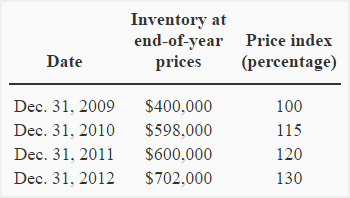

The following information belongs to Best Buy Company:

Required: Compute the inventory Best Buy at the end of each year using dollar-value LIFO method.

Solution:

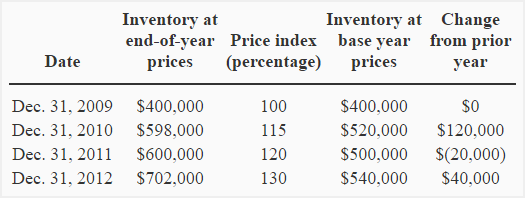

First, we need to add two new columns to the original information given in the example – one to show the inventory at base-year-prices and one to show the changes in inventory from prior year. It is done as follows:

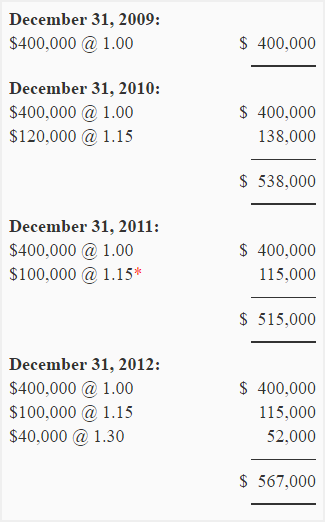

Now, we can compute the dollar value inventory as follows:

* The price index of 2010 has been used because no layer has been formed during the year 2011. The ending inventory at base-year-prices ($500,000) is less than the beginning inventory at base-year-prices ($520,000).

Leave a comment