Specific identification method of inventory valuation

Specific identification method of inventory valuation can be applied in situations where different purchases can be physically separated. Under this method, each item sold and each item remaining in the inventory is identified. The cost of specific items that are sold during a period is included in the cost of goods sold for that period and the cost of specific items remaining on hand at the end of a period is included in the ending inventory of that period.

Consider the following example to understand the calculation of the cost of ending inventory and cost of goods sold under specific identification method:

Example:

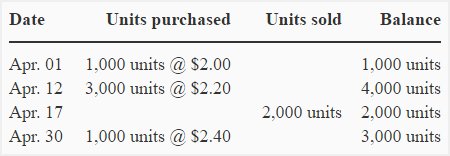

A company made the following purchases and sales during the month of April 2022:

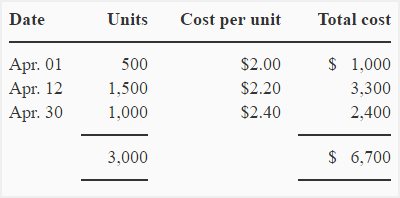

The 3,000 units in the inventory on April 30 is composed of 500 units from purchases made on April 01, 1,500 units from purchases made on April 12 and 1,000 units from purchases made on April 30.

Required: Calculate the cost of ending inventory and the cost of goods sold using specific identification method of inventory valuation.

Solution:

Calculation of ending inventory:

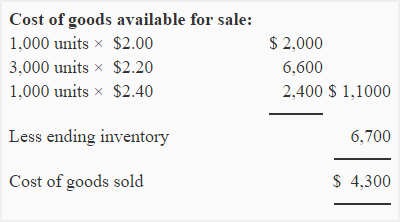

Calculation of cost of goods sold:

This method is ideal in situations where small number of easily distinguishable items (such as jewelry, automobiles, handicrafts and furniture etc.) are handled.

Advantages and disadvantages:

The main advantage of using specific identification method is that the flow of cost corresponds to the physical flow of inventory. In other words, actual costs are matched against revenues collected.

The main disadvantage of using this method is that the net income can be easily manipulated under this method. For example, if some units of identical items are purchased early in the year at different price, the items from the highest or the lowest priced lot may be selected for delivery to customers with the intention of income manipulation.

Leave a comment