Exercise-9 (Computation of ending inventory under FIFO and LIFO)

Alpha Merchandising Company purchases product DX-5 directly from manufacturers and sells it to small retailers as well as customers. The following transactions occurred during the last month of 2022:

- Dec. 01: 800 units on hand @ $40 each.

- Dec. 08: 600 units sold @ $76 each.

- Dec. 14: 1,200 units purchased @ $50 each.

- Dec. 18: 1,080 units sold @ $76 each.

- Dec. 30: 800 units purchased @ $60 each.

Required:

- Assuming Alpha Merchandising Company uses periodic inventory method, compute the cost of inventory on hand at December 31, 2022 under the following cost flow assumptions:

(a). First in, first out (FIFO)

(b). Last in, first out (LIFO) - Assuming Alpha Merchandising Company uses a perpetual inventory method, compute the cost of inventory on hand at December 31, 2022 under the following cost flow assumptions:

(a). First in, first out (FIFO)

(b). Last in, first out (LIFO)

Solution:

(1) Periodic inventory method:

Number of units on December 31, 2022 = Units in beginning inventory + Units purchased during the month – Units sold during the month

= 800 units + *2,000 units – **1,680 units

= 1,120 units

*1,200 + 800

**600 + 1,080

a. FIFO method:

Cost of inventory on December 31, 2022 = (800 units × $60) + (320 units × $50)

= $48,000 + $16,000

= $64,000

b. LIFO method:

Cost of inventory on December 31, 2022 = (800 units × $40) + (320 units × $50)

= $32,000 + $16,000

= $48,000

(2). Perpetual inventory method:

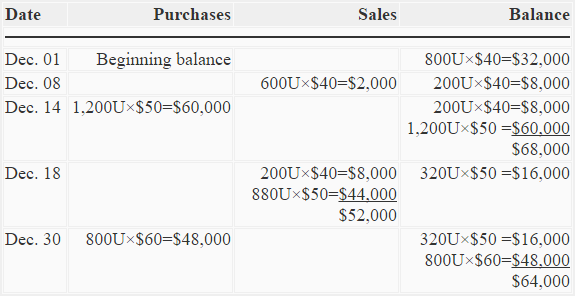

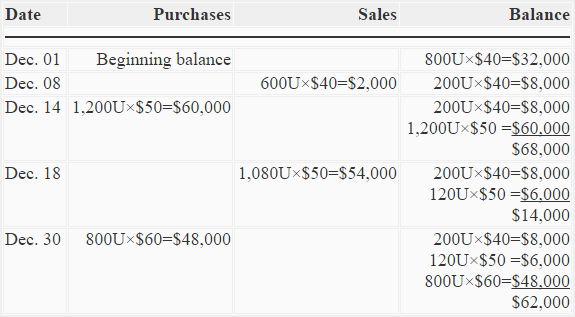

We can determine the value of ending inventory by preparing two perpetual inventory cards – one using FIFO method and one using LIFO method.

a. FIFO method:

Under perpetual FIFO, the cost of inventory on December 31, 2022 is $64,000 (see last row of balance column).

b. LIFO method:

Under perpetual LIFO, the cost of inventory on December 31, 2022 is $62,000 (see last row of balance column).

it is brief for understanding

Please I need more about this chapter

It is very helpful