Exercise-10 (FIFO and LIFO based income statement)

Washington Corporation is currently using first-in, first-out (FIFO) method of inventory valuation. The president wants to know the effect of a change in inventory valuation method from first-in, first-out (FIFO) to last-in, first-out (LIFO) method.

The corporation makes the following information available to you for the year 2023:

- Sales made during the year 2023: 42,000 units @ $100 each

- beginning inventory on January 1, 2023: 12,000 units @ $40 each

- Units purchased on January 15, 2023: 12,000 units @ $44 each

- Units purchased on June 25, 2023: 20,000 units @ $50 each

- Units purchased on December 20, 2023: 14,000 units @ $60 each

A physical count was made on December 31, 2023 and found 16,000 units in inventory. The total operating expenses of $400,000 were paid during the year 2023.

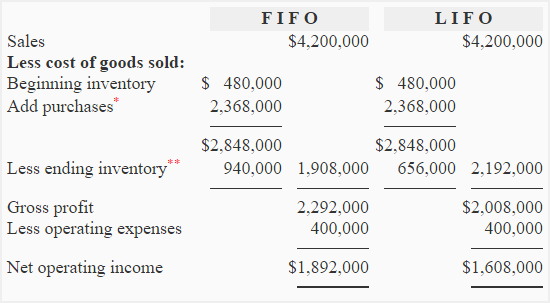

Required: Prepare a comparative income statement using FIFO and LIFO method for the president of Washington Corporation.

Solution

*Purchases:

= (12,000 units × $44) + (20,000 units × $50) + (14,000 units × $60)

= $528,000 + $1,000,000 + $840,000

= $2,368,000

**Ending inventory:

i. Periodic-FIFO: (14,000 units × $60) + (2,000 units × $50)

= $840,000 + $100,000

= $940,000

ii. Periodic-LIFO: (12,000 units × $40) + (4,000 units × $44)

= $480,000 + $176,000

= $656,000

Notice that the gross profit and net operating income under FIFO is higher than LIFO. When prices of goods rise, FIFO generally produces higher gross and net income numbers than LIFO.

Leave a comment